Every effort has been made to ensure accuracy but no guarantee is offered by Technical Commentary or Mike Ellis against errors or omissions and no liability will be accepted for any trading based on the analysis and suggestions provided herein. This information is intended solely for the personal and confidential use of the designated recipient and may not be redistributed, retransmitted or disclosed, in whole or in part, or in any form or manner, without the written consent of Mike Ellis. Copyright © 2017 Technical Commentary.

For those seeking more than just analysis of the Dollar Index as a benchmark for currencies as a whole, this report looks at 8 major spot Forex pairings that make up the lions’ share of the vast global FX marketplace while ensuring that critical diversity key to the successful investor.

For more information please contact Michael here.

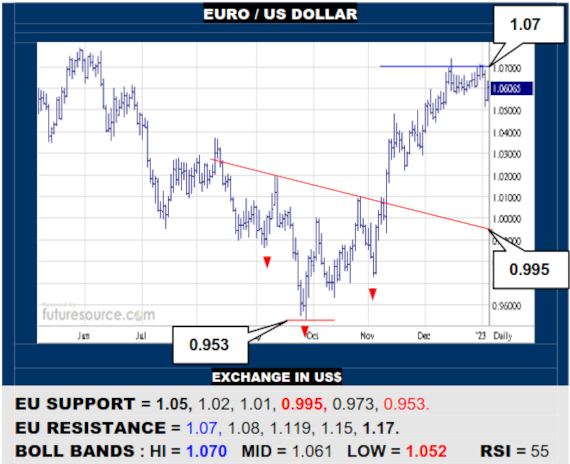

EURO / US DOLLAR

In reaching its 1.07 inverse H&S target the EU has broken the ‘20’s downtrend but still needs to dispatch that 1.07 figure to bust back into a large pre-‘20’s top structure and really hone its upward turn and gain sight of 1.17. A twitchy start to ’23 meantime demands watching 1.05 now as a tripwire to instead correct back to the 1.01 vicinity.

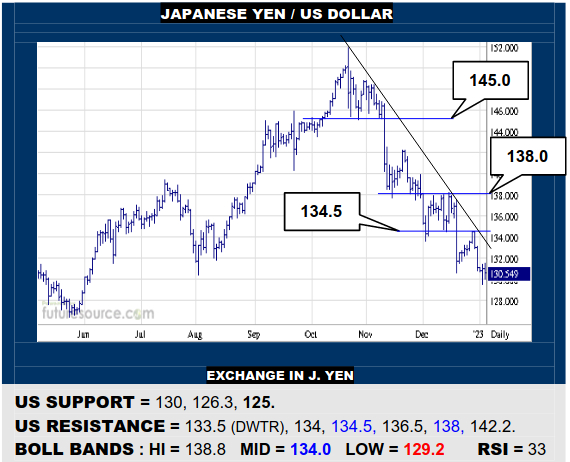

JAPANESE YEN / US DOLLAR

A sequence of downward steps during Q4 have the US on the brink of leaving the 130’s, such a break liable to extend the retreat back to better looking weekly support at 125. To take a more immediate stand will require a jolt back over 134.5, which would shrug off the Q4 downtrend and mid band to buoy chances to recover to 145.

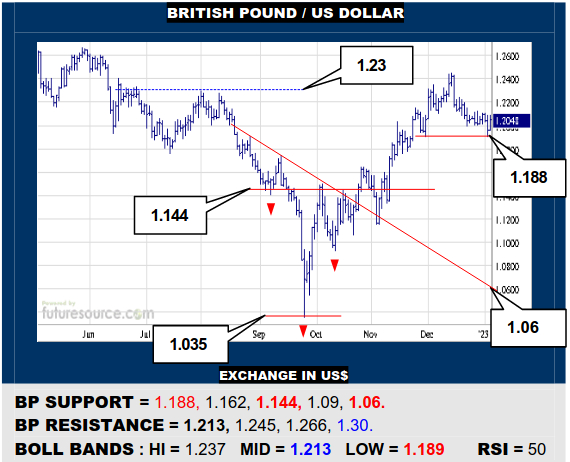

BRITISH POUND / US DOLLAR

The lower Bollinger band helped defend the 1.188 ledge but the BP must shore this up by rebounding over its mid band (1.213) to signal shaking off a Dec correction, which could then spark a next leg north towards 1.30. Alternatively, if 1.188 cracked, beware a more extensive setback to test the 1.14’s, greater space towards 1.06 lurking below.

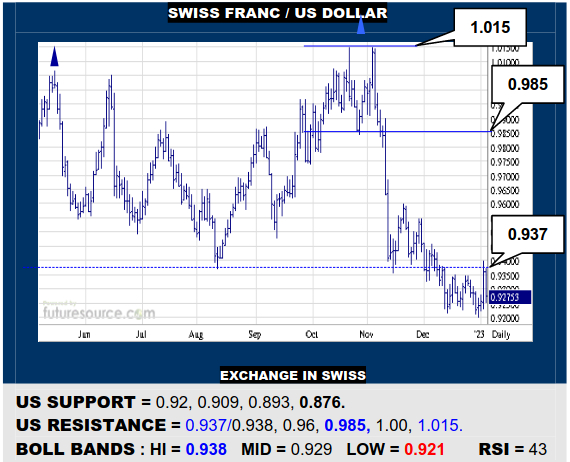

SWISS FRANC / US DOLLAR

The US mustered a new year reflex higher but the upper Bollinger band has helped to keep it hemmed in under the 0.937 neckline of the lately proposed ’22 double top. Only busting cleanly beyond there would make more reliable repairs. Otherwise pressing on through 0.92 would reassure the big new top and infer risk down to 0.876.

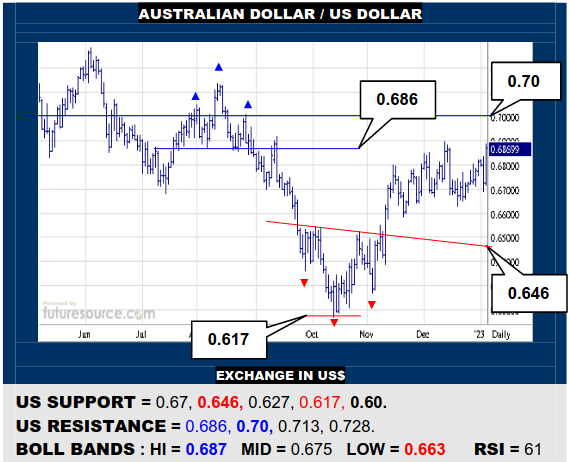

AUSTRALIAN DOLLAR / US DOLLAR

Though blunted by the 0.686+ H&S during Dec, the AD has resumed its attack early in ’23. Breaking through to the 0.69’s would bolster its position but ultimately the much larger weekly top rim at 0.70 is the true graduation point for longer term gains. Meantime watch 0.67 for any sign of faltering and swerving back to the 0.646 prior base brace.

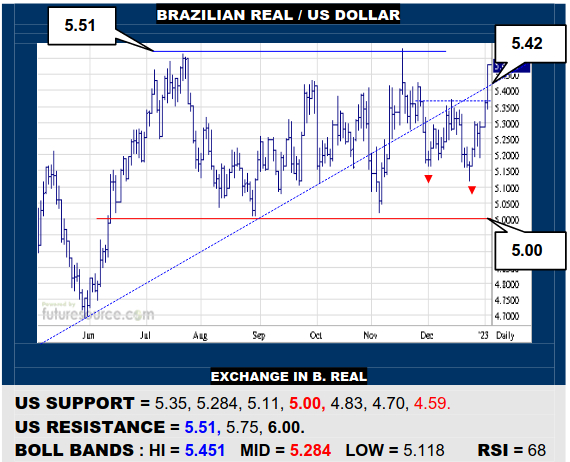

BRAZILIAN REAL / US DOLLAR

Powering back over the 5.37-5.42 span has built a new Dec double bottom and resurfaced across the previously broken uptrend so the US looks to have a very good shot at the 5.51 resistance again with scope on to 5.75 and maybe even 6.00 beyond. Only quickly doubling back below 5.35 would cast doubt on this new year resurgence.

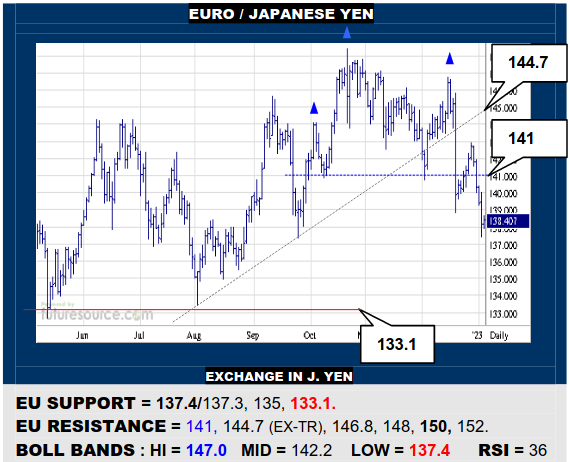

EURO / JAPANESE YEN

A stab back into the Q4 H&S above 141 was quelled well shy of the ex-uptrend and the EU has fallen away from the top again. The lower Bollinger is trying to aid the 137.3 ledge in stemming this new slip. If it can, so the 141 divide will remain in play. If not, the top structure would expand and a road on down into the 133’s would beckon.

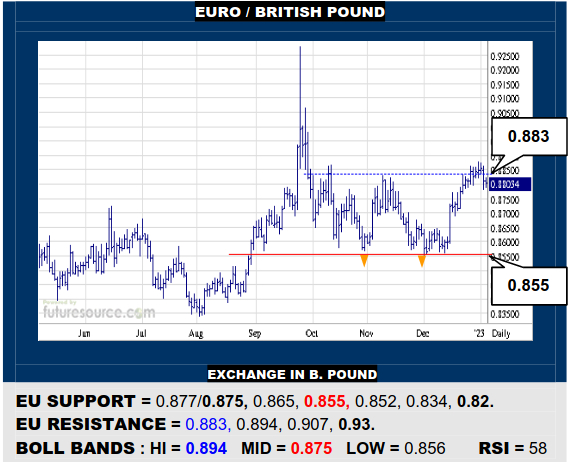

EURO / BRITISH POUND

A late ‘22 peep out over the 0.883 resistance has thus far failed to entrench, which the EU needs if it is to lay claim to a new double bottom and reach up towards 0.93 again. Duly eying the approach of the mid band (0.875) to see if it can revive the offensive. If not, beware pulling back towards the 0.855 low end of the range again.

Every effort has been made to ensure accuracy but no guarantee is offered by Technical Commentary or Mike Ellis against errors or omissions and no liability will be accepted for any trading based on the analysis and suggestions provided herein. This information is intended solely for the personal and confidential use of the designated recipient and may not be redistributed, retransmitted or disclosed, in whole or in part, or in any form or manner, without the written consent of Mike Ellis. Copyright © 2017 Technical Commentary.