Every effort has been made to ensure accuracy but no guarantee is offered by Technical Commentary or Mike Ellis against errors or omissions and no liability will be accepted for any trading based on the analysis and suggestions provided herein. This information is intended solely for the personal and confidential use of the designated recipient and may not be redistributed, retransmitted or disclosed, in whole or in part, or in any form or manner, without the written consent of Mike Ellis. Copyright © 2017 Technical Commentary.

For those seeking more than just analysis of the Dollar Index as a benchmark for currencies as a whole, this report looks at 8 major spot Forex pairings that make up the lions’ share of the vast global FX marketplace while ensuring that critical diversity key to the successful investor.

For more information please contact Michael here.

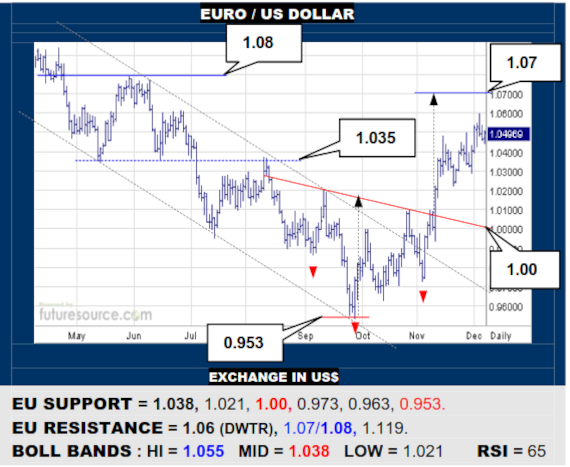

EURO / US DOLLAR

The EU has reached most of the way to its 1.07 inverse H&S target but is now hitting a tougher patch in the weekly downtrend and overall 1.06+ resistance that correlates with the 103’s on the Index. Must wade through the 1.06 to 1.08 span to emerge triumphant. Watch the mid band (1.038) closely meantime for any sign of a pivotal flinch.

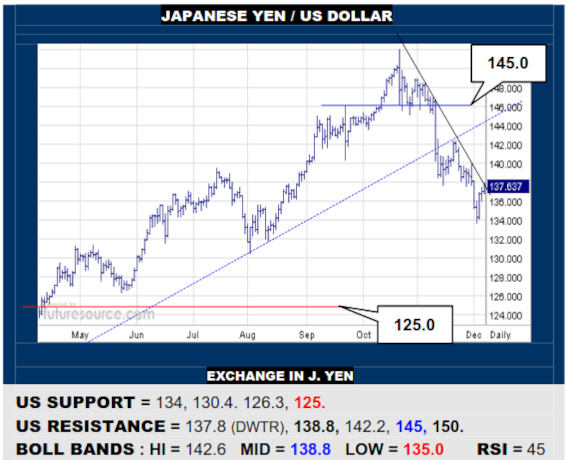

JAPANESE YEN / US DOLLAR

A weekly flag breakdown following the uptrend derailment has been plucked back up but the US must defeat a nearby downtrend (137.8) and the mid band (138.8) to score a more rejuvenating save to bring 145 back into view. If foiled in the 138’s, be prepared for resumed losses with a lingering risk of pressing all the way to 125.

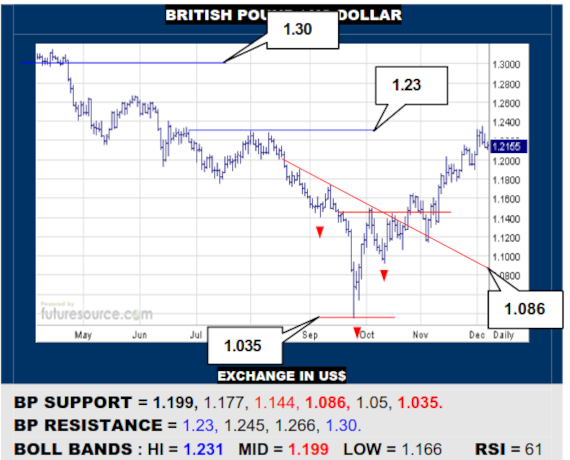

BRITISH POUND / US DOLLAR

The BP rambled on to the 1.23 resistance where it has provisionally lifted off the gas. This initially gives a flaggy vibe so a subsequent bust clear of 1.23 would pique ideas of stretching on to 1.30. Mind the mid band however (1.199) as a slip back through there would dilute the flag chance and instead threaten further decay into the 1.14’s.

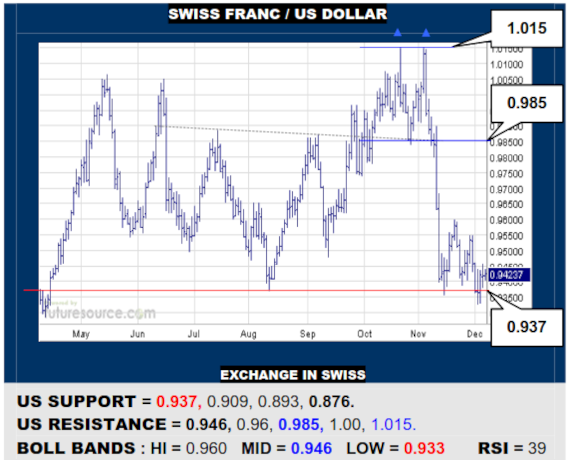

SWISS FRANC / US DOLLAR

The US has promptly retrieved a glance through the main 0.937 shelf and weekly uptrend marker so watch the mid band (0.946) for a sign of a significant catch to turn the tide. However, if blocked by that mid band, a more decisive gouge below 0.937 would propose a broad ’22 top that could instead target 0.876. A pivotal stage therefore.

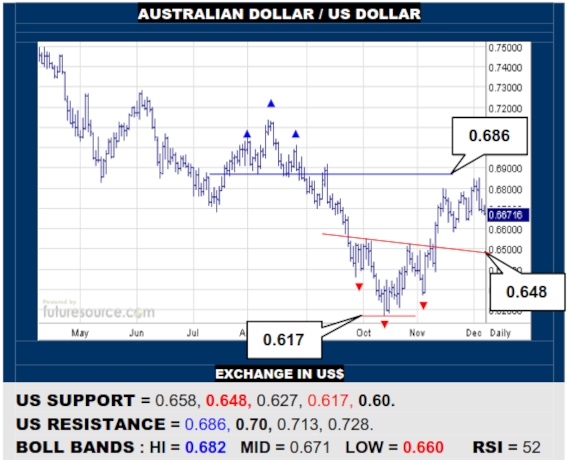

AUSTRALIAN DOLLAR / US DOLLAR

The AD recovery has faded in the face of the small Q3 H&S above 0.686 and the mid band has broken so beware a corrective setback to check the resilience of the more recent inverse H&S neckline (0.648). Must then gather up aboard that base and ultimately overhaul 0.70 to invade the much larger weekly top for a more extensive climb.

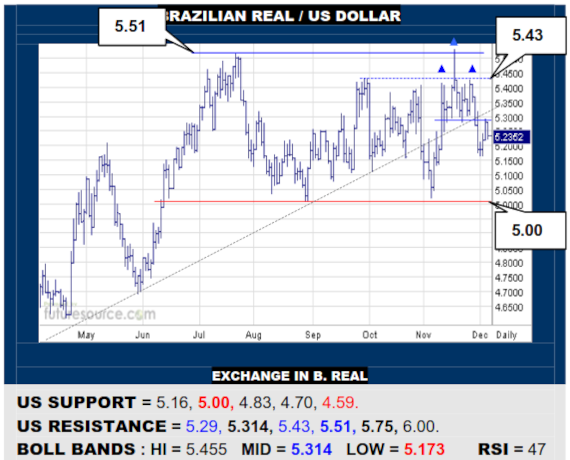

BRAZILIAN REAL / US DOLLAR

A small new H&S installed above 5.29 is initially blocking an attempt by the US to bounce and, while this is the case, beware a bear flag and a further swipe lower to confront the main 5.00 bracing where a much larger top could come together. Only a jolt back over the mid band (5.314) would make repairs and bring 5.51 into range again.

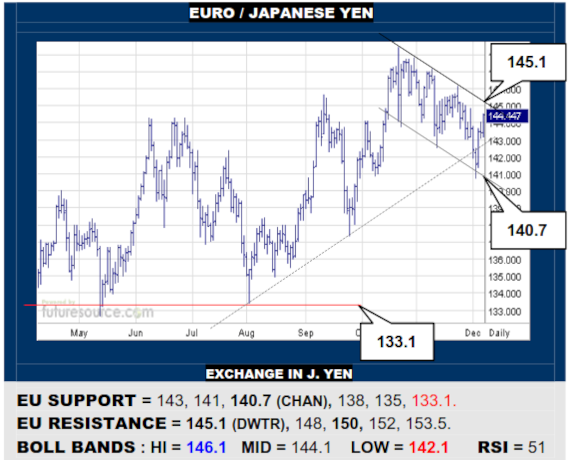

EURO / JAPANESE YEN

A slip through the ’22 uptrend was quickly recovered near 141 so Q4 is assuming more of a descending channel look. If the EU can duly now bust free (145.1), this would achieve a flag-like status on the weekly chart that could well spark a new sortie higher to around 152. If held inside the channel though, beware a new delve to 141 or deeper.

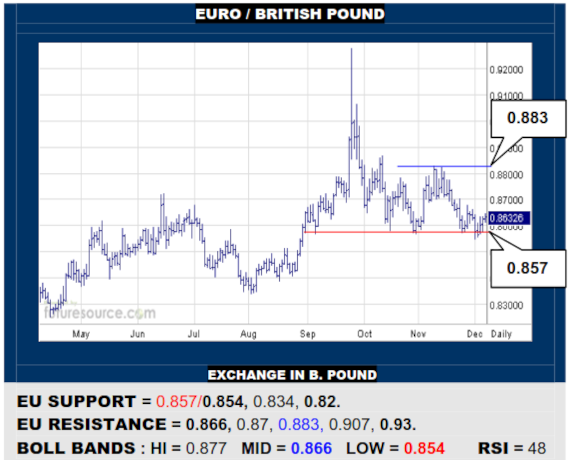

EURO / BRITISH POUND

Aided by the presence of the lower Bollinger band (0.854), the mid 0.85’s continue to buffer the EU and so the mid band should be watched (0.866) as a possible trigger back up towards 0.883. Only a cleaner snap of that mid 0.85’s terrain would instead register a more persuasive breakdown from a new top that could reach on to 0.82.

Every effort has been made to ensure accuracy but no guarantee is offered by Technical Commentary or Mike Ellis against errors or omissions and no liability will be accepted for any trading based on the analysis and suggestions provided herein. This information is intended solely for the personal and confidential use of the designated recipient and may not be redistributed, retransmitted or disclosed, in whole or in part, or in any form or manner, without the written consent of Mike Ellis. Copyright © 2017 Technical Commentary.