Every effort has been made to ensure accuracy but no guarantee is offered by Technical Commentary or Mike Ellis against errors or omissions and no liability will be accepted for any trading based on the analysis and suggestions provided herein. This information is intended solely for the personal and confidential use of the designated recipient and may not be redistributed, retransmitted or disclosed, in whole or in part, or in any form or manner, without the written consent of Mike Ellis. Copyright © 2017 Technical Commentary.

For those seeking more than just analysis of the Dollar Index as a benchmark for currencies as a whole, this report looks at 8 major spot Forex pairings that make up the lions’ share of the vast global FX marketplace while ensuring that critical diversity key to the successful investor.

For more information please contact Michael here.

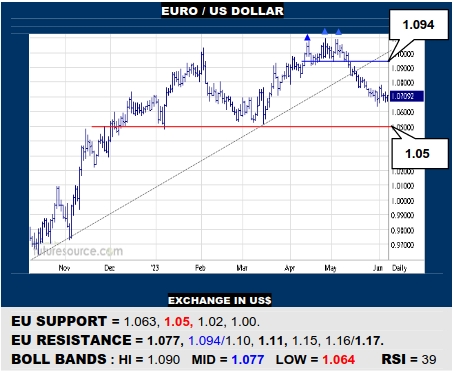

EURO / US DOLLAR

The EU blipped the brake as the US debt ceiling was resolved but has not drawn any lasting bolster and will have to overthrow the mid band (1.077) in order to suggest a shot back up to the mini H&S (1.094). Still eying 1.063 meantime as the tripwire on down to a much more significant divide at 1.05 where a far larger top could be created.

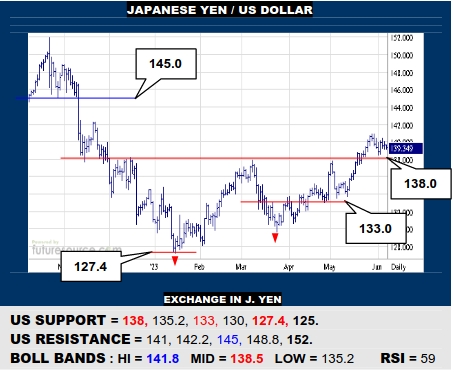

JAPANESE YEN / US DOLLAR

The US broke clear of a hefty 6-month double bottom crossing 138 but lifted off the gas soon after for some nearby congestion. While still balanced on 138, this looks purely corrective and leaves the door ajar for a further leg up to a Q4 top beyond 145. Only reeling back through 138 would undercut the base and present risk on back to 133.

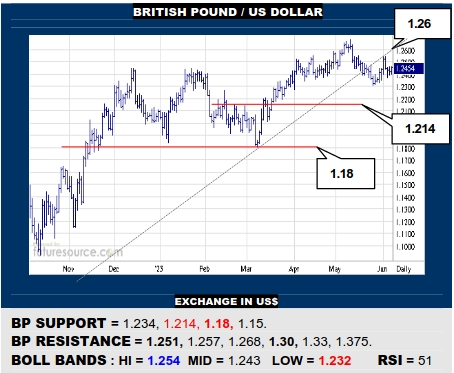

BRITISH POUND / US DOLLAR

Settling the debt ceiling gave the BP a jog back up but it was blunted by the uptrend it had derailed from less than a fortnight prior (1.26). Still wary of further repercussions from the trend break then back to a next ledge at 1.214, shaping Q2 all the more into a H&S top. Must otherwise forge that ex-trend to restore the higher footing.

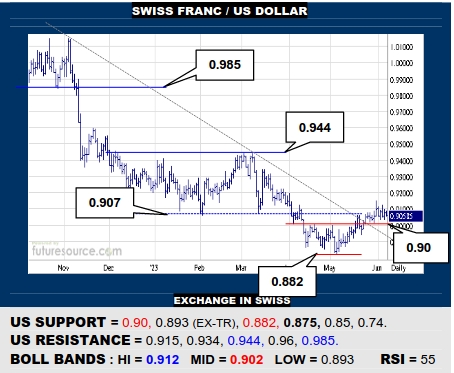

SWISS FRANC / US DOLLAR

The US has shed the downtrend from the 1.01’s and installed a small base under 0.90 but the debt ceiling accord has dulled this initial getaway. Would prefer to see 0.90 maintained to reassure the trend exit then and chances for more of an upside reaction to 0.944. Dipping back below 0.90 would set the balance wavering again.

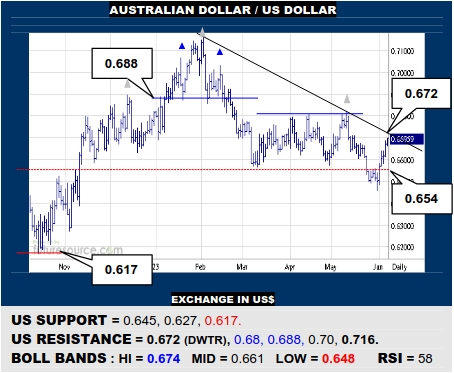

AUSTRALIAN DOLLAR / US DOLLAR

Though temporarily gouging into the prior base under 0.654 to imply a hefty new H&S, the AD has found a spirited reply to immediately cast doubt on that new top. Must still break the ’23 downtrend (0.672) to really prove this turnaround and present a chance across the 0.68’s though while a trend denial would warn the H&S might be restored.

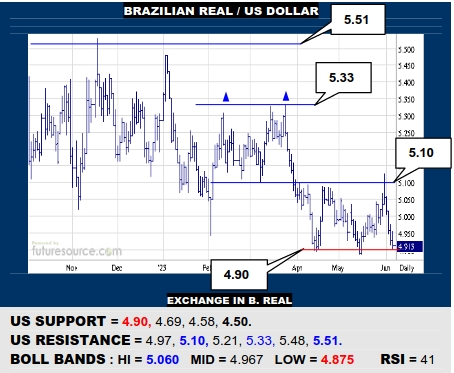

BRAZILIAN REAL / US DOLLAR

The 5.10 rim of the prior Q1 double top curbed the US’ May rebound and the 4.90 support is facing more scrutiny. Third tests often prove pivotal so what happens here could have lasting impact. If 4.90 broke, there is plenty of open space down to the 4.50’s. If able to hold a third time though, 5.10 would call as the exit from a new inverse H&S.

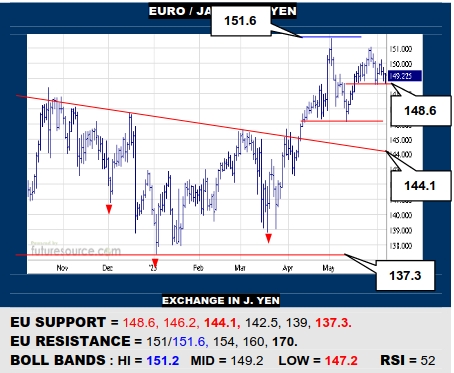

EURO / JAPANESE YEN

EU struggles shy of the 151’s are creating the risk of a tiny H&S if the 148.6 ledge gave way, in which case beware an attack on 146.2 with the threat of a larger dual top to then contest the broader base under 144.1. Must otherwise balance on 148.6 to keep 151.6 in the frame as the escape hatch on up the mountain towards the ’08 high at 170.

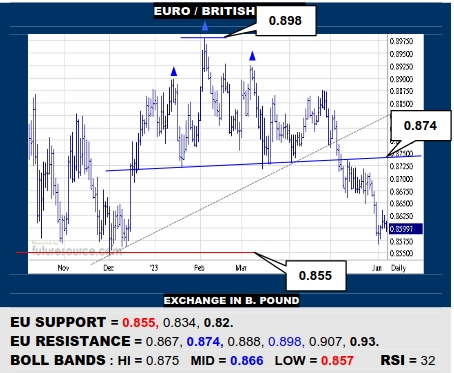

EURO / BRITISH POUND

After completing an H&S early in May to derail from a prior uptrend, the EU has dropped away towards the next main defensive line at 0.855. This is a vital prop to avert an even bigger double top from really turning the screws and driving on down to 0.82. Must at least react back over 0.867 to turn focus onto the H&S neckline (0.874).

Every effort has been made to ensure accuracy but no guarantee is offered by Technical Commentary or Mike Ellis against errors or omissions and no liability will be accepted for any trading based on the analysis and suggestions provided herein. This information is intended solely for the personal and confidential use of the designated recipient and may not be redistributed, retransmitted or disclosed, in whole or in part, or in any form or manner, without the written consent of Mike Ellis. Copyright © 2017 Technical Commentary.