Every effort has been made to ensure accuracy but no guarantee is offered by Technical Commentary or Mike Ellis against errors or omissions and no liability will be accepted for any trading based on the analysis and suggestions provided herein. This information is intended solely for the personal and confidential use of the designated recipient and may not be redistributed, retransmitted or disclosed, in whole or in part, or in any form or manner, without the written consent of Mike Ellis. Copyright © 2017 Technical Commentary.

For those seeking more than just analysis of the Dollar Index as a benchmark for currencies as a whole, this report looks at 8 major spot Forex pairings that make up the lions’ share of the vast global FX marketplace while ensuring that critical diversity key to the successful investor.

For more information please contact Michael here.

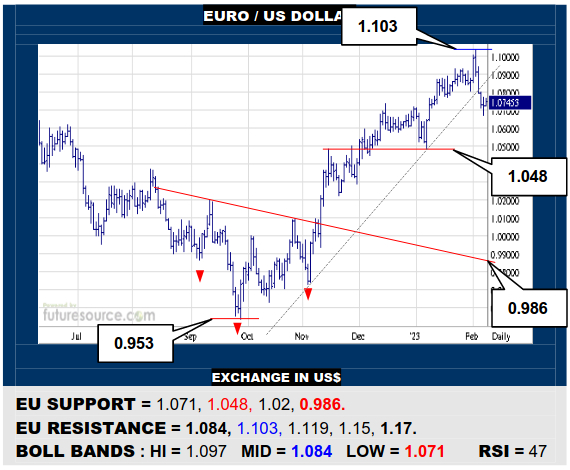

EURO / US DOLLAR

The EU has derailed from the interim uptrend but initially found some buffering at its lower Bollinger band (1.071). Even so, this would have to spark a jolt back over the mid band (1.084) to retrieve the trend disruption and help secure a footing up here. While shy of the mid band, beware something more bear flaggish and a further drop to 1.048.

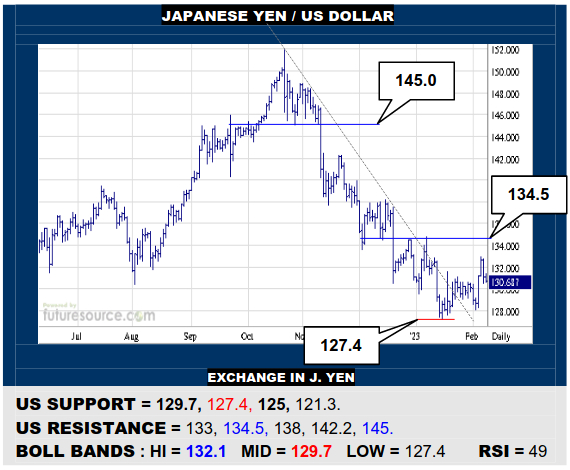

JAPANESE YEN / US DOLLAR

Having wriggled free of the Q4 downtrend during Jan, the US got a preliminary bump in early Feb to hone the trend exit but will need to see 134.5 defeated to further reinforce the turn and create a view to 145. Minding the mid band meantime (129.7) for any sign of fading, in which case still wary of an additional slip through to 125.

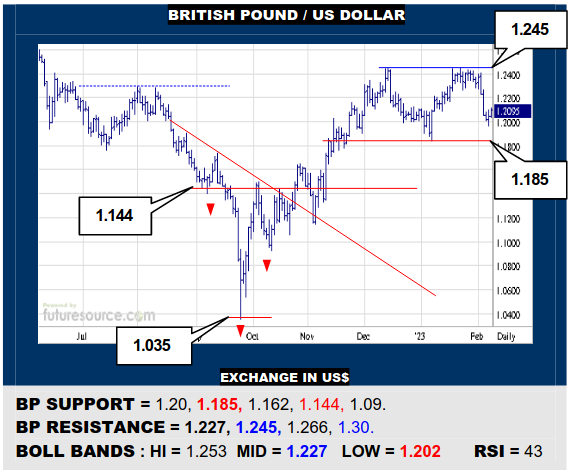

BRITISH POUND / US DOLLAR

The BP has fallen away from the second rebuke at 1.245 but has been allowed a breath in the early going of this week. Still wary of the bear flag dangers of such action so a swat from the 1.20’s would warn of a possible double top resolving at 1.185. Only a jolt back over the mid band (1.227) would make some more reliable repairs.

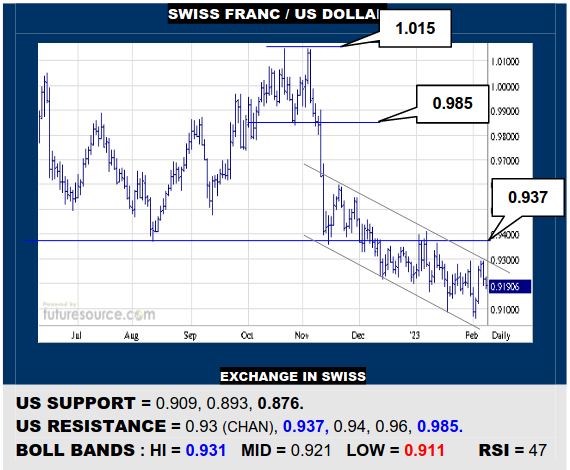

SWISS FRANC / US DOLLAR

A Feb rebound has still been restrained within the gentle descending channel so the US has work to do yet escaping both that (0.93) and then the main 0.937 top border to really shake off the malaise and see a clearer path higher. Alternatively, a decisive snap of the 0.909 support could resume the slide on down to the early ’21 low (0.876).

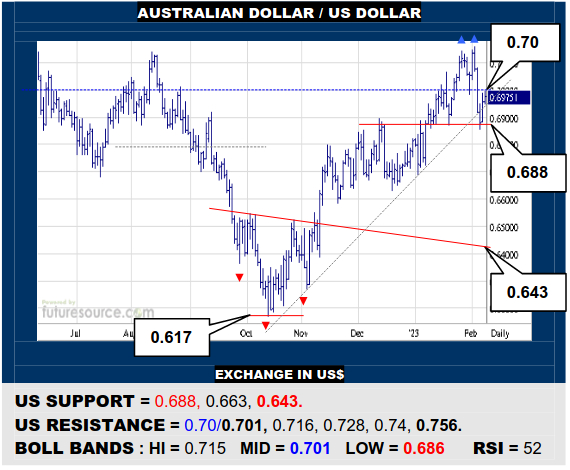

AUSTRALIAN DOLLAR / US DOLLAR

Once again the 0.70’s proved slippery and the AD has posted a small new dual top there. It must punch back over 0.70 then to pierce that pattern and resurface above the mid band in order to patch up recent damage. If held in check at 0.70 however, the uptrend disruption could intensify with loss of 0.688 to trigger a harder fall to the 0.64’s.

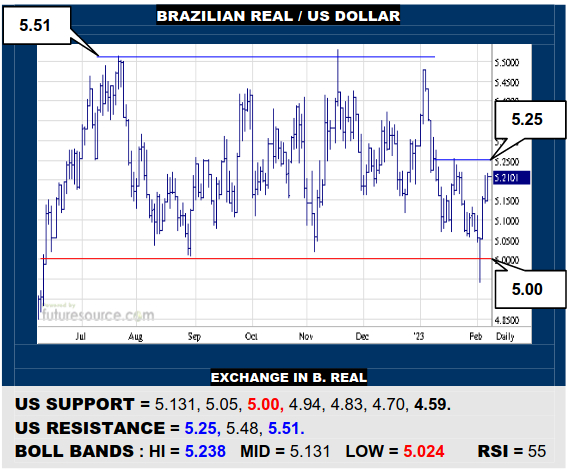

BRAZILIAN REAL / US DOLLAR

Recouping a gouge through 5.00 the very same day proved the grip last week and the US has reacted back up across its mid band. Now looking for it to reinforce the bounce by popping 5.25, in which case the 5.50 area will be back within reach. If blocked at 5.25, it would warn of more thrashy ranging and the risk of another visit to 5.00.

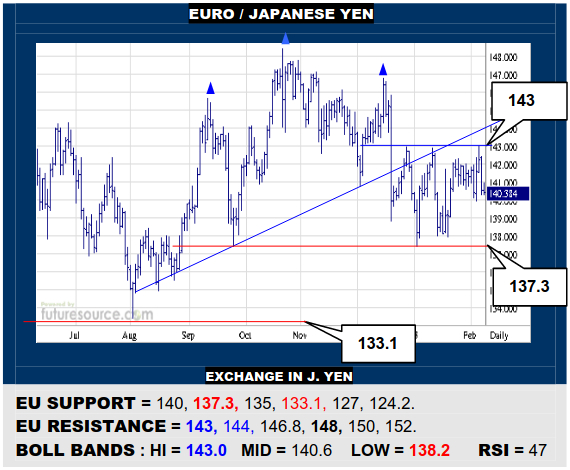

EURO / JAPANESE YEN

No cigar once more for the EU at 143, thereby still denying any sort of new basing effort. This warns to watch 140 as a tripwire back to the broader 137.3 support where the past five months could merge into a far more damaging top structure. Must otherwise dig in at 140 and clear the 143 hurdle to really turn the corner back up to try 148 again.

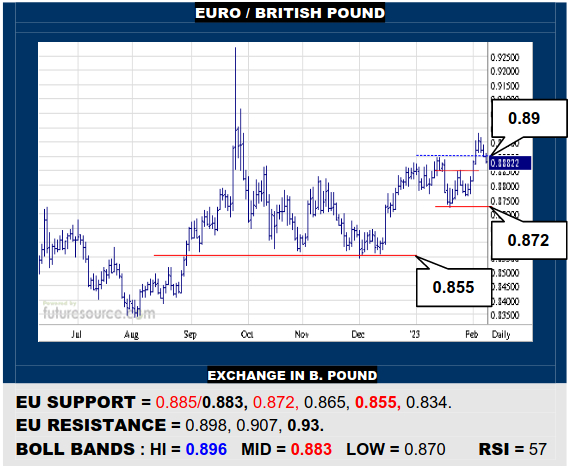

EURO / BRITISH POUND

An EU foray over 0.89 has tailed off a bit but it should find better bracing at a small new 0.885 base ledge with the mid band pulling in behind (0.883). If buffered there, a more incisive drive into the 0.90’s would still be envisaged. Only if the mid band gave way would a recent false breakout be implied to warn of returning to 0.855.

Every effort has been made to ensure accuracy but no guarantee is offered by Technical Commentary or Mike Ellis against errors or omissions and no liability will be accepted for any trading based on the analysis and suggestions provided herein. This information is intended solely for the personal and confidential use of the designated recipient and may not be redistributed, retransmitted or disclosed, in whole or in part, or in any form or manner, without the written consent of Mike Ellis. Copyright © 2017 Technical Commentary.