Every effort has been made to ensure accuracy but no guarantee is offered by Technical Commentary or Mike Ellis against errors or omissions and no liability will be accepted for any trading based on the analysis and suggestions provided herein. This information is intended solely for the personal and confidential use of the designated recipient and may not be redistributed, retransmitted or disclosed, in whole or in part, or in any form or manner, without the written consent of Mike Ellis. Copyright © 2017 Technical Commentary.

For those seeking more than just analysis of the Dollar Index as a benchmark for currencies as a whole, this report looks at 8 major spot Forex pairings that make up the lions’ share of the vast global FX marketplace while ensuring that critical diversity key to the successful investor.

For more information please contact Michael here.

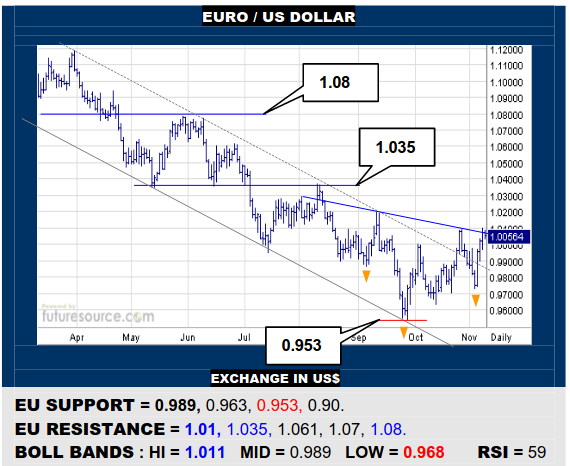

EURO / US DOLLAR

A delve back through the ex-downtrend was quickly retrieved and so the EU now has a shot at forming an inverse H&S if it can soon pop 1.01. That would technically project through 1.035 on up to 1.07 as the first main step of a broader turn. Alas, if foiled by 1.01, beware any new twist back under the mid band (0.989) bursting the base bubble.

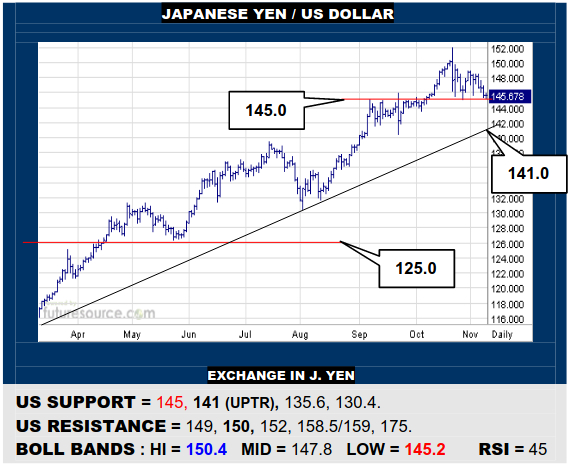

JAPANESE YEN / US DOLLAR

The US is leaning heavily on its initial 145 support shelf, on the verge of a break that would install a ragged new top while also bringing the years’ uptrend into play (141). Subsequent loss of that trend as well would really suggest turning the tide but if able to hold 145 and bounce back over 149, the crisis would appear to pass.

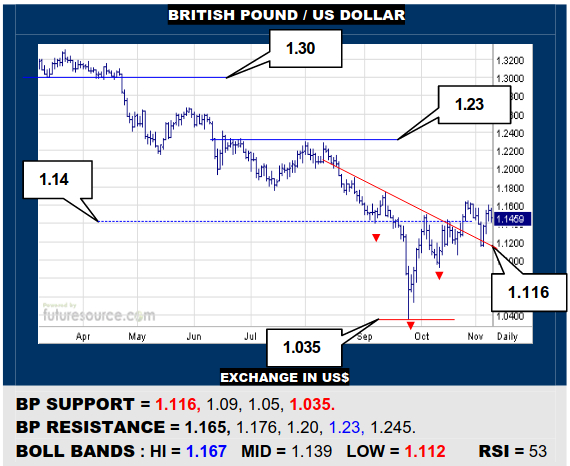

BRITISH POUND / US DOLLAR

The BP’s dip was buffered by the inverse H&S neckline (1.116) and it is back in the hunt for a further base proving escape over 1.165, then setting sights on 1.23. Only if blunted a second time at 1.165 and steered back through the base neckline would this rebellion appear to unravel, threatening a new dunk into the 1.05/1.035 depths.

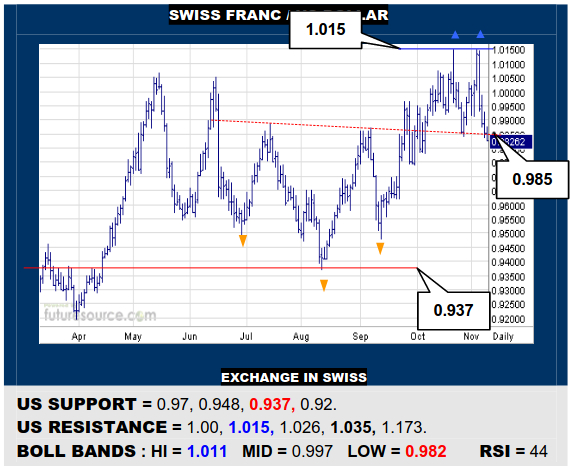

SWISS FRANC / US DOLLAR

Foiled for a second time at 1.015, the US has veered back sharply to provisionally splinter the 0.985 neckline of the prior inverse H&S. If this break were confirmed in the coming days while 109.5 truly cracked on the Index, a longer lasting apex would be implied. Must otherwise claw back into the 1’s to reassure the underlying base instead.

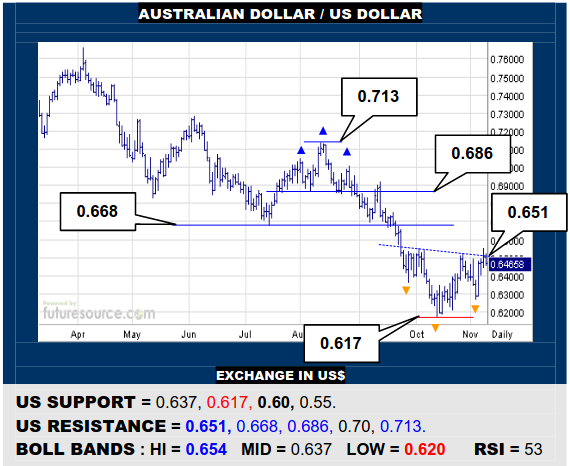

AUSTRALIAN DOLLAR / US DOLLAR

Plucking up last weeks’ dip, the AD has a chance at forming a small new inverse H&S if it can really bust into the 0.65’s and grip. Success would then buoy the odds of overcoming 0.668 and challenging the preceding upright H&S border at 0.686. Alas, if denied access to the 0.65’s, be prepared for more ranging that could reach 0.617 again.

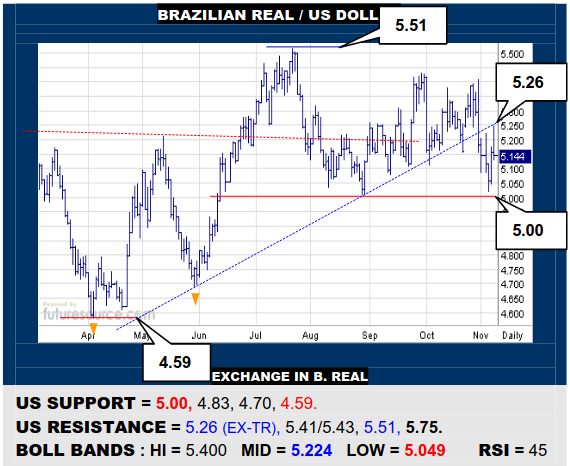

BRAZILIAN REAL / US DOLLAR

The 5.00 support has initially buffered the uptrend derailment but the US has then been blocked by that ex-trend overhead (5.26) amidst some very thrashy action. Only a jolt back over that ex-trend would restore a footing while meantime there is the looming threat of a bigger top resolving if 5.00 gave way, opening the door down to 4.59.

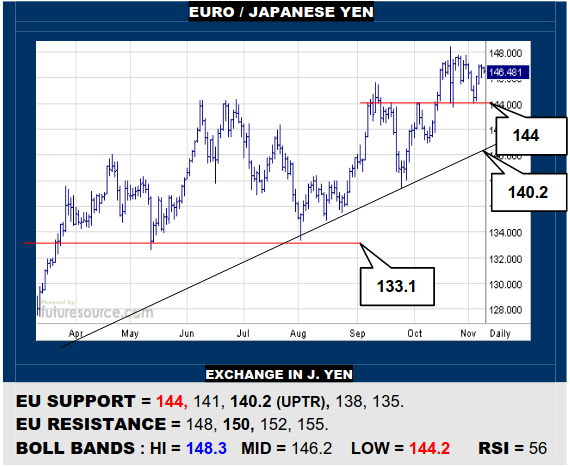

EURO / JAPANESE YEN

The 144 shelf has proven resilient but the EU must soon now bust through the 148’s to suggest more of a flaggish type event that would then point on through 150 to about 155. If subject to more wheelspin under 148, fears would grow for the 144 brace and its demise would warn of a pending confrontation with the main uptrend (140.2).

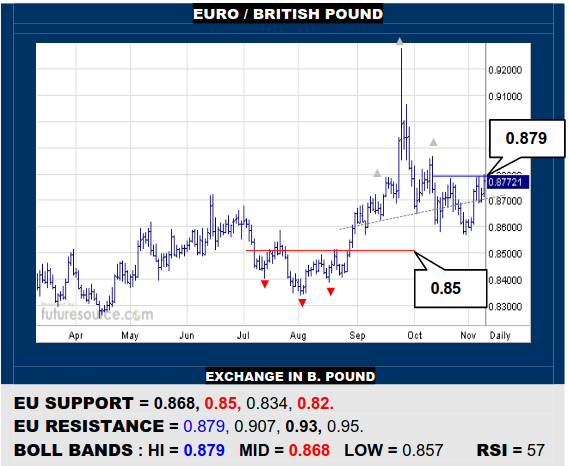

EURO / BRITISH POUND

The EU held clear of a prior 0.85 Q2 base rim and has swerved up to dispel a more recent toppy structure. It just now needs to vault 0.88 and gain grip there to mold recent weeks into a new somewhat higher base to launch another run at the 0.90’s. Only quickly veering back under the mid band (0.868) would undercut this revival.

Every effort has been made to ensure accuracy but no guarantee is offered by Technical Commentary or Mike Ellis against errors or omissions and no liability will be accepted for any trading based on the analysis and suggestions provided herein. This information is intended solely for the personal and confidential use of the designated recipient and may not be redistributed, retransmitted or disclosed, in whole or in part, or in any form or manner, without the written consent of Mike Ellis. Copyright © 2017 Technical Commentary.