Insight Focus

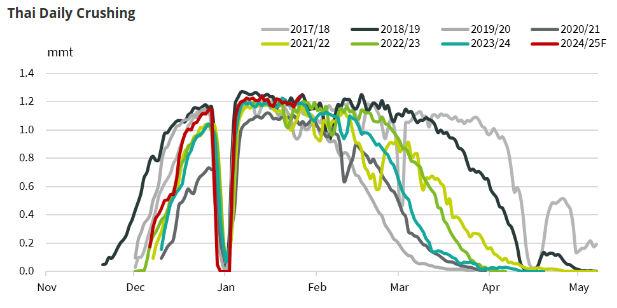

We’ve downgraded our Thai cane crush forecast from 105m to 100m tonnes. Rules on burnt cane are slowing cane acceptance at mills.

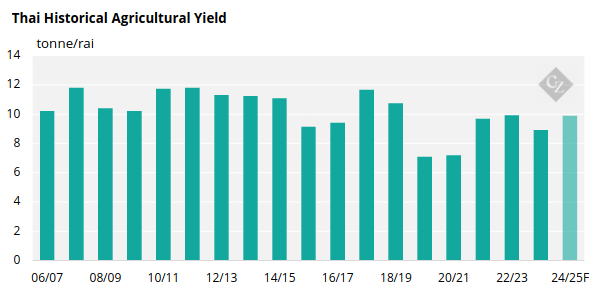

Thailand’s 24/25 Ag Yields Rebound Less Than We Hoped

We’ve made a small adjustment lower to our Thai cane crush forecast. The weather has been cooler than normal in December and January, which has affected cane that’s due to be harvested.

Some areas in the Northeast have also reported cane borer infestations, which can have a negative effect on the cane.

Cane Borer

We’ve therefore lowered our agricultural yield estimate a little, resulting in our cane crush forecast dropping from 105 million tonnes to 100 million tonnes.

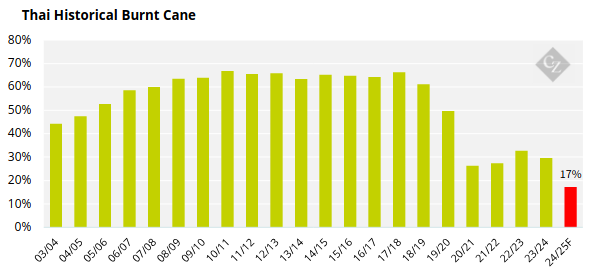

Burnt Cane Policy

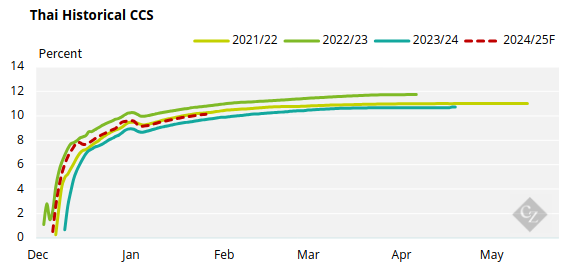

Thai mills are also grappling with the government’s burnt cane policy. Mills are only allowed to accept 25% burnt cane a day; part of the government’s plans to improve air quality. Burnt cane delivered to the mill beyond this level must wait before it can be crushed, meaning there’s a burnt cane backlog. Cane needs to be processed immediately after harvest or it loses moisture and sucrose content.

Although, we expect sucrose yields to perform well this year, the burnt cane policy will impact the recovery at the mill. We therefore expect Thailand will produce 10.8 million tonnes of sugar in the 2024/25 season, down from our previous forecast of 11.6 million tonnes.

So far this season, 58 sugar mills have crushed 45.6 million tonnes of cane and produced 4.6 million tonnes of sugar.

2025 Exports

Current white premium levels do not incentivise mills to produce additional white sugar. This is especially the case given China recently banned liquid sugar and premix imports from Thailand. If the Chinese ban remains in force it’s possible the Thai remelt is lower than we’d first expected which could lead to an additional 300k tonnes raw sugar availability in Q2’25.