349 words / 2 minute reading time

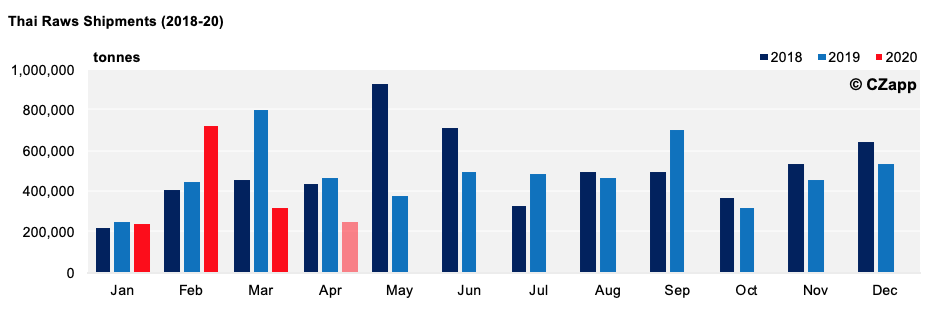

- After an impressive February, raw sugar shipments were down 481k tonnes year-on-year (YoY) in Mar’20.

- We are beginning to see reduced demand for Thai sugar as increasing prices allow other origins to compete into other destinations.

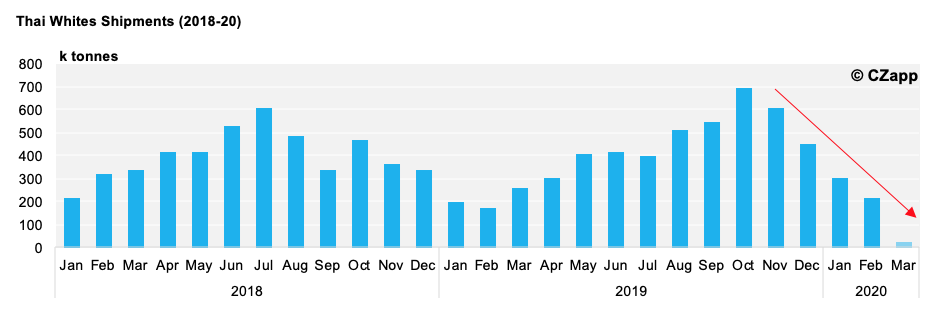

- The white sugar export flow also dropped by 89k tonnes month-on-month (MoM), from January to February.

Raws Shipments: Coronavirus Lessens Producers’ Needs

- After huge shipments in February, the demand for raw sugar out of Thailand has significantly diminished.

- This is because we are starting to see reduced demand for Thai sugar as their increased premiums have meant other origins can now compete into different destinations, such as Indonesia.

- However, the progress in April so far does not look too bad, with 246k tonnes having already been nominated.

- As production has started to continue as normal in locations, such as China, the pace of exports out of Thailand could perhaps follow suit; this may be wishful thinking at this point, however…

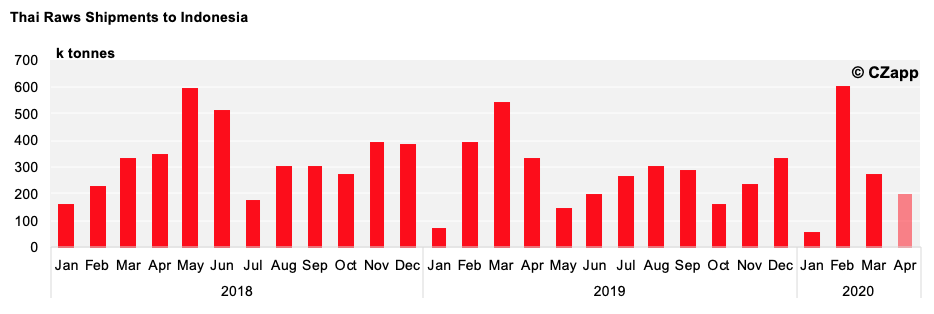

- Almost all of Thailand’s raws exports went to Indonesia in Feb’20.

- However, we saw a major drop off in March as other origins have started to compete with Thailand to a larger degree.

Whites Shipments: Started 2020 Strong, Now Declining Rapidly

- Whites shipments started strong in 2020, up 109k tonnes year-on-year (YoY).

- Despite this, the decline in shipments, which begun in Oct’19, is yet to show any sign of rebounding.

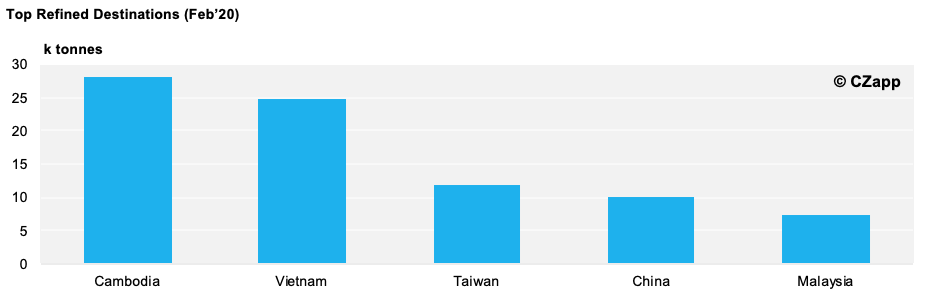

- With 216k tonnes having been shipped in Feb’20, Cambodia was the top destination once again, taking 27k tonnes in February; down 30k tonnes MoM.

- Other key smuggling regions* appeared in the top five destinations as well, as you can see below.

*Key Smuggling Regions: Cambodia, Laos, Myanmar, Taiwan and Vietnam.

- This is interesting because shipments to key smuggling regions were down by 705k tonnes YoY as 2019 came to an end.

- They were also down 55k tonnes between Dec’19 and Jan’20.

- Does this mean that with China being back to work, smuggling flows are starting to pick up once again?