Insight Focus

Thailand’s pineapple supply is tight. September output is down 40% and prices are around THB 14/kg. Limited supply has halted product lines, pushing juice prices higher. However, Q3 rainfall may boost 2025 yields.

Thai Pineapple Shortage Worsens

Thailand’s pineapple industry is facing a supply shortage as factories scale back production amid a tough season. A representative from a local pineapple producer shared that it had ceased new orders and paused production for nearly a week.

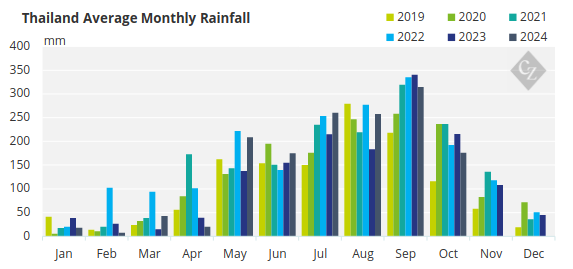

The winter crop, usually a reliable source for replenishing supply, has been delayed due to challenging weather. Though Thailand is no longer in El Niño phase, rainfall since Q1 and Q2 fell short for pineapple development, pushing back the Q4 harvest.

Production figures highlight the strain on supply. September’s output fell 40% short of initial forecasts, and even during the peak season from November to December, daily capacity is expected to reach only 4,000 to 5,000 tonnes—well below the 6,000 tonnes needed to meet industry demand.

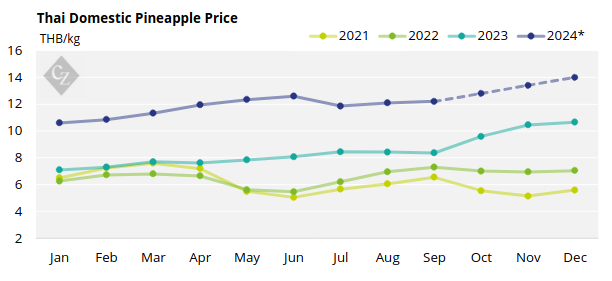

This shortfall is driving up domestic pineapple prices to around THB 14/kg, while concerns over quality are growing as nitrate levels increase, with only 7-10% of the fruit meeting premium standards.

One major pineapple factory has halted production of pineapple-based products due to the high cost and scarcity of fresh pineapples. While other production lines are still running, items specifically made from pineapple are temporarily on hold.

Juice Market Faces Delays, Rising Prices

The juice market faces similar pressures. High prices at the end of the summer crop pushed farmers to harvest all available fruit, affecting quality and squeezing the winter crop. As a result, Thailand’s juice supplies may not arrive in Europe until November. Prices for juice for November to March shipment have climbed to around USD 3,800/tonne.

The outlook for the winter crop is more favourable. Mr. James, a pineapple farmer I met in Ratchaburi province who owns 100 rai (16 hectares) of plantations, shared that his fields received adequate rainfall during the third quarter, resulting in improved fruit performance.

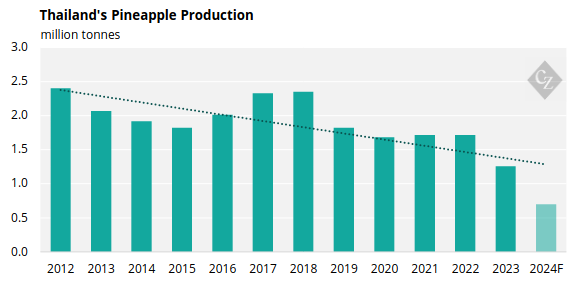

Production for 2024 is expected to reach around 700,000 tonnes, slightly below last year’s figures. However, with higher prices and ongoing replanting efforts, output could rise to between 800,000 and 1 million tonnes by 2025. While this increase would represent positive progress, it is worth noting that Thailand’s production once exceeded 2 million tonnes annually.