Insight Focus

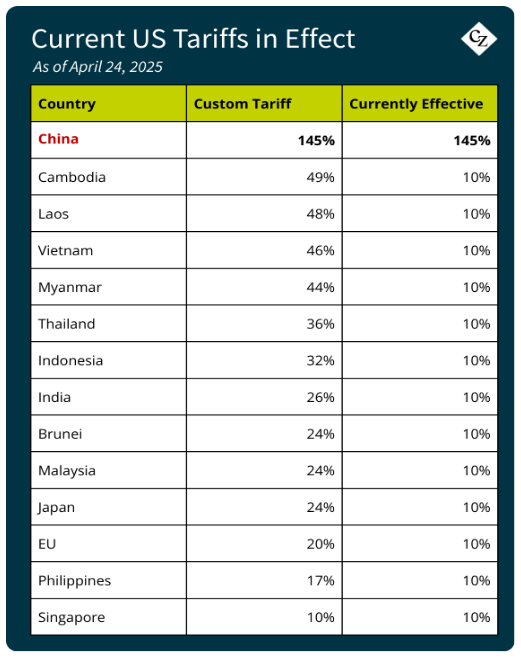

Thailand faces a major economic challenge following the imposition of new tariffs. US President Donald Trump has imposed a minimum 10% tariff on all countries. Thailand has been hit with a potential custom tariff of 36%, although this has been temporarily suspended and the 10% rate now applies.

US President Donald Trump has announced a 10% import tariff on all goods from every country and additional tariffs for several nations. Thailand, if the higher rates for certain countries go ahead, will face a 36% tariff on all types of goods (except for some agricultural products).

Trump’s “America First” policy focuses on reducing the US trade deficit and stimulating domestic economic growth. By increasing import tariffs, he aims to reduce reliance on foreign goods and encourage US consumers to buy domestically produced products.

Since the original announcement, Trump has now announced a 90-day break for some extra tariffs the US placed on other countries. This pause gives the US and its trade partners time to talk and possibly make new deals.

Thailand is prepared to negotiate and will consider reducing tariffs on US imports, particularly on goods that it already imports from other sources, such as animal feed corn and soybeans. This is in an effort to help reduce production costs domestically and strengthen trade relations with the US.

However, China is not included in the pause. In fact, the US has raised tariffs on Chinese goods to 145%, the highest rate of all. The 10% import tariff that applies to all countries is still in place and hasn’t been paused. It’s unclear what will happen after the 90 days.

Impact on Soybeans

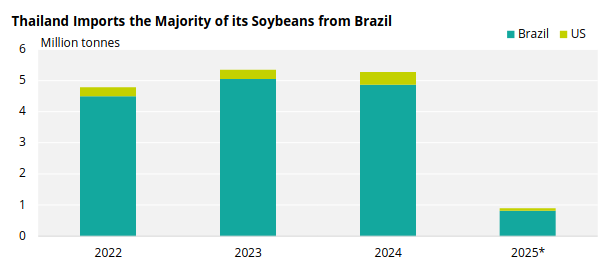

China is facing a staggering soybean shortage of around 90 million tonnes annually, making it heavily reliant on imports, particularly from Brazil and the US. With tensions rising, China is turning to Brazil for its soybean supply, driving up the premium prices on Brazilian soybeans.

Thailand mainly imports soybeans from Brazil, and an increase in Brazilian prices could also raise Thailand’s import costs. To manage this, Thailand may import more soybeans from the US to offset the price increase from Brazil and help reduce its trade surplus with the US.

Impact on Corn and Wheat Feed

In 2025, Thailand will need 9.2 million tonnes of animal feed corn, but it can only produce 3.67 million tonnes domestically, meaning the rest must be imported, mainly from Myanmar and Laos.

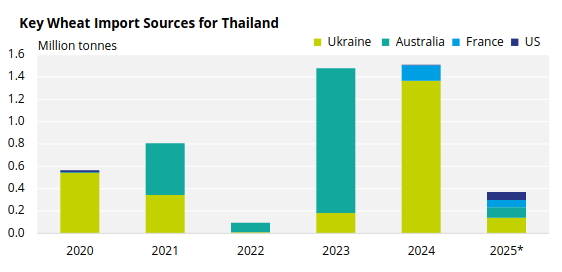

Similarly, according to data from Thailand’s Ministry of Commerce, Thailand imports approximately 1 million tonnes of wheat annually, primarily from Australia, Ukraine, France, and the US. However, in response to recent increases in US import tariffs, Thailand may import more soybeans from the US to reduce its trade deficit with the US.

At the same time, the Thai government is working to reduce air pollution (PM 2.5) by refusing to buy grain from farms that burn crops, which could lower domestic production even further, making Thailand even more reliant on imports.

The strategy of increasing soybean and animal feed corn imports has sparked controversy in Thailand. Rising imports could lower domestic corn prices, making it harder for local farmers to compete. This could also lead to monopolies controlled by large businesses that import raw materials, negatively affecting the income of Thai farmers.