- After touring the cane fields in North-East Thailand, we have reduced our estimates for cane planting and crushing next season.

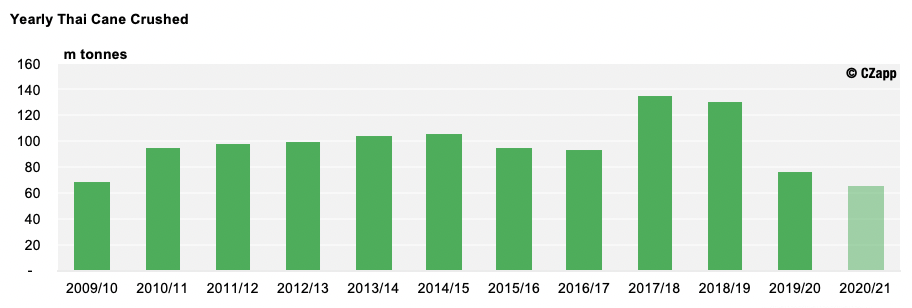

- Thailand will crush approximately 65m tonnes of cane in 2020/21.

- This is their poorest crush in over 10 years.

Thailand’s Poorest Crush in Over 10 Years

- We think Thailand will crush 65m tonnes of cane next season, less than half of what was crushed in 2018/19.

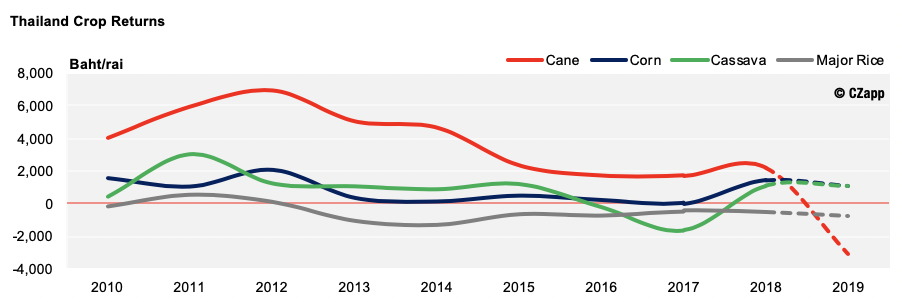

- This is because farmers have switched from planting cane to cassava due to its higher profitability.

- The increased demand for seed cane also means more farmers are reserving cane for this purpose, dropping availability to a 10-year low.

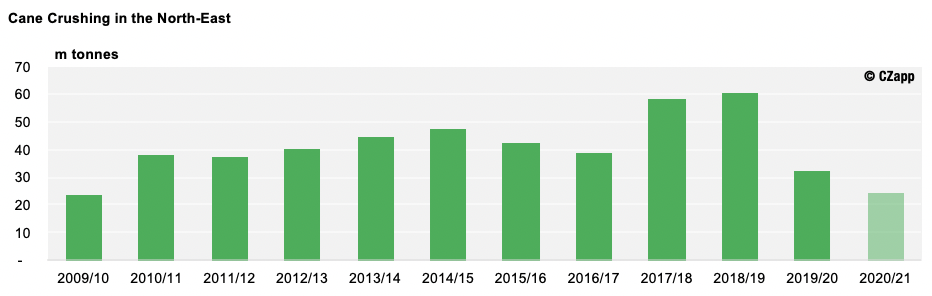

Planting and Crushing Decline in the North-East

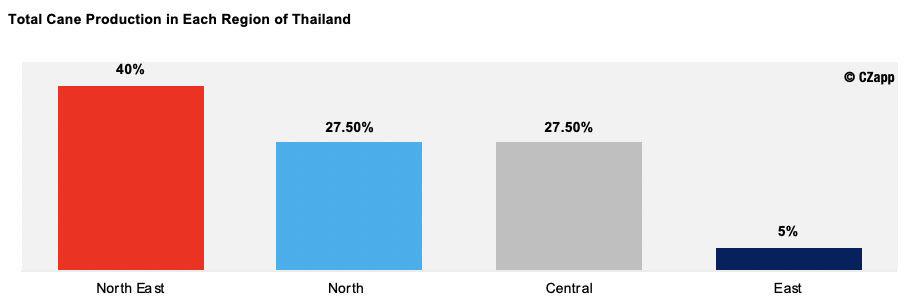

- The North-East is Thailand’s largest cane-growing region, accounting for 40% of its yearly production.

- However, both cane planting and crushing will decline there next season.

- Crushing will reduce by 8.2m tonnes year-on-year, totalling 24.4m tonnes.

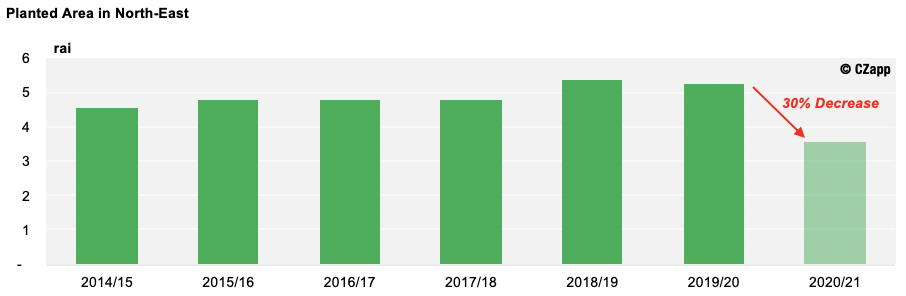

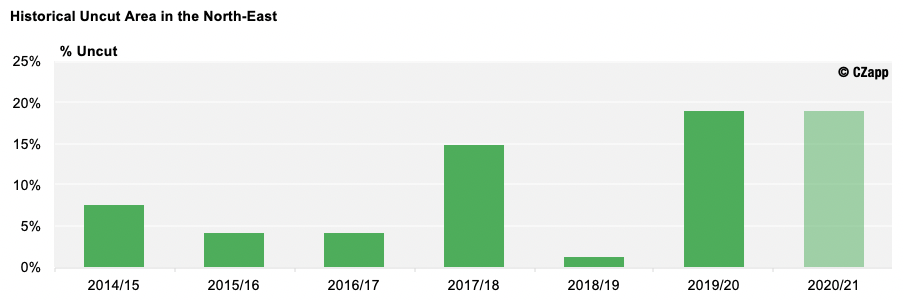

- The North-East’s planted area has also dropped to its lowest level on record.

- In some areas, 50% of cane has been lost to other crops, most notably cassava.

- We have consequently reduced our North-East planted area by 30%.

- The switch to cassava started to occur in 2019/20, as cane agricultural yields almost halved in some areas and seriously reduced the profitability of cane.

- More recently, other factors such as cassava’s shorter growing cycle, government assistance on price, and its better drought-resistance have supported the farmers’ decisions to switch.

- With this in mind, we think cassava could be a threat to cane planting in the North-East in the long-term.

High Demand for Seed Cane Further Reduces Availability

- Farmers will likely reserve more of their cane from the upcoming crop for seed cane than they have done in previous years.

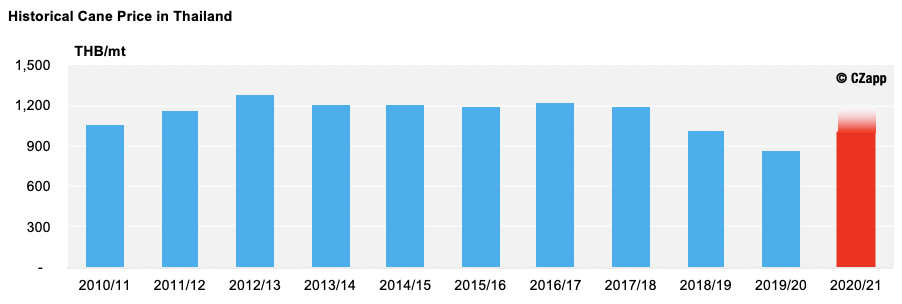

- This is because cane prices should move above 2,000 baht/mt in 2020/21, in excess of the expected cane price at 1,200 baht.

- Cane prices should improve this season and over the next couple of seasons.

- As a result, we think we will see a strong demand for seed cane in Q4’20 in the North-East, which will reduce the volume that would otherwise have been crushed in 2020/21.

Cane Yields Could Increase, But Not Enough

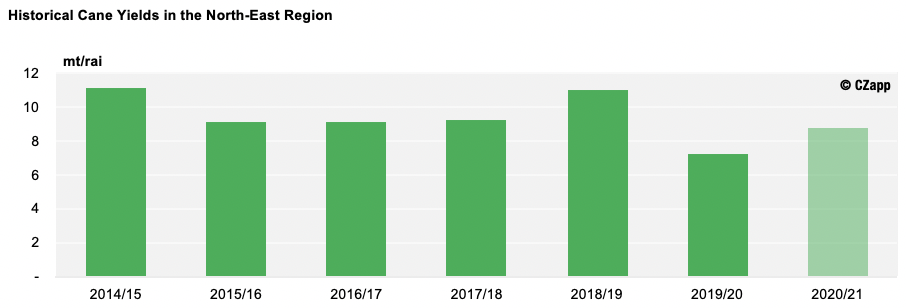

- We think cane yields in the North-East will increase slightly from last year.

- This comes as farmers are more likely to look after their cane crops well this year, in light of the good price.

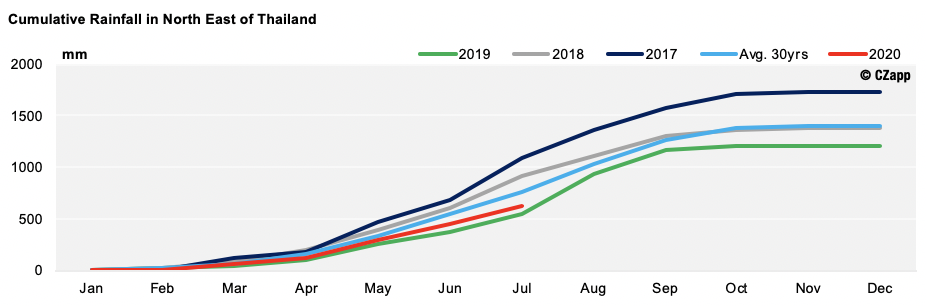

- Rainfall should also be good going forward, despite former difficulties caused by drought earlier in the year during the key growing stage.

- However, any increased yields will unlikely make up for the large reduction in production.

Other Opinions You May Be Interested In…

- Vietnam’s Refined Sugar Imports Surge; Can Thailand Respond?

- Pineapple: More Crop Woes for Thailand

- The Philippines: Sugar Consumption Falls