Opinions Focus

- Ethanol feedstocks in Thailand are expensive.

- Heavy rain and flooding has damaged the cassava crop.

- Ethanol producers and refineries are preparing for a challenging year ahead.

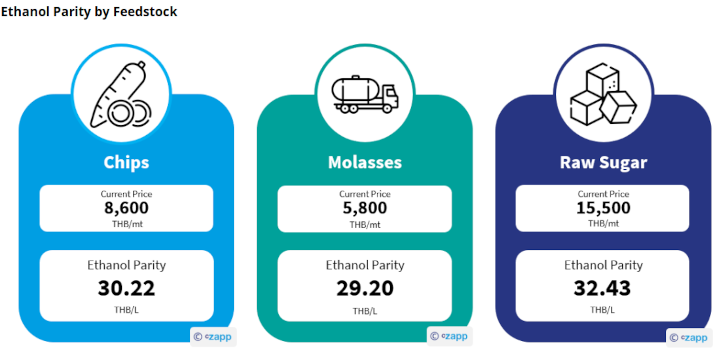

High Molasses Prices Push Up Ethanol Parity

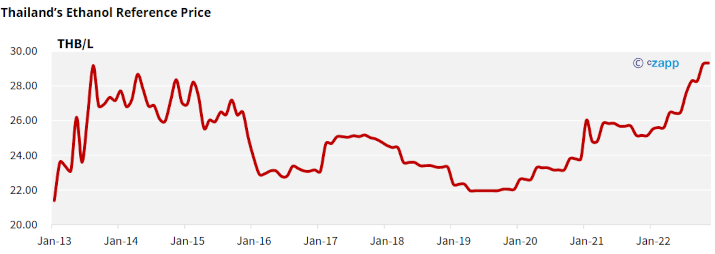

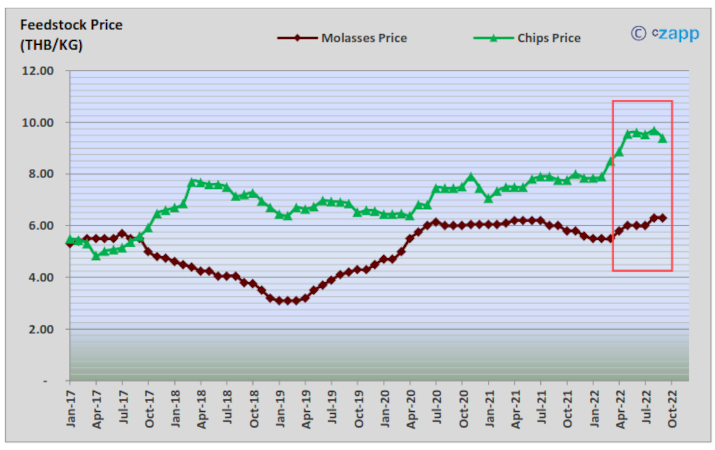

Thai ethanol prices need to stay above THB 29.2/litre given current domestic molasses prices. However, this parity is still cheaper than cassava chips given curent feedstock prices.

As it stands, the ethanol price is at 29.32 THB/L.

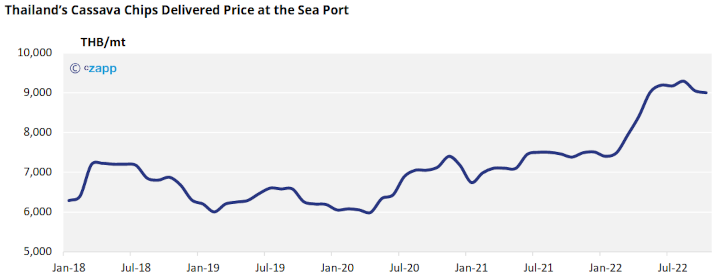

Thai cassava chips are expensive because there’s strong demand from China as well as the Thai ethanol producers. Competition between the two is liekly to support cassava prices for at least another year. As of October 2022, the delivered price of cassava chips at sea ports is THB 9,000/mt.

Heavy Rainfall Hits Crops

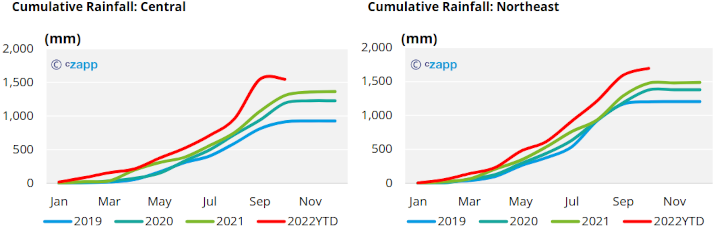

Typhoon Noru resulted in heavy rains and caused serious flooding in wide area of the Central and Northeast region.

The flooding causes a serious problem with cassava as it becomes rotten after standing in water.

Some farmers have to harvest early to avoid flood damage, which might lead to poor quality roots. This also means harvesting will be reduced in the peak season in December. This condition is the same as last crop’s which resulted in the highest cassava price ever amidst high demand from China.

How Should the Industries Prepare for It?

For this coming season, domestic molasses supply is expected to be around 3.6m metric tonnes, with little imports expected. In order to meet the feedstock demand (based on a daily ethanol demand of 4m litres per day), then an additional 3.5m-4mmt of cassava chips will be required.

Given current ethanol prices, this creates an issue for ethanol producers using cassava as a feedstock and until we see higher ethanol prices, it might mean that cassava-based ethanol producers continue to reduce production volumes and offer less into tenders.

As a result, we expect to see ethanol producers waiting to buy any dips on the cassava prices with the view to build stocks at levels that will be competitive.

In addition, there may also be opportunities for some ethanol producers to lock in raw sugar, in the event which we see any weakness on the No.11 market. However, at the time of writing the sugar price is above 19c/lb and we see that the price needs to be below 16.50 c/lb for raw sugar to be at positive parity for the ethanol at current levels.

Having in place an active risk management structure, to be able to forward hedge raw sugar, in the event there are these opportunities might be a route that some producers take.

If all feedstock prices remain supported, then this should see higher ethanol prices as we go into 2023.