Insight Focus

- Expansion of Thailand’s E20 mandate on hold again, say industry sources.

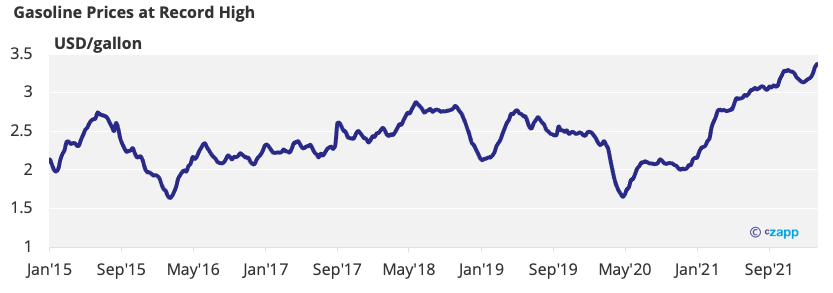

- Gasoline price surge main reason for delay.

- Thai cane production should still increase in 2022/23 as sugar prices rally.

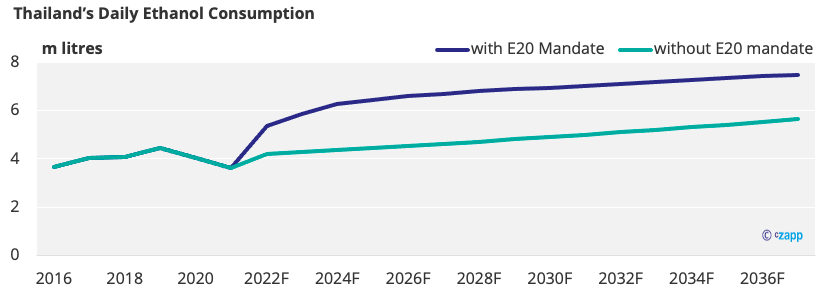

In 2018, the Thai government developed its Alternative Energy Development Plan. Through this, it hopes renewable energy will account for 30% of national energy consumption by 2037. To make this happen, the government wants to raise the amount of ethanol its blends with gasoline. It currently has a 10% blend but wanted to limit sales of this in July 2021, favouring E20 instead. This didn’t happen due to COVID, and it may be delayed again as the gasoline price is surging.

Thailand’s E20 Mandate on Hold Again?!

- Thailand’s E20 mandate was postponed last year as COVID hit fuel demand.

- Industry sources say it could be delayed again this year, with soaring gasoline prices making it difficult for the government to subsidise and promote E20.

- It’ll instead promote electric vehicles.

- With little being done to support the ethanol industry in the short term, we don’t think we’ll see a jump in E20 consumption, limiting the progress of AEDP 2018 for now.

- We also think high fuel prices and continued COVID restrictions will mean fuel demand remains below pre-pandemic levels.

What Does This Mean for Thai Ethanol Producers?

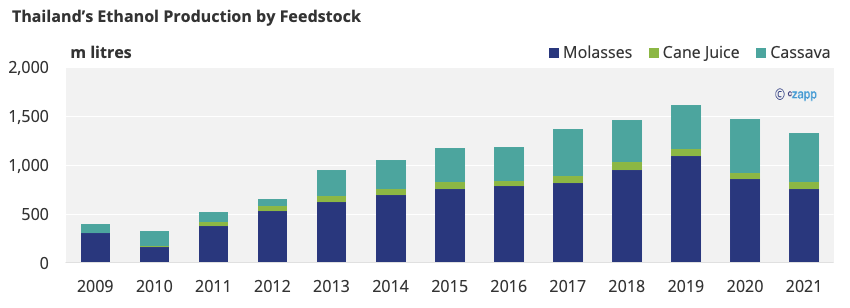

- Thai ethanol producers are coming under pressure as falling demand from gasoline blenders cuts both their earnings and ability to pay high prices for agricultural feedstocks.

- This could hit the cane farmers too as the revenue from sugar and molasses is reflected in the cane payments they receive.

- That said, the government should be able support both ethanol and electric vehicles as Thailand has an plenty of molasses and cassava that can be used to make ethanol.

- So, whilst it should remain difficult for Thailand to roll out the E20 mandate in full, the government should still manage to convince motorists to consume more E20.

What Does This Mean for Thai Sugar Producers?

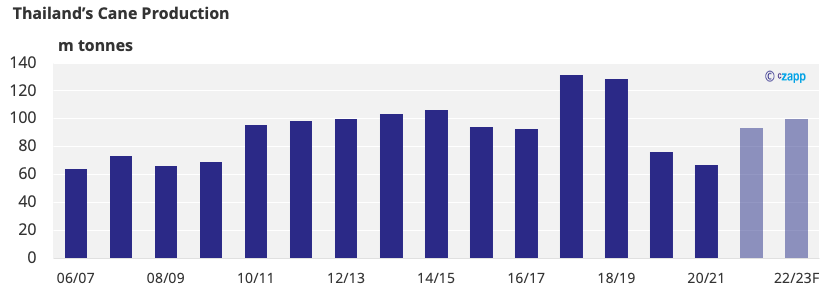

- The cane industry doesn’t earn much from molasses, so farmers see the sugar rather than ethanol prices as their incentive to plant cane.

- We therefore think Thailand will produce above 100m tonnes of cane in 2022/23, with the provisional price at a record high 1,000 THB/tonne.

- With this, more farmers should switch back to cane from cassava.

- Of course, this will still depend on consider less predictable factors like the weather as well.

Other Insights That May Be of Interest…

How Achievable is Thailand’s E20 Ethanol Goal?

The World Needs More Sugar…Can Thailand Help?

High Cane Returns Help Thai Farmers Through Energy Crisis

Explainers That May Be of Interest…