This update is from Sosland Publishing Co.’s weekly Sweetener Report. For more information and subscription details, CLICK HERE.

Insight Focus

- A quieter month for the US sugar market.

- Sugar supplies remain tight.

- Refined cane sugar prices have edged higher.

Cane sugar was offered by one refiner at 62¢ a lb f.o.b. at all locations for spot purchase, which compared with 68¢ a lb through Dec. 31, 2022, and with 61¢ a lb for 2023 previously. Refiners were either sold out or were highly sold in most cases. Beet sugar prices for 2022-23 were nominally 59¢ to 60¢ a lb f.o.b. Midwest with supplies mainly available from distributors. Processors offered small amounts if available. There still was uncovered business for 2022-23.

Deliveries of contracted beet sugar were slower in December, which is typical, although some trade sources expected deliveries for the full October-December quarter to be up from a year earlier mainly due to strong October shipments. Cane sugar deliveries appeared to be on pace for the season, and in some cases were above average as users turned to cane sugar to replace unavailable beet sugar.

Some minor disruptions to beet sugar production were indicated in late December due to a combination of weather and labor shortages over the holiday period.

Sales for 2023-24 progressed slowly. Recent offers were unchanged at 51¢ a lb f.o.b. Midwest for beet sugar and 52.50¢ a lb f.o.b. Southeast from one cane refiner. It was expected that sales won’t pick up until late February when buyers and sellers gather on the sidelines of the International Sweetener Colloquium in La Quinta, Calif.

It appears most of the 2022 Louisiana sugar cane crop escaped damage from a hard freeze late in December, although reports were mixed. The crop was said to be 80% to 85% harvested when the freeze occurred over multiple days. Kenneth Gravois, PhD, Louisiana State University AgCenter, said facilities were processing the crop with normal sucrose recovery, although damage may take time to appear. The US Department of Agriculture in its monthly crop update for December said sugar cane harvest continued through the month amid extremely wet field conditions with many producers reporting concerns from freeze damage.

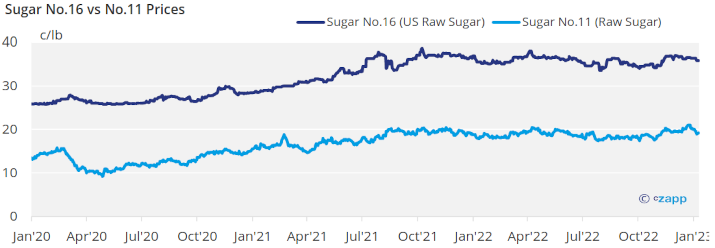

New York No. 11 world raw sugar futures tumbled on pressure from indications of increased world raw sugar supplies after a period of tightness sent nearby prices to six-year highs in late December. Strong early production in India and Thailand along with political changes in Brazil that discouraged ethanol production from sugar cane (thus increasing sugar production) were pressuring factors. Domestic No. 11 raw sugar futures followed world raws lower.

New corn sweetener contracts took effect Jan. 1 at prices up 20% to 40% or more from 2022 contracted levels. Numerous buyers still had needs to cover with limited options.