Insight Focus

Limited recycling and supply chain competition challenge PET producers. These factors mean they struggle to achieve recycled content mandates. Consumer demand for sustainable packaging grows, but cost remains a challenge. Solutions require industry collaboration, recycling investment, and consistent policies.

The challenges facing PET producers are constantly evolving, making it a moving target to stay ahead of these issues. But that’s not to say that we can’t make our target practice a little sharper by looking at how the latest challenges are impacting on the PET industry.

1. Recycled Content Mandates

PET producers are well versed in staying ahead of the changing legislation regarding recycled content through necessity, in order to respond positively to the market demands for more sustainable packaging.

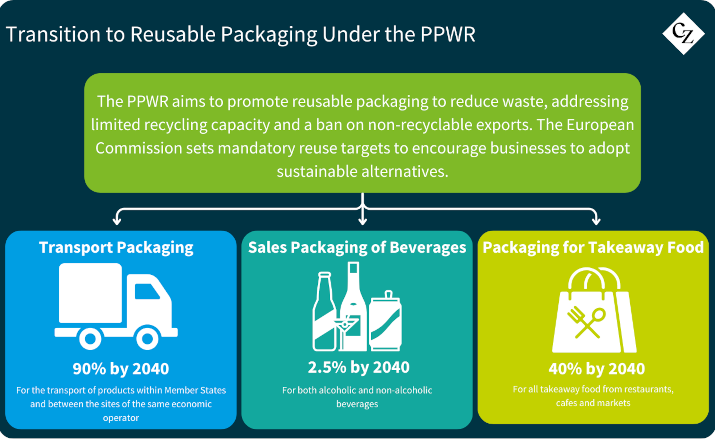

In Europe, legislation for plastic packaging is being shaped by the proposed revisions under the EU Packaging and Packaging Waste Regulation (PPWR). The current proposal is for 30% recycled content by 2030, with food-safe packaging suggested that a lower but still-critical 10%.

In the US, several states, including Washington and New Jersey, have proposed mandates for recycled content in plastic packaging, but the supply chain issues of fulfilling these suggestions are causing challenges and so the mandates are yet to be made law.

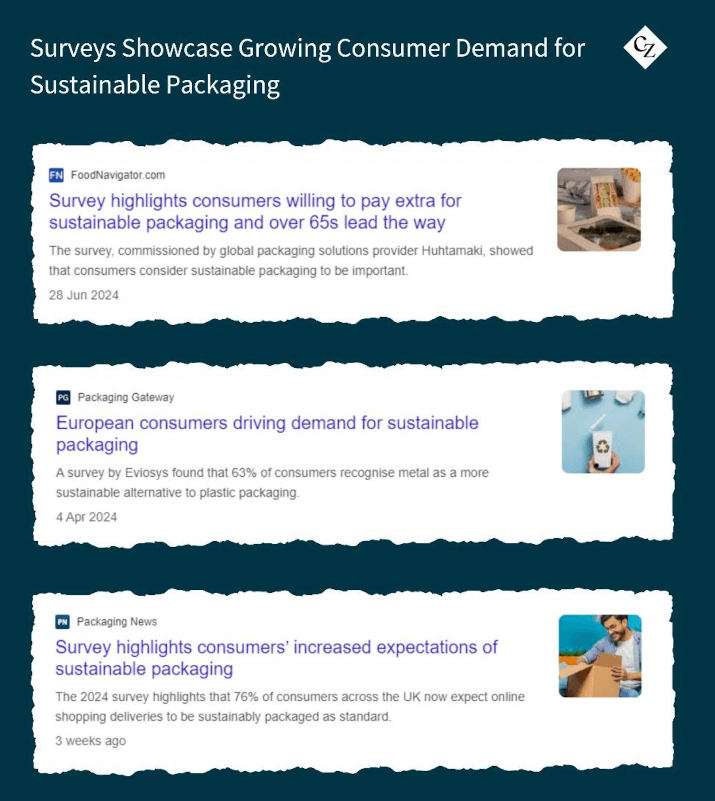

2. Consumers Demand Sustainability

Sustainability sells, but that’s not to say that sustainability pays. Consumers (in focus groups, at least…) say they want more sustainable solutions for the packaging of the products they choose, but in reality, they do not want to pay more for them (even if they say they will).

Brands want to meet sustainability targets, but they also need to have sustainable businesses from a commercial perspective, so here’s the rub.

The smart money is on integrating sustainability in an invisible-to-the-consumer way in terms of cost, yet in a marketable way in terms of messaging. This means design for recycling, lightweighting, downgauging and tethered closures are GO.

3. Recycling Infrastructure is Limited

For PET producers to be able to reach the recycled content mandates, they need to have reliable, regular access to recycled content. Insufficient recycling facilities and a lack of investment in the required infrastructure and standardised processes means that the volumes required are simply not available.

This also means that the price of rPET (recycled PET) can be hard to predict and not competitive. Which brings us back to the previous point of consumers only wanting sustainable packaging if there’s no price difference.

The required changes take time to implement, so as the mandate dates get closer, the urgency for the implementation also increases. With the fragmented legislation of different rules in different states and markets, this also impacts on the complications.

4. Supply Chain Competition is High

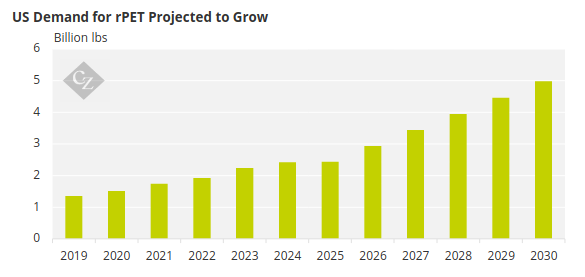

With the huge demand for rPET driven by the competing forces of sustainability across many sectors, not just packaging, the demand for this currently non-abundant material is felt from sectors including food and beverage, clothing and textiles, construction materials and automotive interiors.

Source: Mckinsey and Co

With everyone wanting the same thing, and the infrastructure lagging behind, the competition is high. For PET producers that have a reliable source of rPET, the advantage is strong.

These four key issues facing PET production underscore the need for more joined-up industry collaboration, increased investment in recycling technology, and policy reforms that are comparable across markets and territories to support a sustainable PET supply chain.