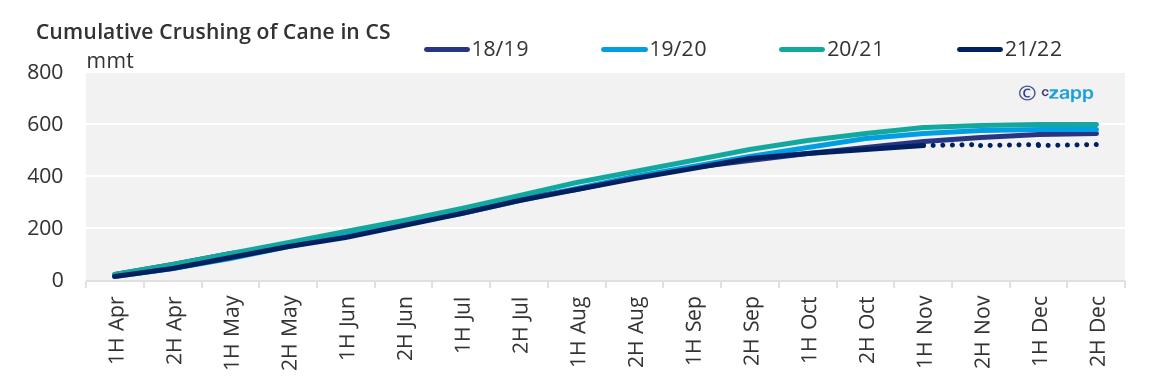

- Total cumulative crushing so far at 516mmt , close to our estimate of 520mmt for the total crop…

- The result is 31.8mmt of sugar produced by mid-November.

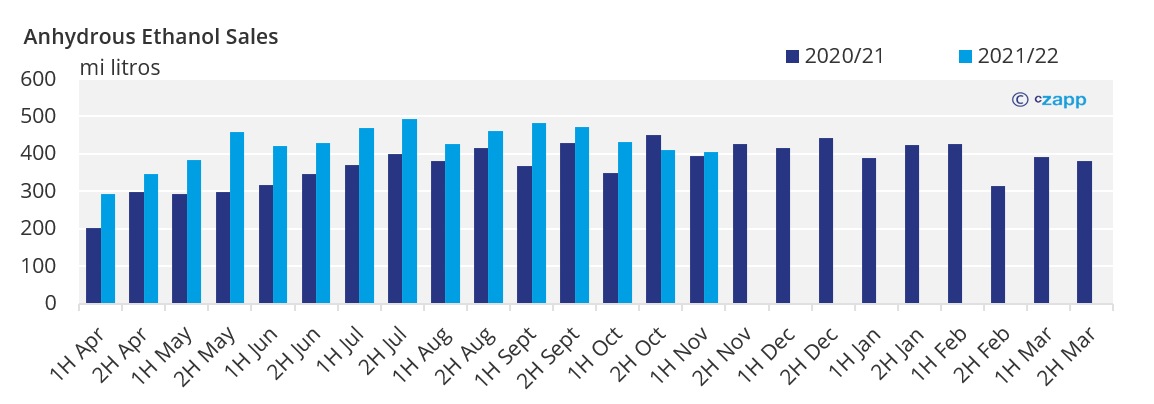

- For ethanol, anhydrous production growth over hydrous.

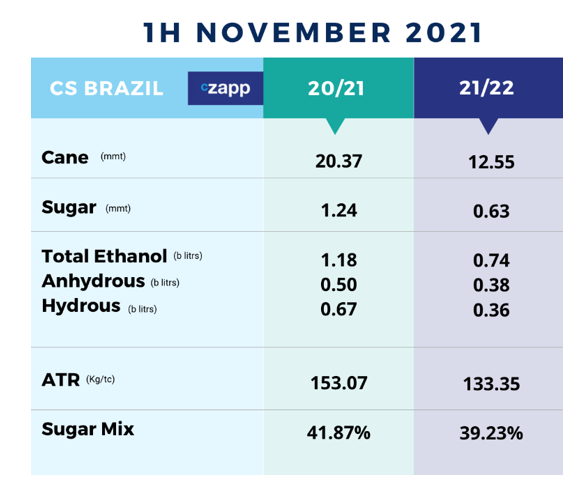

Crop 2021/22 – 1H November

Crop 2021/22 Getting to the end

- At the beginning of November, 12.6mmt of cane was crushed – bringing the cumulatve result for the crop to 516.2mmt.

- Although UNICA states in its report that crushing in the Center South should exceed 520mmt, we continue with our estimate of this value.

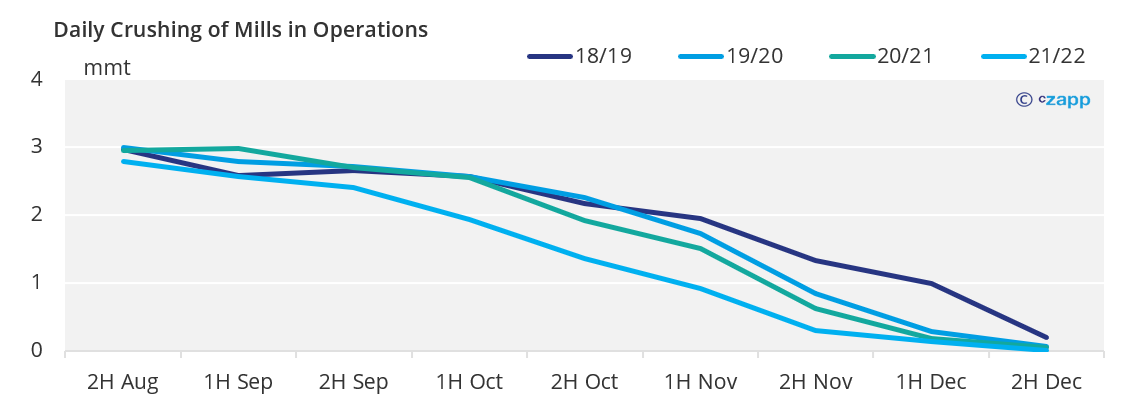

- The rains seen at the end of October, even if smaller, in this fortnight had two impacts:

- A lower ATR compares to the same period of 20/21;

- And some relief for the cane field after months of below-average rains – even so, the concern for 2022 has not yet passed.

- The result of the fortnight was a production of only 626kmt of sugar, taking the cumulative production to 31.8mmt.

- Only 75 mills were operating until the first half of November – 65 of which were sugar, 2 flex and 8 corn.

- In the same period last year, 114 mills were in operation.

Ethanol Market

- Hydrous ethanol and gasoline parity continues to rise, and last week it reached 82% in the state of São Paulo,

- As a result, the consumer has preferred to fill up with fossil fuel that contains a mixture of 27% anhydrous ethanol.

- In this way, anhydrous sales have been rising, being 20% above last year in total.

- Concerns about off-season availability seem to have receded, with mills increasing the supply of anhydrous ethanol through increased production and with news that around 600m liters should be imported in the coming months.

Other reports that you might like:

CS Brazil: Record Cane Price Weakens Mill Returns

Brazil: Ethanol Imports at a Loss to Save the Blend

Dashboard that you might like: Crop Models