- This Global PET Market Overview is brought to you by Wood Mackenzie Limited.

- As a company, they pride themselves on empowering strategic decision-making in global natural resources with quality data, analysis and advice.

- Here, they break down some of the more significant market-moving events of last month.

Demand for Pet Resin Stays Strong in the US

US PET resin demand stayed strong across all end-use market segments, as warm weather lingered and supported the single-serve beverage sector, primarily in carbonated soft drinks.

Regional PET resin producers are running flat out as a result and are in a sold-out position, with nearly all of them having announced a price increase surcharge of 4-4.5 c/lb from the 1st October 2020. This should remain effective for the rest of the year.

Demand for Mexican PET Continues to Recover

Demand for PET resin in Mexico remains on its path to recovery. This has been supported by strength in Q4 orders from both domestic and export markets.

The average packaging size has returned to pre-pandemic levels, highlighting an uptick in purchasing levels for immediate out-of-home consumption.

Mexican PET resin producers continue to operate at strong rates, at or close to full capacity, pending MEG availability, to support both domestic demand and the tight US market, resulting from its ongoing disrupted production.

Mexican Bottle-Grade Resin Exports Up Year-on-Year

Mexico exported 122k tonnes of bottle-grade PET resin in Q2’20, down 8% (11k tonnes) from Q1, but up 3% (3k tonnes) year-on-year.

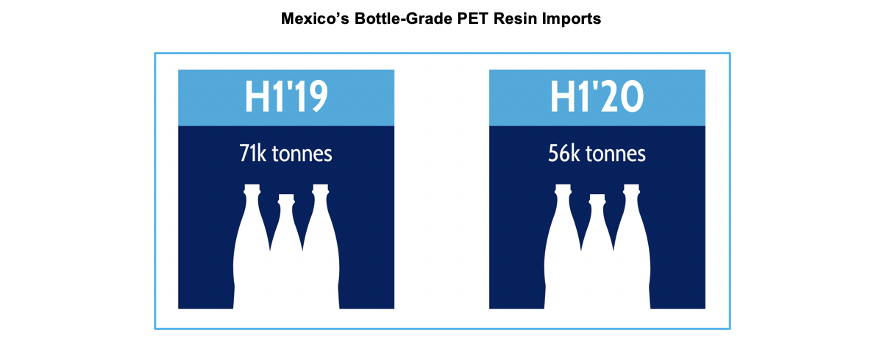

With this, Mexico’s bottle-grade PET resin exports were up 11% year-on-year (YoY) in H1’20, totalling 255k tonnes. Bottle-grade PET resin imports totalled were down 22% (15k tonnes) YoY in the same period, totalling 56k tonnes.

The Demand Recovery for PET Resin in the EU is at Risk Amidst Returning Restrictions

The European PET market seems to be taking backward steps in its progress against the coronavirus, with the reintroduction of restrictions blanketing most of the region.

September’s PET Resin sales were buoyed by the US enquires, which helped alleviate excess stock pressure. This is a potential game-changer for European producers now entering contract negotiations, coupled with European producers continuing to enter maintenance, as stock levels are more balanced.

European PET resin prices have increased by around 25 EUR/mt from September. Large volume enquiries from the US continue to hound European producers, with many securing large volume export deals, which are helping to alleviate accumulating stock pressure.

Pet Resin Imports in the EU Down in Q2’20

The EU27+UK imported 299k tonnes of bottle-grade PET resin in Q2’20, up 26k tonnes from Q1’20, but down 21k tonnes YoY. Total imports for 1H’20 were down 113k tonnes year-on-year. Around 70% of the PET resin imported came from Asia.

China’s Demand for PET Resin Stays Weak

Weakness in both China’s domestic and export markets pressured PET producers to lower prices in a bid to stimulate deals and reduce overall stock levels.

An early drop in seasonal temperatures brought about the premature end of peak season, adversely impacting PET demand.

Chinese PET resin prices have dropped by 300 RMB/mt (44.58 USD/mt) in September. PET producers’ inventory levels producers increased dramatically as a result and, by the end of September, reached above 30 days with delays in both domestic and foreign exports, combined with continued high regional operating rates.

PepsiCo Exhibits Strong Growth in Q3; Nan Ya Plastics Suffers Losses

Pepsi reported net revenue growth of 5% in Q3 (to $18.1 billion), and 3% to $47.9 billion in the first nine months of 2020. The group’s organic revenue in food and snacks business grew by 6%, while the beverages’ organic revenue grew by 3% for the quarter.

Nan Ya Plastics Corporation revealed that its net sales from external customers declined by 16% (to NT$60.6 billion) in Q2, and down 12% (to NT$126.2 billion) for 1H’20.

Coca-Cola’s Core UK Portfolio is Now 100% Recyclable and Contains 50% RPET

Coca-Cola European Partners (CCEP), in partnership with Coca-Cola Great Britain, have announced that all the company’s plastic bottles across its core brands produced within the UK are now made with 50% RPET. With this announcement, Coca-Cola Great Britain is now using over 21k tonnes of RPET across its portfolio.

The Absolut Company Has Started to Prototype Testing Paper Bottles

Absolut is rolling out 2,000 paper bottle prototypes as part of the Paper Bottle Company Initiative, launched last winter. The first production will be carried out in November, with Sweden and the United Kingdom the first pilot consumer markets. The latest design consists of 57% paper and 43% recycled plastic. The entire bottle is recyclable, produced by paper bottle company Paboco – a joint venture between ALPLA and Swedish pulp manufacturer BillerudKorsnäs.

Other Opinions You May Be Interested In…

- Aluminium: The Basics You Need to Know

- Aluminium: A Closer Look at its Carbon Footprint

- Aluminium: The Anatomy of the Can

- Aluminium: From Beverage Factory to Consumer

- Aluminium: New Can Manufacturing Technologies

- Aluminium: Consumer Beverage Trends