3,324 words / 20 minute reading time

- Many major food and beverage companies are seeking to reformulate (or diversify) some of their product portfolios.

- Each company has a different approach; some foods and drinks are easier to reformulate than others.

- This trend is just starting and will have a huge influence on the sugar market in the coming years.

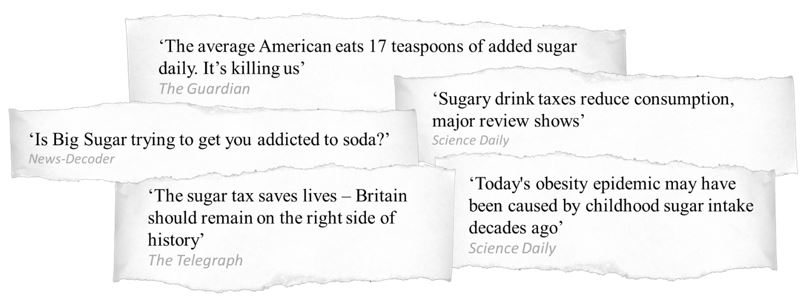

Interest in Sugar is Growing

I’m sure you’ve noticed that something has happened to sugar consumption.

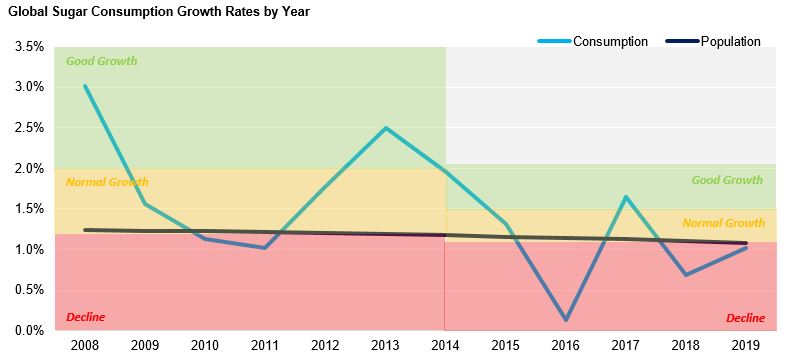

We used to assume that 2% consumption growth per year around the world was normal; 1% for rising population and 1% because people tend to eat more sugar as they get wealthier.

But in recent years this has changed. Sugar consumption growth of around 1% per year seems normal. On a per capita basis this means sugar consumption is barely growing.

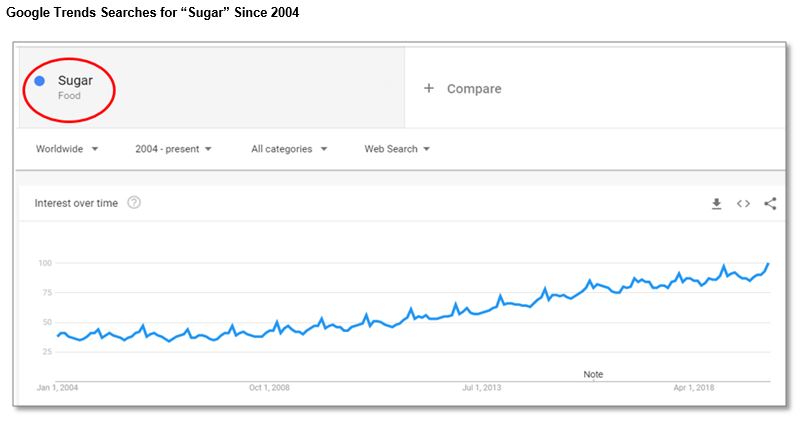

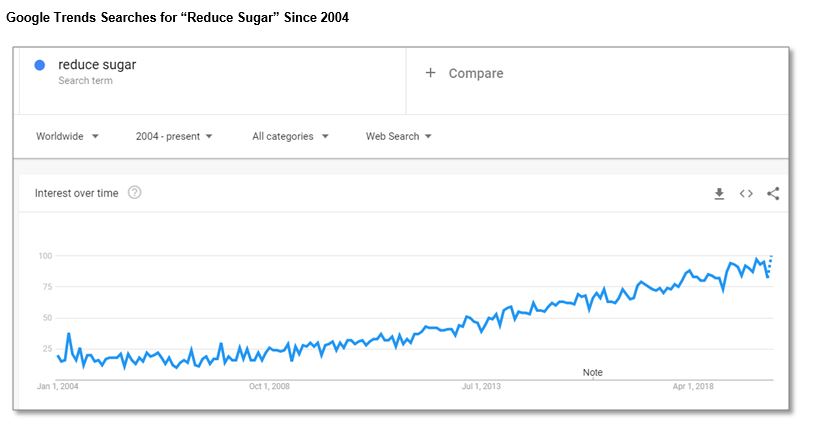

Sugar consumption is notoriously hard to measure. One thing we can do is find out how interested people are in sugar by analysing how often they search for it on Google. This comes with its own problems. Google is not available in China, for example, and its popularity in other countries varies. Nevertheless, here is how often people have searched for the term “sugar” worldwide across the last 15 years.

Interest has increased consistently, especially from 2008 onwards. Those little peaks of interest you can see each year happen in December and January, and so show the pre-Christmas orgy of eating followed by the January period of dieting.

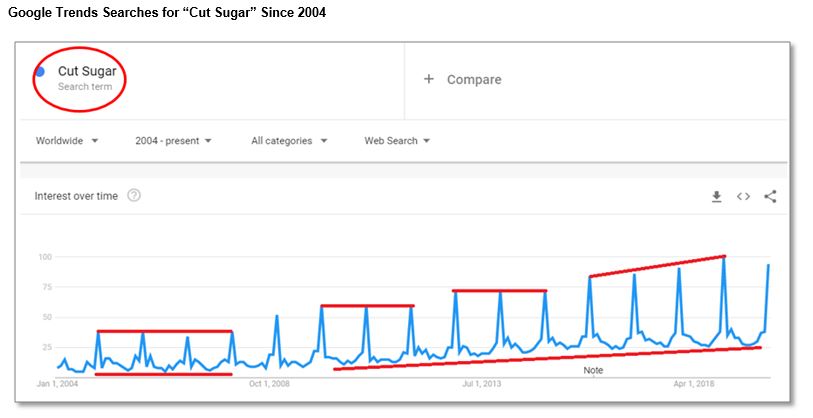

If we use a more precise search term, we can look at “cut sugar”.

Forgive the crude technical analysis and concentrate on the trend. From 2009, people have taken an increased interest in cutting sugar from their diets.

Or perhaps we could try looking at “reduce sugar” instead?

Where public opinions lead, governments and companies will often follow.

I’ve already written about the spread of sugar taxes around the world, last November. In this report I will examine what actions major food and beverage companies are taking – in product reformulation, in packaging and in portion control.

Reformulating Sugary Foods and Drinks

Reformulating food and drinks to remove sugar can be difficult. For a start, there are several reasons to include sugar in food.

Clearly, the dominant reason to use sugar is its sweet taste. To state the obvious, humans find sweet tastes pleasant and most food producers want their products to taste attractive.

This can apply equally to savoury foods, where a hint of sweetness can balance other flavours. Try making tomato sauce with and without sugar if you don’t believe me.

However, sugar is useful in other ways because it attracts and retains moisture (it’s hygroscopic). This means it can act as a preservative, because it will draw moisture out of bacteria, slowing growth.

This can be seen in the centuries-old tradition of making jam to preserve fruits into winter and beyond. Indeed, old-fashioned synonyms for ‘jam’ in the United Kingdom are ‘preserve’ and ‘conserve’.

Sugar’s moisture retention also means it can give foods an attractive texture. Cakes without sugar are dry and crumbly. Ice creams without sugar are less smooth and have a thinner mouth-feel.

When sugar is heated it caramelises. This property has multiple benefits. Sugar helps cereals and biscuits to crisp. It helps crust formation in bread. It also gives baked goods their appealing brown colour.

Finally, sugar adds bulk. A cake without sugar is a flat and sad affair.

All of these benefits could be lost if food manufacturers reduce the amount of sugar in their products.

In addition, consumers can often care deeply about their favourite brands. They expect a consistent experience and taste when they buy an iconic brand. Companies are therefore extremely cautious about changing their flagship brands, if they dare do so at all. Non-millennials may remember the introduction of “New Coke”1. We mentioned AB Barr’s problems when they reformulated Irn Bru in 2018 in our previous report on Sugar Taxes.

So manufacturers need to tread carefully when they reformulate. They need to ensure the new recipe tastes as good as it did before and the lost sugar is appropriately replaced.

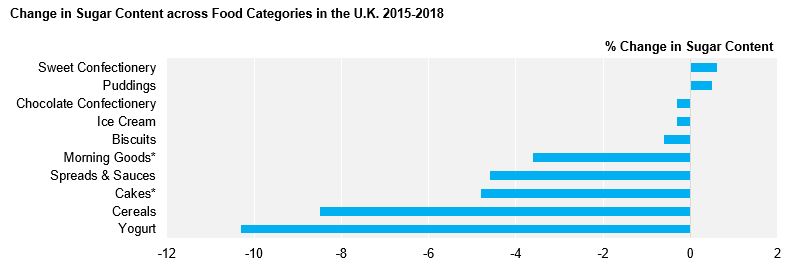

The difficulty of reformulating foods can be seen in figures from the United Kingdom. The U.K. government has been encouraging food and drink manufacturers to reduce the amount of sugar in their products by 20% between 2015 and 20202. Last year they released an interim report showing progress made between 2015 and 2018 for a range of foods3.

*The baseline year for cakes and morning goods is 2017, not 2015

Soft drinks were not included in the analysis because they are regulated by the Soft Drink Industry Levy (sugar tax).

You can see that yogurt and cereal producers have made good progress in reformulating recipes to include less sugar. But other foods have been harder to change. How do you take sugar out of a product such as sweet confectionary when their ingredients are often >95% sugar, for example?

As a result, each food and drink company has a different strategy to sugar reduction and reformulation. Let’s look in more detail.

Case Studies: Soft Drink Reformulation

Removing sugar from soft drinks is well-established. The main role of the sugar in the drink is to add a sweet flavour. Diet/low calorie variants have existed for decades4, and these often closely match the flavour profile of the full-calorie versions. Diet soft drinks are widely accepted by consumers.

While it may be common to reformulate soft drinks using non-sucrose sweeteners, companies are sensitive about making changes to their core brand. For this reason, both The Coca-Cola Company5 and Pepsico6 emphasise the range of products in their portfolio. Both companies have broadened their range of products in recent years and customers can choose what they consume.

In many regions, Coca Cola is aggressively marketing Coca-Cola Zero Sugar, which contains a low-calorie sweetener blend. In Q3’19 the company reported that its sparkling soft drink segment grew by 2% worldwide, but that Coca-Cola Zero Sugar showed “double-digit growth”7.

But the company actually offers more than 4,000 drinks as part of 500 brands across the world, and 18 of their top 20 selling drinks have low or no-sugar options8. In a further measure to expand its portfolio, The Coca-Cola Company also recently purchased Costa Coffee for $4.9b to give it a foothold in the hot drinks market across the world9.

Pepsico has a slightly different positioning. Although best known for its flagship cola, it’s actually also a food and beverage company which sells Quaker Oats, Frito-Lay snacks and Tropicana Juices.

It’s aiming for more than 67% of its beverage portfolio to have fewer than 100 calories from sugar per 12oz serving by 202510. In other words, they will give customers a choice of products and they can make their own decisions about what they eat and drink.

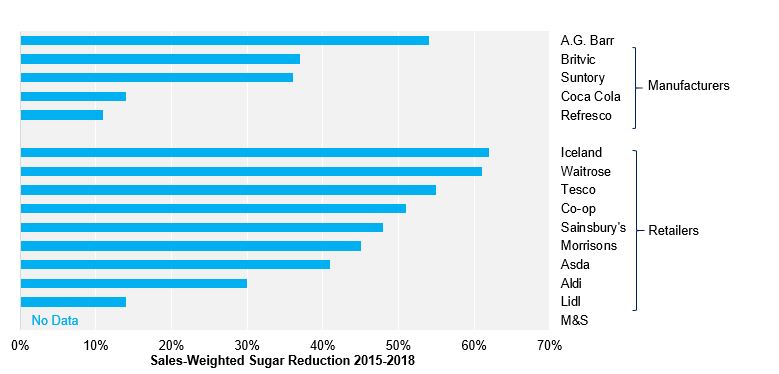

If we return to the U.K. and look at how drinks companies have responded to the sugar tax, we can see widespread reformulation between 2015 and 2018 across a range of manufacturers11.

It is probable that drink manufacturers around the world will continue to broaden the range of products they offer consumers in the future, and that similar levels of sugar reduction could be achieved in other countries that replicate the U.K.’s Soft Drinks Industry Levy.

Case Studies: Cereal Reformulation

Cereal manufacturers have also had some success at reducing the amount of sugar in their products.

Kellogg’s have extensively reformulated some of their best known brands in markets such as the United Kingdom. For example, Coco Pops in the U.K. now contain more than 40% less sugar than they did three years ago and 30% less sugar than similar cereals12.

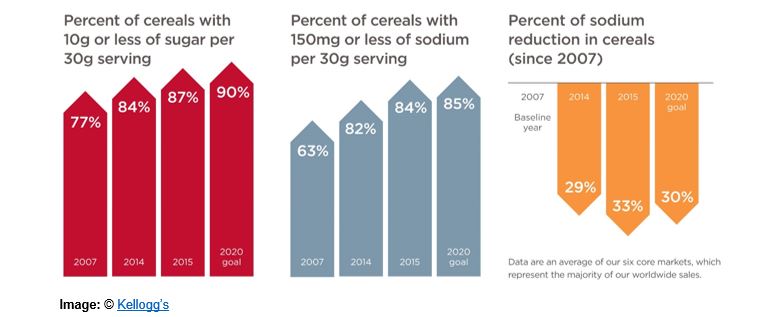

Ricicles (sugar-coated rice pops) were discontinued entirely13, perhaps because they couldn’t be adequately reformulated in a way that made them distinguishable from the Rice Krispies brand. Globally, Kellogg’s says that 90% of its cereals will have 10g of sugar or less per 30g serving by the end of 2020, up from 77% in 200714.

The company has also repositioned its product portfolio to match its ambitions on sugar reduction. It sold many of its biscuits and confectionery brands to Ferrero in April 2019 for $1.3b15 and acquired nutrition bar company RXBar in October 2017 for $600m16.

Meanwhile, General Mills has been controlling the amount of sugar in cereals aimed at children for years. In 2008, it cut the amount of sugar in its cereals marketed to children to a maximum of 12g per serving, and announced in 2009 that this limit would reduce to 10g sugar per serving17, all without using artificial sweeteners.

However, they have also highlighted how reformulation needs to be made in small incremental steps to ensure consumer acceptance18. They also highlighted that they didn’t think reducing the sugar content to below 9g per serving would be feasible using current food technology because the resulting cereal would be too bland19.

As a consequence, the company has been investigating new food technology. In 2017, General Mills published a patent which detailed how they could reduce sugars in the coatings of their cereals without changing their texture or appearance20. General Mills are also concentrating on other brands within their portfolio, and have reduced sugar in more than 370 products by 5-30%21.

Case Study: Confectionery and Snack Reformulation

As we saw earlier, it can be difficult to reduce the sugar content of many confectionery and snack foods. The role that sugar plays in the food can be too varied. But the world’s major snack companies are still taking action.

Nestlé is the largest food company in the world and has committed to reduce added sugar in its food and beverages by 5% from 2017 levels by the end of 202022. It has already reduced the amount of sugar in its products by 32% between 2000 and 201323.

However, Nestlé has found that it’s reached the limit of how far sugar content can be reduced before the food becomes unpalatable. As a result, it is actively exploring new food technology to reduce sugar content without sacrificing flavour. For example, it’s replacing sugar with fibre in Milo drinks24, and has experimented with adding cocoa pulp to chocolate bars, enabling a reduction in sugar content25.

Mondelēz has also been looking at new technology to reformulate, most notably on its Dairy Milk chocolate range. The company has launched a variant with 30% less sugar than the original26, achieved by replacing the sugar with soluble maize fibre.

The team here at Czapp tried both bars in a blind taste test in January 2020 and were unable to distinguish between the two bars by taste alone. Yes, being a sugar analyst is a tough job. Mondelēz also promotes portion control, as does Mars Wrigley.

Likewise, Ferrero has found it difficult to reformulate its chocolates in a way it considers to be acceptable, though it has managed to reduce the sugar content in its products by almost 5% in 6 years27. Ferrero also concentrates on delivering smaller portions of higher value.

Finally, Kraft-Heinz are working to reduce the amount of sugar in their products, but are concerned about consumer acceptance so are moving steadily and quietly. The company terms this, “Doing Good by Stealth”28. For example, in the UK they have already cut the sugar content of their baked beans by 27% in the past 25 years. Their tomato soup has seen an even greater reduction of 34%.

Perhaps most famously, they took the artificial colours out of their iconic Mac and Cheese in the USA without anyone noticing for three months, despite the fact that the product ingredients were clearly listed on the packet29!

Food and Beverage Portion Control

Where companies have been unable to reduce the sugar content of their products any further, there are other options available to promote healthier eating. The first of these is portion control.

By the end of 2017, 99% of Mars Wrigley chocolate and confectionery products were sold in serving sizes below 250 calories30. The company now has an ambition to increase the number of <200 calorie treat packs31.

It’s a similar story at Mondelēz; they increased the range of products sold in portions of 200 calories or fewer by 7% in 2018, and want to increase this to 25% by the end of 202032. Meanwhile, 95% of the products Ferrero sells are individually wrapped in servings of less than 150 calories33.

Portion control isn’t limited to food. The Coca Cola Company now sells 40% of its sparkling drinks brands in packages smaller than 250ml34.

Clearly, people can choose to increase the number of portions they consume in a single sitting. But in practice it’s hard to find evidence this happens, especially when portions are individually wrapped. For many consumers, smaller portions means that cutting back on sugar isn’t a conscious choice.

Developments in Food and Beverage Packaging

We have previously talked about sugar taxation in our last consumption report. We believe that many won’t stop at taxation. Governments will move to restrict advertising of foods which they think are unhealthy, especially to children. There is a parallel here with cigarettes; in the United Kingdom cigarette advertising is banned, cigarette packets must be plain and the boxes themselves are not allowed to be placed in customer view in shops.

Is this the future for sugary foods and drinks too? Well, we’re already seeing this trend in Chile.

In 2016, the advertising of foods the government deemed unhealthy for children was heavily regulated. Mascots and promotional toys were banned. So, for Kellogg’s Zucaritas, the tiger mascot and the bowl of cereal have been replaced by a plain box. In come two black labels at the top right corner of the packet to warn the food is high in sugar and calories.

Kellogg’s and Pepsi have been fighting this development in Chilean courts, arguing that the regulations infringe on their intellectual property.

Most other countries have less extreme packaging regulations, but nevertheless, many large food and beverage companies are taking matters into their own hands. Almost all are in favour of increasing clear front-of-packet nutrition labelling. Others are going even further.

Kellogg’s have rebranded their European cereal packets so that they no longer show full bowls of cereal, but instead show more appropriate portions. Mascots no longer hold the bowl or spoon themselves. The boxes have a traffic-light front-of-packet nutrition panel35.

Mars Wrigley have implemented front-of-pack calorie labelling on all of their chocolate, confectionery and food products36. Meanwhile Mondelez is reinforcing portion messaging prominently on their packs37.

Sugar Consumption Trends for 2020

All of the trends described in this article are likely to continue in 2020. This means that sugar consumption growth around the world will remain sluggish. This is something we identified in our November report on taxation.

But that doesn’t mean that the outlook for sugar is gloomy. Sugar still has a lot going for it. To demonstrate this, I’ve randomly chosen six articles on food trends in 2020 of the sort that are published in the New Year to fill space in newspapers and on websites38-43.

Some of these are clearly bad news for sugar consumption; low sugar and low carbohydrate diets look set to remain popular.

But sugar is also plant-based, it’s often consumed in the country it’s made, it’s often sustainable (check out Vive44 for more information on this), it is fun to eat and it is also cheap.

So, yes, consumption growth could be better. But sugar isn’t a dying industry. As long as humans crave sweet foods and attention there will be plenty of people who make piles of syrup-drenched pancakes for breakfast and put the photo on Instagram. Sweet foods and drinks will always be in demand.

The world doesn’t stay still. Those who evolve can prosper.

References

1) Wikipedia (2020), New Coke, available from https://en.wikipedia.org/wiki/New_Coke

2) Public Health England (2017), Sugar Reduction: Achieving the 20%, available from https://assets.publishing.service.gov.uk/government/uploads/system/uploads/attachment_data/file/604336/Sugar_reduction_achieving_the_20_.pdf

3) Public Health England (2019), Sugar reduction: Report on progress between 2015 and 2018, available from https://assets.publishing.service.gov.uk/government/uploads/system/uploads/attachment_data/file/839756/Sugar_reduction_yr2_progress_report.pdf

4) Wikipedia (2020), No-Cal, available from https://en.wikipedia.org/wiki/No-Cal

5) The Coca-Cola Company (2020), Our Brands, available from https://www.coca-colacompany.com/brands

6) Pepsico (2020), Product Information, available from https://www.pepsico.com/brands/product-information

7) The Coca-Cola Company (2019), Q3 2019 Earnings Release, available from https://investors.coca-colacompany.com/news-events/press-releases/detail/973/coca-cola-reports-continued-strong-results-in-third

8) The Coca-Cola Company (2020), In Our Products, available from https://www.coca-colacompany.com/sustainable-business/in-our-products

9) The Coca-Cola Company (2020), The Coca-Cola Company Completes Acquisition of Costa, available from https://www.coca-colacompany.com/press-releases/the-coca-cola-company-completes-acquisition-of-costa

10) Pepsico (2020), Our Goals, available from https://www.pepsico.com/sustainability/our-goals

11) Public Health England, op.cit.

12) The Kellogg Company (2020), Coco Pops, available from https://www.kelloggs.co.uk/en_GB/brands/coco-pops-.html

13) The Kellogg Company (2020), Kellogg UK Commits To Making Breakfasts Healthier With The Launch Of Its New Better Starts Plan, available from https://www.kelloggs.co.uk/en_GB/press-release/kellogg-uk-commits.html

14) The Kellogg Company (2020), Positive Nutrition Around the Globe, available from https://www.kelloggsnutrition.com/en_worldwide/where_we_are/articles/Our_Continued_Commitment_To_Nutrition.html

15) Ferrero Group (2019), Ferrero To Acquire Kellogg Company’s Cookies and Fruit Snacks Business, available from https://www.ferrero.com/fc-4073?newsRVP=1371

16) The Kellogg Company (2017), Kellogg adds RXBAR, fastest growing U.S. nutrition bar brand, to wholesome snacks portfolio, available from http://newsroom.kelloggcompany.com/2017-10-06-Kellogg-adds-RXBAR-fastest-growing-U-S-nutrition-bar-brand-to-wholesome-snacks-portfolio

17) McKinney, M (2009), General Mills is dialing back its sugary cereals another notch, Star Tribune, available from http://www.startribune.com/general-mills-dialing-back-sugary-cereals-another-notch/78921792/

18) Geller, M (2010), General Mills steps down sugar in kids’ cereals, Reuters, available from https://www.reuters.com/article/us-generalmills/general-mills-steps-down-sugar-in-kids-cereals-idUSTRE6B82VK20101209

19) Jargon, J (2011), Success Is Only So Sweet in Remaking Cereals, The Wall Street Journal, available from https://www.wsj.com/articles/SB10001424053111904563904576589182476489512

20) Froseth, B and Nowakowski, C (2017), Reduced sugar pre-sweetened breakfast cereals comprising tri- and tetra saccharides and methods of preparation, US Patent and Trademarket Office Application #20170188610, available from https://www.freshpatents.com/-dt20170706ptan20170188610.php?id=fpkwm

21) General Mills (2019), Our Food, available from https://globalresponsibility.generalmills.com/HTML1/general_mills-global_responsibility_2019_0016.htm

22) Nestlé (2017), Nestlé Policy on Sugars, available at https://www.nestle.com/sites/default/files/asset-library/documents/library/documents/about_us/nestle-policy-sugars.pdf

23) Nestlé (2020), What are you doing to reduce sugar in your products? available at https://www.nestle.com/ask-nestle/health-nutrition/answers/what-are-you-doing-to-reduce-sugar-in-your-products

24) Nestlé (2020), Reducing sugars, sodium and fat, available at https://www.nestle.com/csv/impact/tastier-healthier/sugar-salt-fat

25) Nestlé (2019), Nestlé invents the first 70% dark chocolate made entirely from the cocoa fruit and nothing else, available at https://www.nestle.com/media/news/nestle-first-chocolate-cocoa-fruit

26) Mondelēz (2019), Cadbury Dairy Milk expands its range with new 30% less sugar choice, available at http://www.mynewsdesk.com/uk/mondelez-uk/pressreleases/cadbury-dairy-milk-expands-its-range-with-new-30-percent-less-sugar-choice-2899913

27) Ferrero Group (2019), Ferrero contribution to sugar reduction, available at https://www.ferreronutrition.uk/wp-content/uploads/2019/08/190316-nutrition-brief-FINAL.pdf

28) The Kraft Heinz Company (2017), 2017 Corporate Social Responsibility Report, available at https://www.kraftheinzcompany.com/pdf/KHC_CSR_2017_Full.pdf

29) Goldman, D (2016), Kraft changed its mac & cheese recipe and nobody noticed, CNN, available at https://money.cnn.com/2016/03/08/news/companies/kraft-mac-and-cheese-recipe/index.html

30) Mars (2020), Innovations Today to Ensure a Healthy World Tomorrow, available at https://www.mars.com/sustainability-plan/nourishing-wellbeing/product-renovations

31) Mars (2020), Added Sugars, available at https://www.mars.com/about/policies-and-practices/added-sugars

32) Mondelēz (2018), Inspiring Mindful Snacking, available at https://www.mondelezinternational.com/Snacking-Made-Right/Mindful-Snacking

33) Ferrero Group, op. cit.

34) The Coca-Cola Company, op. cit.

35) Polianskaya, A (2019), “Contemporary” Redesign for Kellogg’s Looks to Make It “Instantly Recognisable”, Design Week, available at https://www.designweek.co.uk/issues/25-february-3-march-2019/contemporary-redesign-for-kelloggs-looks-to-make-it-instantly-recognisable/

36) Mars (2015), Nourishing Wellbeing, available at https://gateway.mars.com/m/14365c14a900b073/original/Nourishing-Wellbeing.pdf

37) Mondelēz, op. cit.

38) McDowell, E (2019), 20 foods expected to be on the rise in 2020, Business Insider, available at https://www.businessinsider.com/popular-foods-everyone-will-be-eating-in-2020?r=US&IR=T

39) Madej, E (2019), Global Trends in food Tech, available at https://www.slideshare.net/elamadej/food-tech-trends-ela-madej-fifty-years-aug-2019

40) Leary, B (2019), The Top 10 Food Trends to Look For in 2020, available at https://blog.yelp.com/2019/12/the-top-10-food-trends-to-look-for-in-2020

41) Naylor, T (2019), 20 food trends for 2020, available at https://www.bbcgoodfood.com/howto/guide/20-food-trends-2020

42) Patel, A (2020), More meat alternatives and CBD products: The biggest food trends for 2020, Global News, available at https://globalnews.ca/news/6334233/food-trends-2020/

43) Times of India (2019), Food trends that may be become popular in 2020, available at https://timesofindia.indiatimes.com/life-style/food-news/food-trends-that-may-become-popular-in-2020/photostory/72383735.cms

44) Vive Sustainable Supply Programme (2020), available at https://www.viveprogramme.com/