491 words / 3 minute reading time

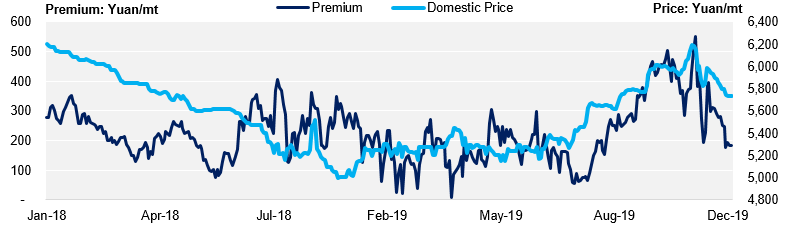

- The 19/20 season sugar output by end of November was at a record high.

- A large volume of new crop sugar will enter the market to pressure sugar prices, narrowing the physical premium.

- Frosty weather and pre-Chinese New Year buying may provide some support for prices.

Market Update

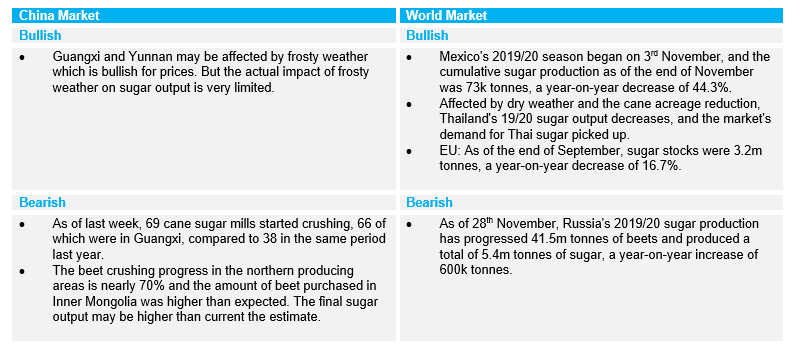

19/20 Season Supply & Demand

- We estimate the supply and demand for the 19/20 season to be balanced.

- But we could see higher sugar production, imports, smuggling and destocking in 2020, which will add to the surplus.

19/20 Season White Sugar Supply & Demand

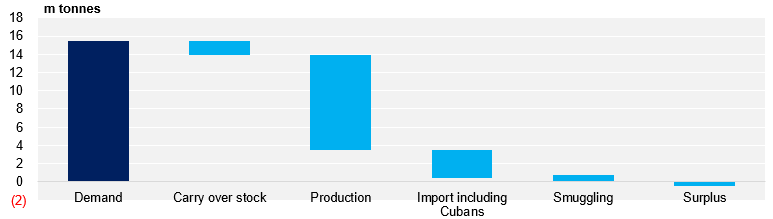

Domestic Sugar Price

- Spot prices and premium movements are in line with last week’s estimates and continue to fall, due to the faster pace of Guangxi crushing and the launch of new crop sugar.

- The current premium has fallen below 200 yuan per tonne. The frosty weather and holiday purchase may give some support, but the overall view remains bearish.

China Grade One Sugar Price and Physical Premiums

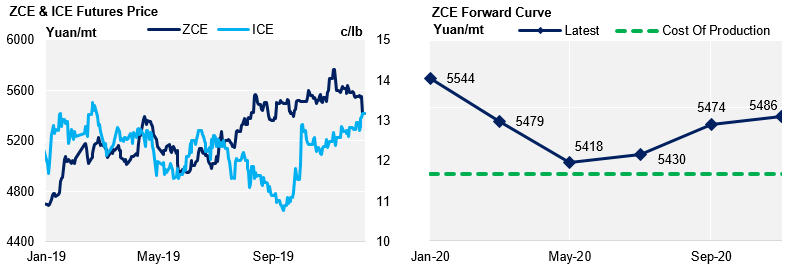

ZCE & ICE Sugar Futures

- ICE raw sugar rose over 13c/lb. Although the market has recently benefited from good news, such as the failure of the US sugar beet and Thailand’s production reduction, overall market flows remain relatively loose.

- The ZCE sugar price fluctuated within a narrow range last week and the active contract switched from Jan’20 to May’20.

19/20 Season Crushing Progress

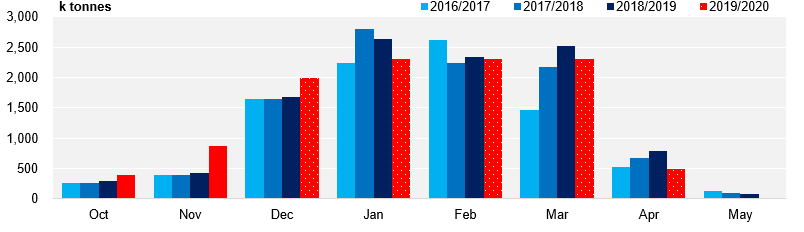

- Factory sugar production was 1.1m tonnes by the end of November, an increase of 548k tonnes year-on-year.

- Guangxi is entering the full wing campaign and other cane sugar mills will also start soon. We think that the December factory sugar output will still be at a historical high.

- Guangxi’s sucrose yield in November was 2.19% higher year-on-year, which means the final sugar production could be higher than expected if the sucrose yield holds.

Factory Monthly Sugar Production