- Mexican sugar consumption dropped in 2020 to its lowest level since 2014.

- The sales value of soft drinks and other non-alcoholic beverages dropped before COVID hit Mexico.

- The drop in demand therefore can’t be solely attributed to COVID; there are more factors at play here.

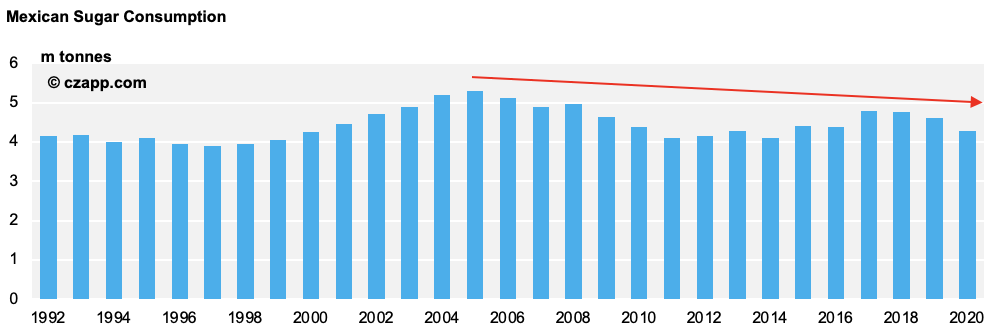

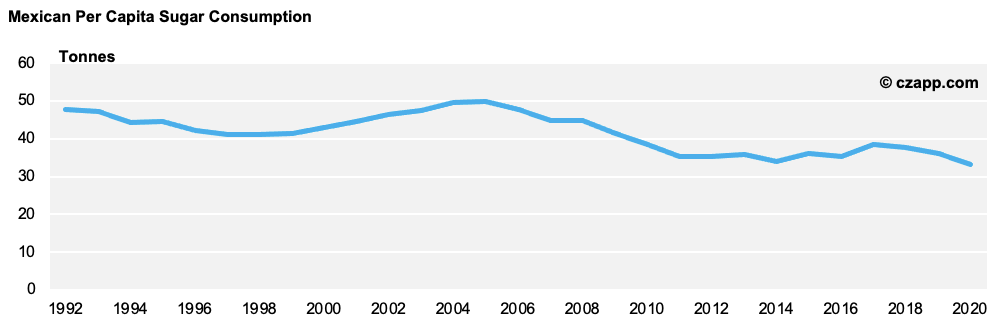

Mexican sugar consumption dropped in absolute terms in 2020 to the lowest levels since 2014 and per capita consumption dropped alongside it. But the sales value of soft drinks and other non-alcoholic beverages began dropping early as January, before the pandemic made landfall in Mexico. This suggests that the drop in demand cannot be solely attributed to COVID-19 restrictions and there are more factors at play here.

To get a better picture of why demand dropped and formulate a potential indicator of future demand, we’ll look at the factors that have played a role in consumption trends and sugar demand over the last decade.

How Are Mexican Consumers Behaving?

Although overall sugar consumption in Mexico seems to be rising year-on-year, a look at the historical data shows that it’s been progressively falling since 2004.

Interestingly, a more pronounced dip in per capita sugar consumption can be seen since 2004, indicating that peak sugar demand was reached during this year. Per capita demand should remain flat in the next few years at about 35kg.

Several factors could be to blame for the decrease in sugar consumption, including an increase in sweetener use, the country’s 2014 sugar tax, educational campaigns, and the impacts of Covid-19 lockdowns. It is possible that a combination of these factors has contributed to the downward trend.

Is Sugar Being Replaced by High Fructose Corn Syrup (HFCS)?

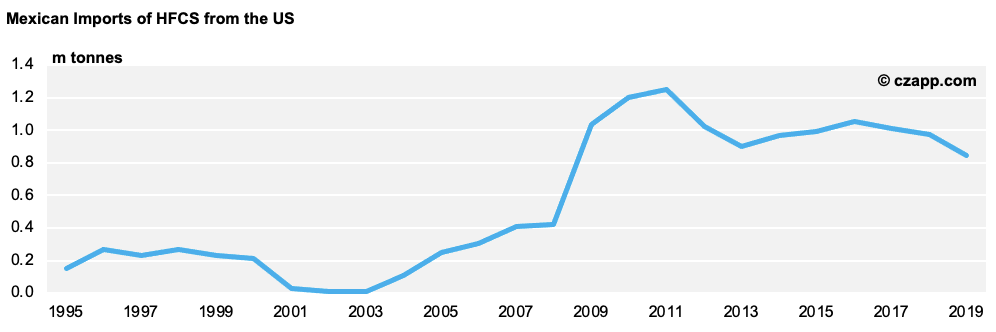

One argument for the drop in sugar demand is that consumers are increasingly buying products that use artificial sweeteners, such as high fructose corn syrup (HFCS), rather than sugar. The data shows that HFCS consumption did increase steadily from 2003 onward, although this also hit its peak in 2011 and has since declined.

Mexico produces little HFCS, meaning its main source is importing the sweetener from the US. Since 2011, Mexico’s imports of US HFCS have dipped, although remain above 800k tonnes per year. 2020 saw its lowest level of imports since 2010 at 842,000 tonnes, which at first glance suggests COVID may be impacting demand for HFCS. However, import data from the first quarter of 2021 shows that demand continues to decrease, with only 165,207 tonnes imported in Q1’21, down 18% on Q1’20 and even lower than Q2’20, Q3’20 and Q4’20 figures. This information would suggest that, as early as 2011, Mexico’s appetite for sugary or sweetened food and beverages has actually been waning.

Source: USDA Sugar and Sweeteners Yearbook

Soft Drinks Demand is Declining (From a High Peak)

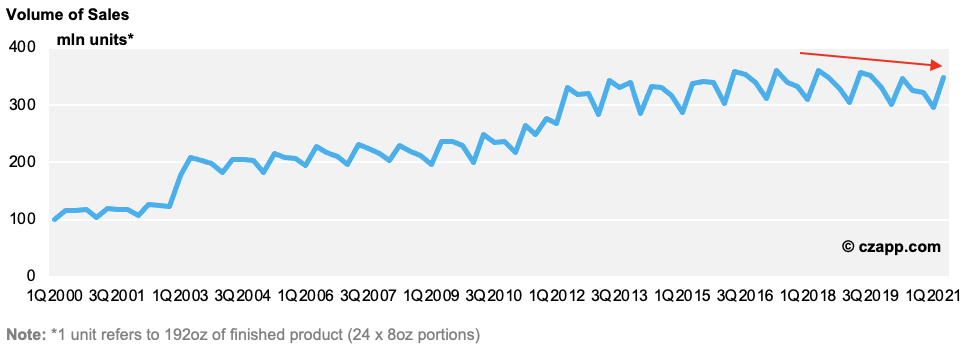

Coca-Cola has by far the greatest market penetration in Mexico. In a recent survey by Kantar, Coca-Cola obtained 1,529 consumer reach points, more than double the number earned by nearest competitor, Laia, and over six times greater than fellow soft drinks manufacturer, Pepsi. Sales figures from bottler Coca-Cola FEMSA show that the group’s volume of sales has declined since 2018.

A sharp dip was witnessed in the third and fourth quarters of 2020, which could be related to COVID-19 restrictions in the country. The only comparable third quarter dip of this magnitude registered in the prior years was in 2017, when the states of Puebla, Oaxaca, Chiapas and Guerrero were hit by several earthquakes measuring up to 8.1 on the Richter scale, spreading devastation across the country.

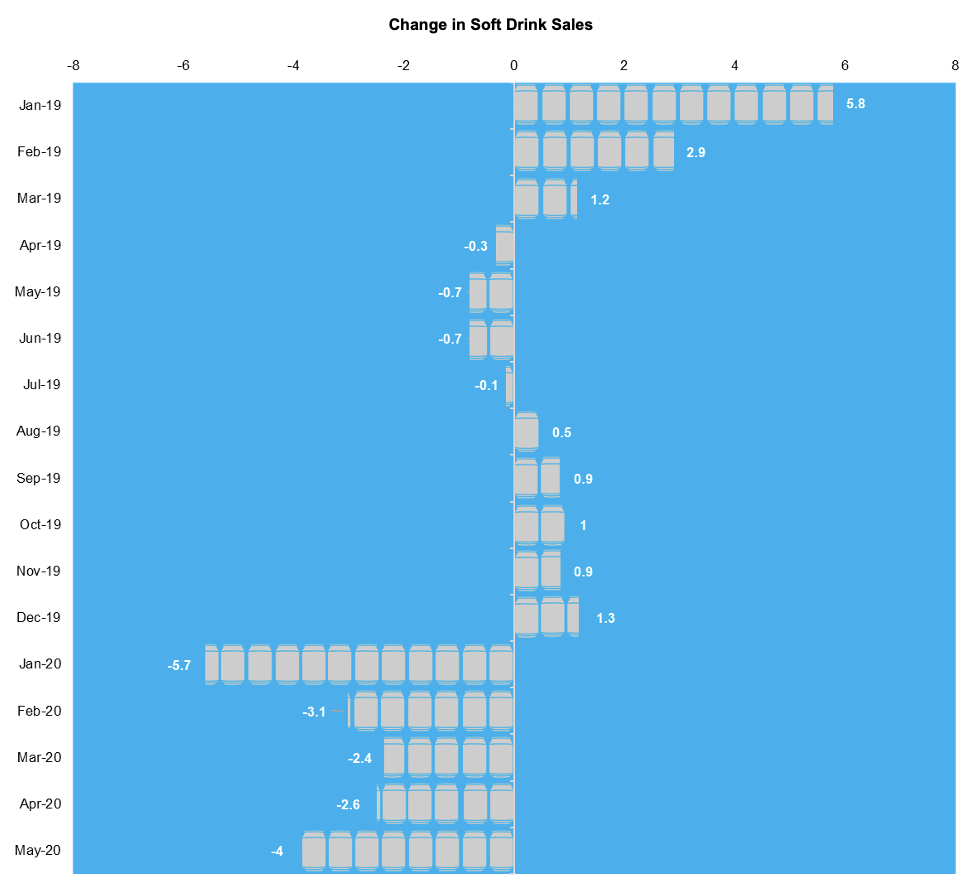

Data from statistics agency, INEGI, shows that this phenomenon is not just limited to Coca-Cola FEMSA. As early as January 2020, there was a sharp contraction in soft drink sales and year-over-year sales figures continued to contract throughout 2020. Although this suggests that COVID-related restrictions did play a part in the drop in sales, this doesn’t fully explain the drop in demand as early as January, indicating there are more factors at play.

A Sugar Tax Was Implemented in 2014

In 2014, Mexico’s authorities passed a sugar tax of 1 peso per litre for sugar sweetened beverages (SSBs), representing a 10% price increase. The tax, or IEPS, has subsequently been increased to 1.17 pesos per litre in 2019 and again to 1.27 pesos per litre in 2020.

The effectiveness of this kind of tax is debatable. Some research has found the tax to have been effective in reducing sugar consumption from SSBs, recording a 6.1% average decline in sales of taxed SSBs in 2014 and a decline of between 9% and 17% among lower socioeconomic households. Alongside the drop in SSBs purchased, the researchers also noted a 4% increase in the purchase of untaxed beverages, including water. However, it should be noted that this particular observational study covered only the year 2014 and there’s a lack of research that would indicate consumer behaviour after this period.

Another study published in March 2020 found that SSB taxes were ineffective for those with high sugar intakes, less effective among the older demographic and do not succeed in achieving large reductions in sugar intake. Another short-term study carried out in the UK found that a £0.10 levy on SSBs in a restaurant chain did reduce consumption of the beverages, although this move was also combined with clear labelling on the menus and an extensive media campaign. A similar tax on fat was applied in Denmark in 2011 but was abandoned after just 15 months whem evidence showed that consumers either absorbed the additional costs elsewhere in their budgets or opted for cheaper versions of the same product.

Coca-Cola FEMSA’s sales data does show an increase in sales from 2014 to 2016, before numbers began to drop in 2018. It should be noted however that these figures include all soft drinks, not just those containing free sugars.

The Mexican Government Has Campaigned Against Sugar Intake

As part of the tax on SSBs, the Government launched an extensive publicity campaign against sugar intake. The campaign drew a direct correlation between sugar intake and the contraction of type 2 diabetes.

A study conducted by a researcher at the Autonomous Metropolitan University of Mexico (UNAM) found that, in 2011, government health advertising about the subject of diabetes was “virtually non-existent.” The study also found that the advertising that existed was ineffective in providing health information or recommendations.

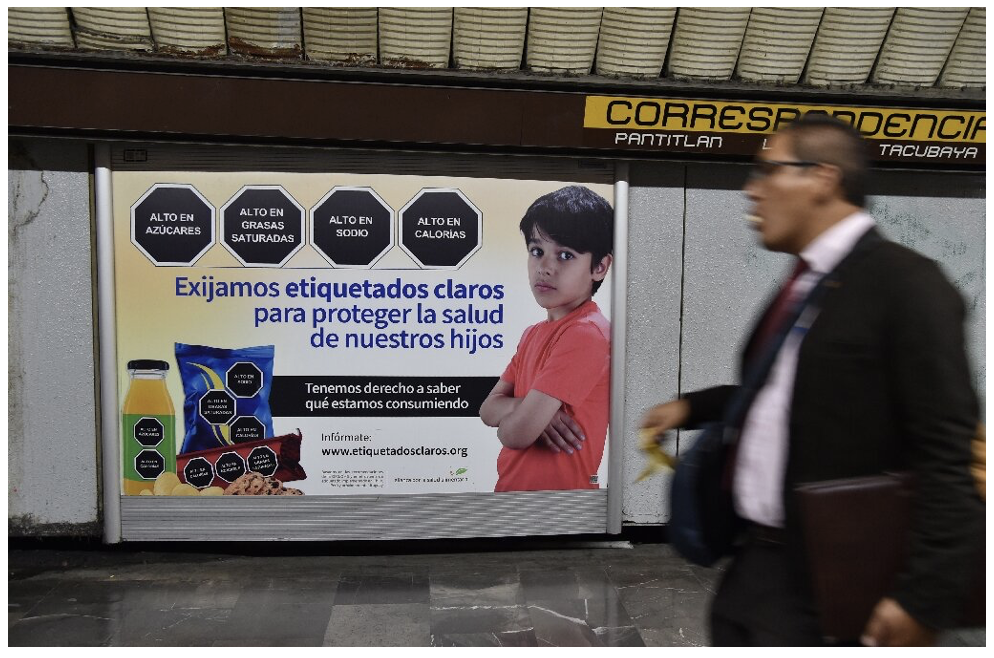

In 2012, the Food Health Alliance launched an advertising campaign on public transport in Mexico City to warn of the risks of obesity and diabetes. In 2014, the Government also began to restrict TV commercials for sugary drinks and snacks aimed at young children. And in 2016, the Food Health Alliance launched another campaign called “Don’t Harm Your Heart,” with prominent advertising on public transport, billboards and on social networks.

But more recently, high ranking Mexican government officials, including President Andres Manuel Lopez Obrador, have soft drinks in the crosshairs once more. Deputy Secretary of Prevention and Health Promotion Hugo Lopez-Gatell placed blame on the country’s sugar consumption for the impact of the COVID-19 pandemic.

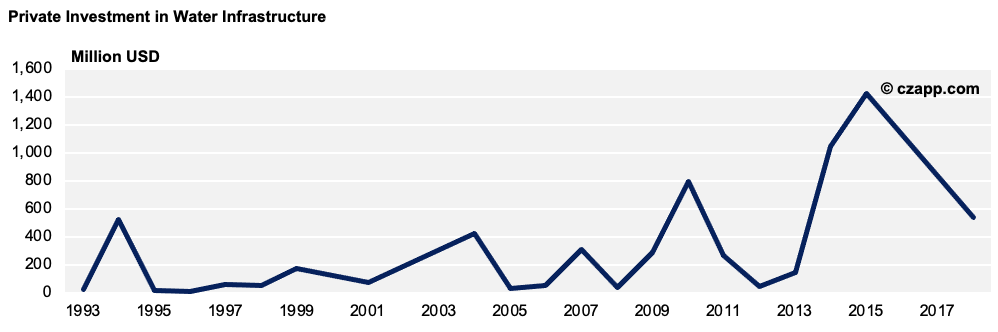

2014/15 Saw Increased Private Investment in Water Infrastructure (That Has Since Declined)

In 2014, the Mexican president was Enrique Pena Nieto, whose campaign platform focused on including the private sector in more public infrastructure projects. In 2014, the President laid out the National Infrastructure Plan 2014-2018, which included an initial investment of $18.2 billion pesos to strengthen the country’s hydraulic infrastructure.

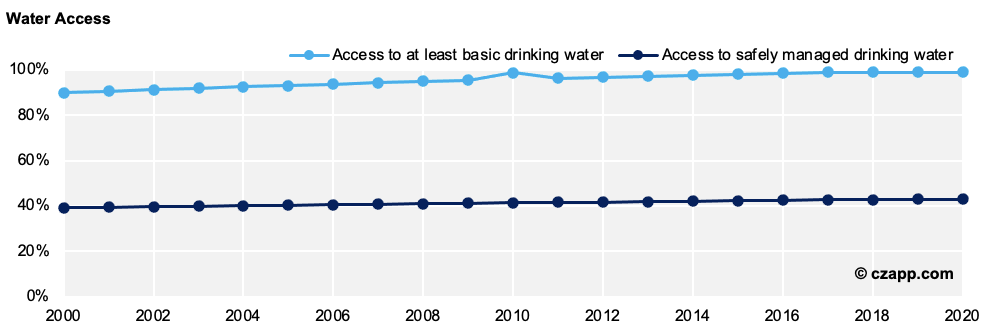

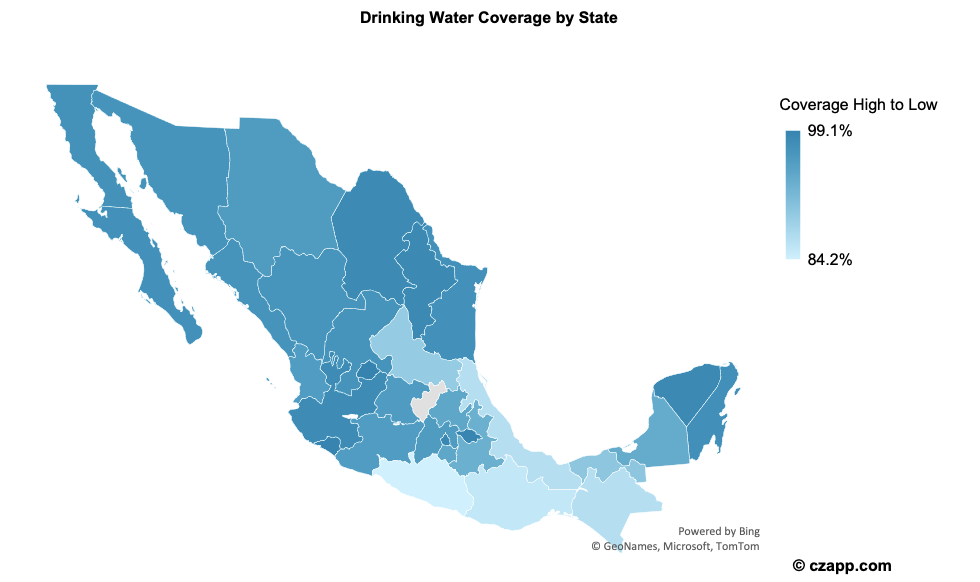

As a result of increased investment in water infrastructure, access to water also continuously improved across the country. By 2020, 43% of the population had access to safely managed drinking water and 99% to at least basic drinking water. This is 5.74 million more Mexicans with access to safely managed water and 12.1 million more with access to basic water. Safely managed drinking water refers to one located on premises, available when needed and free from contamination. Basic drinking water is an improved source located within a 30-minute round trip.

Some of the proceeds of the SSB tax in 2014 were also used to increase access to water fountains.

Areas in Mexico with lower water availability typically show higher soft drink consumption. The southern state of Chiapas hit the headlines in 2019 after a study by the Chiapas and Southern Border Multidisciplinary Research Center (Cimsur) showed that residents’ sugar intake is as high as 821 litres per person per year, more than five times the national average.

To put that into perspective, US residents are estimated to drink about 100 litres per year, and the global average is just 25 litres per person per year. An increase in water availability could explain part of the drop in sugar intake in 2020.

COVID-19 Restrictions Have Played a Role

Whilst it’s difficult to measure just how much sugar consumption has been affected by COVID-19 restrictions, drop in demand for food and beverages in a social setting can be gauged by employment figures. Across key hospitality jobs, including fast food preparation, cooks, bartenders and waiters, there have been month over month and year over year declines in employment.

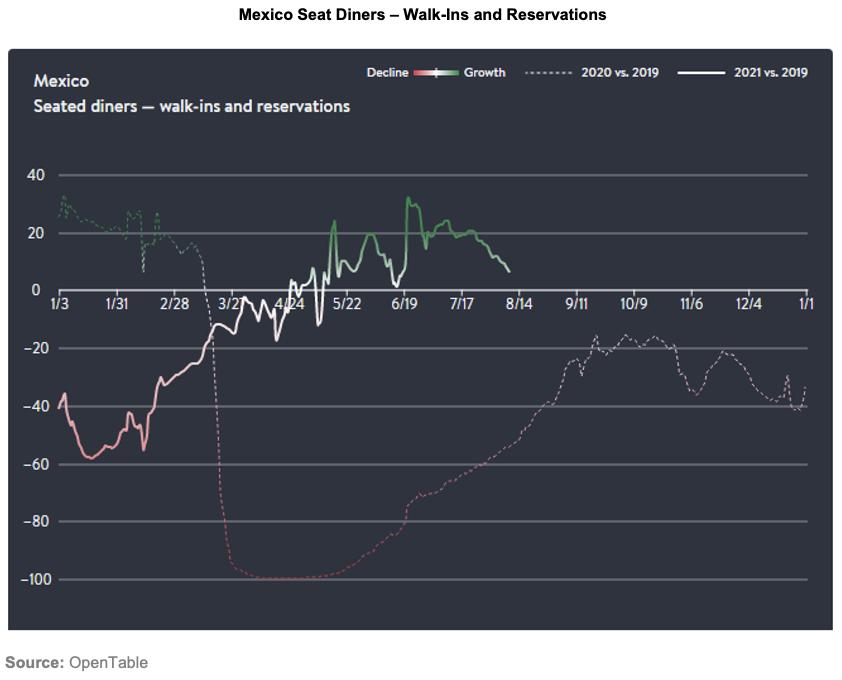

The number of seated diners also dropped drastically when the pandemic started to be felt in Mexico in March 2020, plunging to zero in April as lockdown was imposed. The number of seated diners did not exceed 2019 levels again until April 2021. The highest level reached in 2020 was in September and October, when dining numbers sat at about 15% below 2019 levels.

In-Home Consumption Compensates for Loss of Out-of-Home

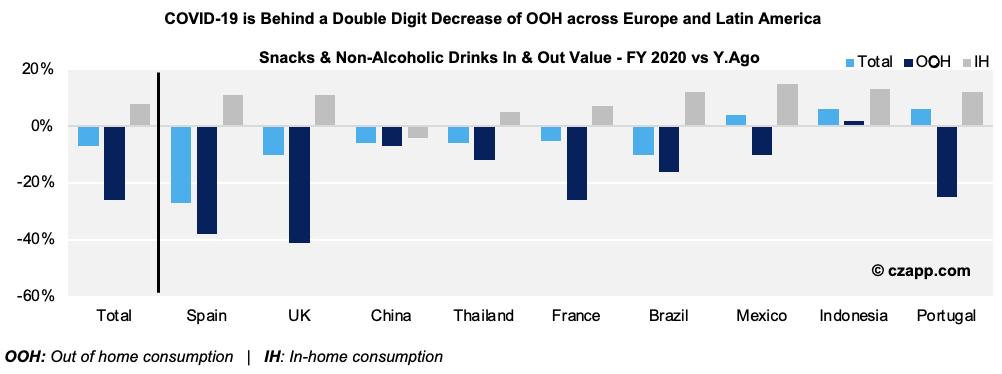

In the first quarter of 2020, Mexico was one of the few countries where an increased in-home consumption of snacks and non-alcoholic drinks compensated for the reduction in out of home consumption, according to data consultancy Kantar. While out of home consumption dipped 10% year over year, in home consumption increased by 15%.

Of all the countries measured in the study, the 8% increase in at home consumption could not even nearly offset the massive 26% drop in out of home consumption.

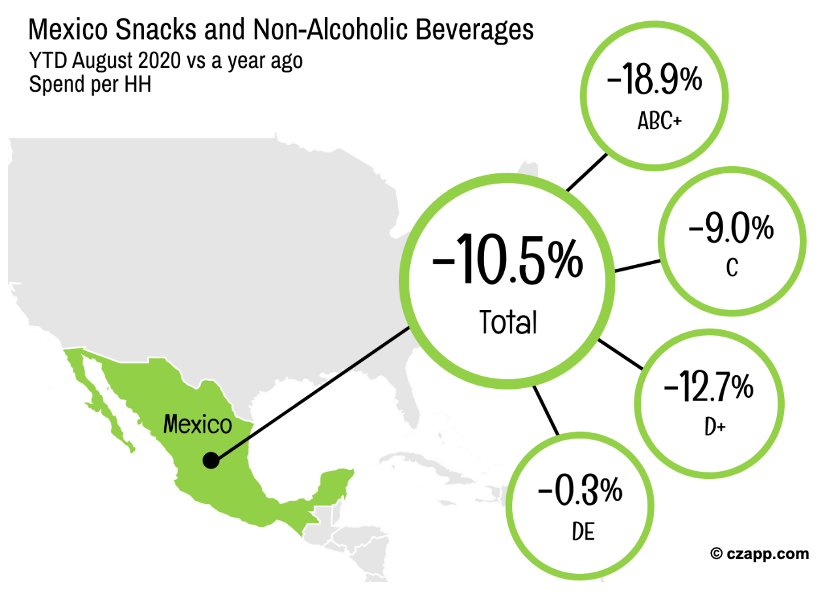

According to Kantar, countries like Mexico are much more likely to be snacking oriented. Additionally, in Mexico, trends were seen across socioeconomic lines. The highest income households followed lockdown protocols, accounting for an 18.9% drop in snacks and non-alcoholic beverages in the first nine months of 2020. This is compared to the lowest socioeconomic brackets, where only a 0.3% year over year dip was seen.

But although the sales weighted average total sugar levels consumed in the home are found to be slightly greater for manufacturers and retailers compared to the out-of-home sector, the number of calories consumed in one sitting is significantly higher in the out-of-home sector. The out-of-home sector averages just over 350 calories per portion compared to about 150 calories per portion for at-home consumption.

What Developments Should the Sugar Industry Keep its Eye On?

In the long term, it’s likely the decline in consumption is down to the education campaign surrounding the introduction of the SSB tax. Although flat taxes are widely considered to lack teeth when it comes to mitigating sugar consumption, the aggressive educational campaign that accompanied the tax seems to have been effective. This would mean future attempts by the Government to regulate sugar intake may further impact Mexico’s sugar demand.

There are several new pieces of legislation on the table related to sugar consumption. The first is a ban on sales of sugary snacks to children, which has already come into effect in some of the country’s southern states. It’s now being considered on a federal level.

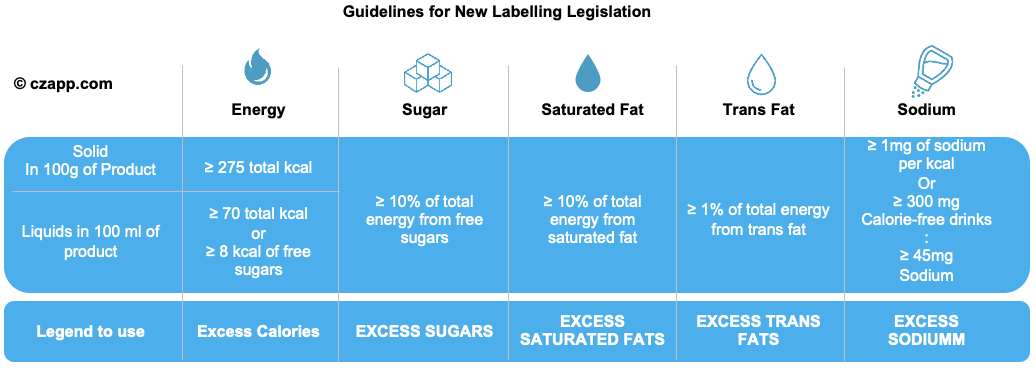

The second is a new labelling law that came into force late last year. Under the guidelines, drawings and animated characters marketed at children are prohibited. Packaging must also contain large black warning labels advising of excess of fat, sugar, calories, presence of sweeteners and caffeine and the degree to which the product is processed.

Notably, when these requirements were adopted in Chile alongside a raft of other food regulations aimed at reducing intake of SSBs, consumption of SSBs dropped almost 25% in the first 18 months. In the UK, it’s likely the traffic light system was one of the factors resulting in a drop in per capita sugar consumption in recent years.

Other Opinions You Might Be Interested In…

- Mexico’s Drought Issues to Persist in 2021/22

- The Long Read: Sugar Consumption and Reformulation

- Sugar Taxes: Going Up Because of COVID?

Explainers You Might Be Interested In…