Insight Focus

Soybean supply is set to increase in the next year, especially since Argentina seems to have finally recovered from its devastating drought. This has led many to speculate that there will be an oversupply of soybean products, but I predict that demand increases will easily keep pace with supply.

Last week I wrote a post addressing USDA economists’ curious usage of the ominous verb “deplete” to characterize impending declines in global vegetable oil ending stocks. If you missed reading it, you can find it here.

The post caused many readers to reach out to me and ask for more details on the state of the US soybean meal market. They wanted my views on how this summer’s and next year’s soybean meal market will play out, especially in light of the significant expansion in US soybean processing capacity. Capacity has increased by 3.4 million tonnes (125 million bushels) during the 2024/25 September/August grain calendar year.

Quite frankly, readers who sent me notes after reading my previous post could not believe I had suggested the potential for a spike in meal prices this summer, especially with the well-publicized expansion in US processing capacity (that they mistakenly believe is available to operate today).

Allow me to provide some background. Our little world of North American oilseed processing has been hyper focused on the thesis that excessive soybean meal supply is going to manifest itself in the very near future and cause generational problems for profitability in US soybean processing, as well as Canadian canola processing.

There is no better example of that focus than the widely distributed and discussed thought piece Rapid Expansion of U.S. Soybean Industry Processing Capacity Risks Industry Overbuild released by economists at CoBank in March.

While I agreed with many parts of the CoBank economists’ analysis, I really struggled with this bullet point highlighted at the beginning of the paper:

“Murky,” I remember thinking to myself, “what the heck?”

Soybeans Get Murky

“Time for the Oxford English Dictionary,” was my next thought. Oxford scholars provided the following explanations of murky and the first year of usage (in parenthesis):

- Of places: excessively dark or gloomy (1340)

- Of air, mist, clouds, etc.: thick, dark; of gloom, darkness: intense (1667)

- Very dark in colour (1791)

- Dirty, grimy (1798)

- Of looks: sullen, cheerless, gloomy (1841)

For the life of me, I cannot make any of those definitions from 1340 to 1841 serve as an adjective for the global vegetable protein meal trade. I can, however, make number five fit for cheerless analysts sullenly badgering the Bunge and ADM management teams during recent earnings calls about the gloomy future of their oilseed processing businesses due to anticipated surplus meal supplies.

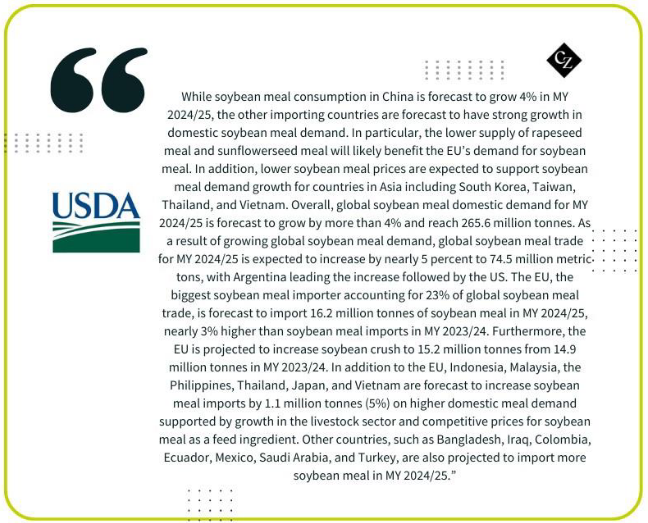

I have always thought of US soybean meal export sales and associated purchasing data compiled by the USDA as clear and detailed. I even reread the USDA’s initial outlook for the 2024/25 crop year for global soybean meal demand with the adjective “murky” in mind. Here is what the economists had to say in the USDA’s May 2024 Oil Crops Outlook:

First off, we can observe that USDA economists provide some very meaty detail about global meal consumption:

- Global demand is up 4%.

- Global trade is up 5%.

- EU imports are up 3%.

- China consumption is up 4%.

Secondly, USDA economists provide country level detail to support their expansive outlook. Imports into Indonesia, Malaysia, the Philippines, Thailand, Japan and Vietnam are up 5% collectively. And Bangladesh, Iraq, Colombia, Mexico, Saudi Arabia and Turkey are all forecasted to expand.

USDA economists also provide extensive data tables for every major destination on the planet. The USDA also has boots on the ground (agricultural attaches) reporting on all facets of food and feed demand. Here, for example, is detail on Nigeria, which will import ZERO US soybean meal in the coming marketing year.

The Devil in the Detail

Murky? Nothing murky about any economic forecast that can include details on Iraq! For me, USDA economists must feel pretty good about their forecasting abilities to project soybean meal demand in Iraq, where I doubt they are able to garner much assistance from Iraq’s protein meal consumers or their trade associations. An oil rich country like Nigeria NOT importing soybean meal, who knew? The USDA!

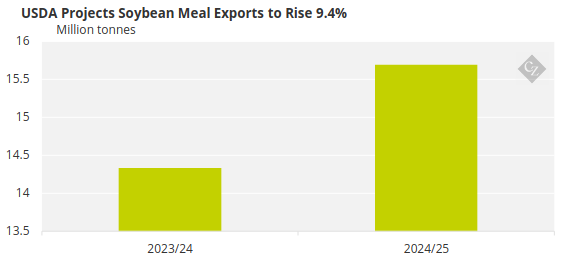

The USDA currently forecasts that US exports for this coming marketing year will rise by 1.5 million short tons (1.36 million tonnes), up 9.4%, and a new record at 17.3 million short tons (15.7 million tonnes).

This current marketing year’s record forecast for 15.8 million short tons (14.3 million tonnes) of exports is primarily a function of last year’s disastrous Argentine drought with the world turning to the US for replacement.

Note: Values converted to tonnes

But keep this in mind: Argentina is back in the game this year and the USDA is still increasing exports by 9.4%. In the USDA’s May 2024 WASDE report, the economists wrote this about the above-record forecast:

Bam! 2% increase in global market share. That was easy. Economists need a high level of statistical confidence about export destinations’ soybean meal needs if they are to project a new record, right? Nothing murky here either.

Maybe the CoBank economists concluded exports of US soybean meal are hard to gauge (murky) because USDA economists just cannot seem to get this year’s forecast correct and have had to increase initial forecasts due record soybean meal sales and shipments that just keep expanding.

US Export Sales Hindered by Argentina?

Here is the USDA economists’ commentary revising exports higher from the March 2024 Oil Crops Outlook:

The 15.8 million short ton (14.3 million tonne) outlook is still inadequate and likely gets revised closer to 16.2 million short tons (14.7 million tonnes) given the current US export pace for the 2023/24 season.

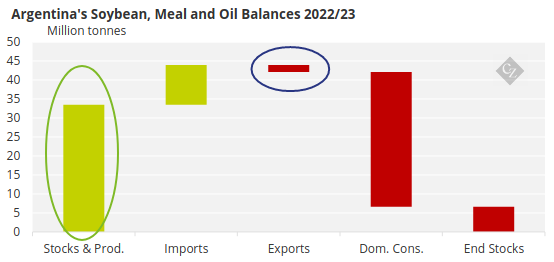

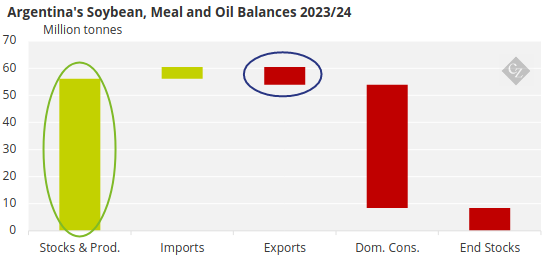

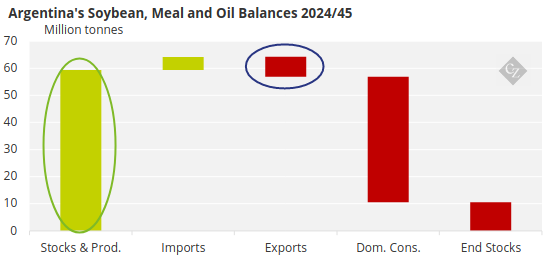

Last week’s USDA export report detailed Mediterranean destinations that usually would be shipped from Argentina at this time of year. Argentine soybean production has recovered this year and the May filing in Buenos Aires suggests more to come in the coming marketing year. The attaché forecasts:

- Soybean production normalizing after last year’s disastrous drought (green circles).

- Sharply increased soybean meal exports from the world’s number one provider for global trade due to the drought ending and the Argentine industry in full recovery mode this year and next.

- Argentine soybean meal exports (blue circles) by crop marketing year:

Source: USDA

So, the US export pace likely speaks to a sequential record forecasted by confident USDA economists who are also informed of recovery at the world’s number one provider, Argentina, by a local attaché. If we accept that soybean meal exports from the US (and Argentina and Brazil) can be forecasted and quantified, then we cannot accept the CoBank’s economists’ characterization of the global trade as “murky.”

Analysts Struggle to Quantify Growth

Here is where I might have added an edit for the CoBank economists. I would have suggested to them that they characterize the growth factor for global trade as “difficult to quantify”. This is because the impending increase in available supply for global trade, delivered by a US industry providing more export tonnes, could be hard to predict.

It is not that growth is hard to predict; consumption of soybean meal grows with global population and global wealth, with few historic periods of contraction primarily due to interruptions in supply. What is hard to predict is how much growth will occur when global consumers can access more supply at lower prices. That is what all of us in the global oilseed processing industry will discover in the coming two years.

Analysts concluding that global demand will not meet the increase in supply, or potentially spur a dramatic expansion in demand that allows for ongoing profitability, might be too gloomy. I will return to an article I wrote last July where I detailed the ADM CEO Juan Luciano’s answers to a series of questions during an earnings call about the potential for burdensome soybean meal supplies.

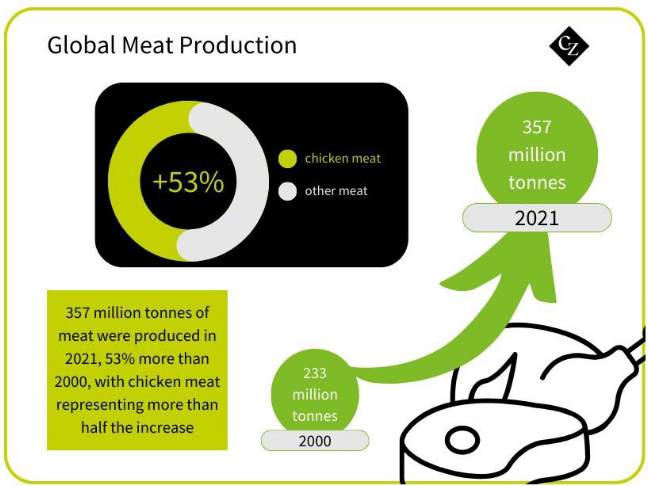

From a long-term perspective Mr. Luciano returned to metrics from prior earnings calls. These included the fact that US total meat consumption is at 270lbs per capita, China is at 170lbs per capita, and the world is at 100lbs per capita.

He then asked all of us listening to the call to imagine how significant global vegetable protein meal demand would be in the future given rising demand for feed for meat proteins as each global citizen climbs the rungs toward the total US consumption metric.

If global meat production grew 53% from 2000 to 2021 and maintains that growth moving forward (likely a higher increase), it necessarily means global soybean meal production needs to maintain the same pace. Imagine that.