- We expect prices to bottom in H1’19, if they haven’t already.

- However, high global sugar stocks will make it hard for the market to strengthen significantly.

- We therefore expect market action to be choppy in 2019.

——————————————————————————————————————————————————————————————

There’s an episode of The Simpsons where Marge and Homer are upgraded to first class on a flight. Homer picks up a magazine and says to Marge, “Look at me. I’m readingThe Economist. Did you know Indonesia is at a crossroads?”

The episode was first screened in 2004; even 15 years ago that kind of thematic reporting was old-fashioned enough to make a good joke. So we have written this report with

some nervousness.

Another problem with writing about longer-term themes is avoiding extrapolating recent events or compiling a dull recap of the consensus. Financial commentator Meb Faber recently made this point on Twitter.

Readers will be able to decide whether we’ve avoided Simpson and Faber problems in due course. The short version of what we will cover in this article is:

1) Global sugar production is falling.

2) Increased government intervention in the sugar market makes Point 1) slower than you’d expect.

3) This means we may not see a meaningful decline in sugar stocks.

4) This implies that we probably won’t see significantly higher sugar prices in 2019 unless something catastrophic happens.

5) Sustainable sugar will become increasingly important.

6) The reduction of the sulphur content in marine fuels could have knock-on effects on the sugar market.

We imagine that most readers are primarily interested in price, and so that’s where we will start.

Will sugar remain in a downtrend in 2019? Or could the market transition towards a more positive environment?

Monthly Raw Sugar Futures Over The Last Decade

Overproduction

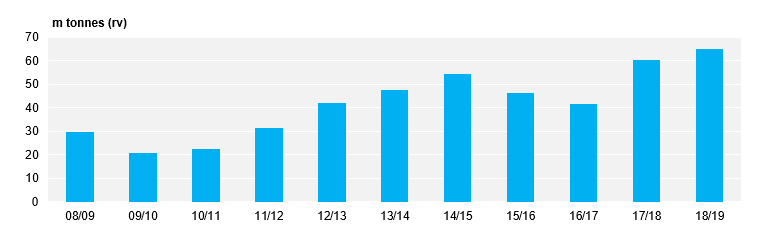

In the past two years, farmers have grown so much cane and beet that sugar stocks around the world have risen to record levels.

Global Sugar Stocks are at Record Levels

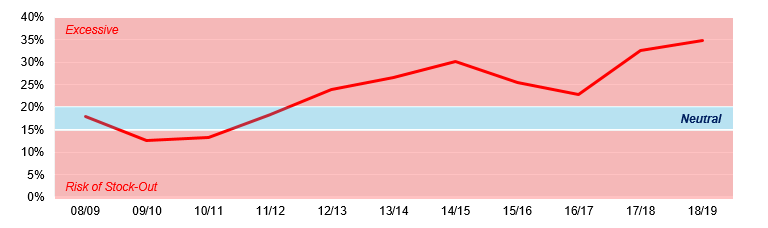

In fact, stocks of sugar around the world have been excessively high since 2012. At Czarnikow we believe that if global sugar stocks are below 15% of annual consumption, supply chains run the risk of breaking down. This leads to increases in price. However, a stocks-to-use ratio above 15% is a neutral level, while stocks-to-use above 20% is excessive. After all, stocks are expensive to carry.

Global Stocks-To-Use Ratio

2018 Production

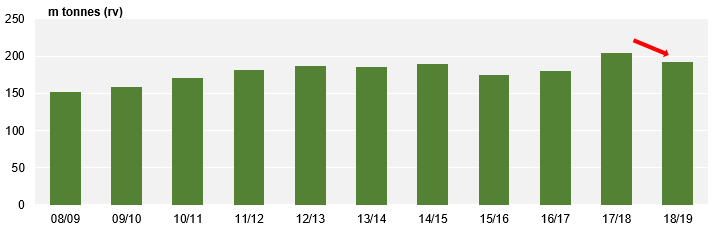

In the 2018/19 sugar harvest, it looks as though vast overproduction has started to change.

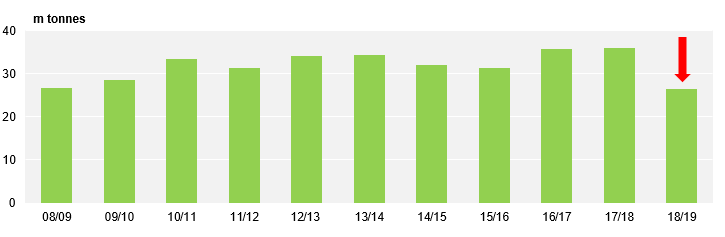

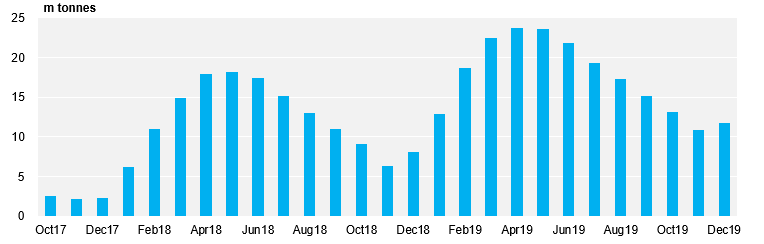

Global Sugar Production by Crop Year

This change has almost entirely happened in Centre-South Brazil. This has been the world’s largest sugar producing region since 2001.

CS Brazilian Sugar Production by Crop Year

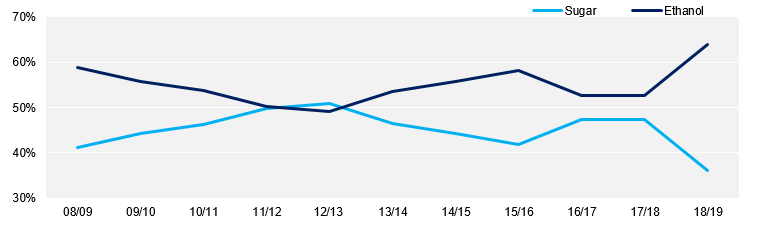

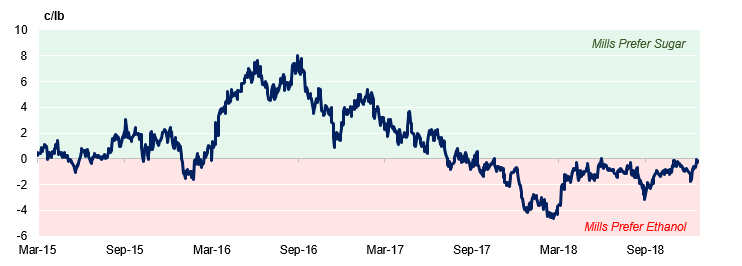

However, cane mills here have a choice – many can make either sugar or ethanol, depending on which is the best-returning product.

CS Brazilian Production Mix by Crop Year

In 2018, ethanol paid mills more than sugar, and so mills reduced their sugar output from 36m tonnes to 26.3m tonnes in the space of a season.

CS Brazilian Mill Returns

While this reduction in output is welcome, it hasn’t actually stopped the growth in global sugar stocks; output in other countries is simply too high for CS Brazil to offset by

itself.

The root cause of the overproduction also hasn’t really been addressed. Around the world farmers are not receiving the right price signals – the cheap sugar market hasn’t

incentivised large-scale crop switching in 2019.

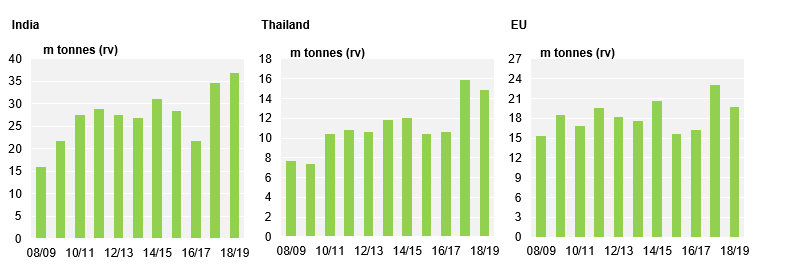

We anticipate that production in…

- India (now the world’s largest sugar producer)

- Thailand (the world’s 2nd largest raw sugar exporter)

- The EU (the world’s largest beet grower)

…will be close to record levels.

Sugar Production is High in Three Other Major Markets

We believe that increased government intervention in agricultural markets is partly to blame.

Intervention

This is a natural response to lower prices – protecting rural incomes is often a core policy for governments. Ironically, by shielding farmers from the effects of low sugar prices,governments around the world have probably prolonged the price depression. Let’s take a closer look at some of the most significant sugar producers around the world.

Those with no interest in sugar policy can safely skip this section and resume reading at 2019 Production and Stocks.

India

As we saw above, India is now the world’s largest producer of sugar. Sugar is defined in law as an Essential Commodity, meaning the government retains huge control over allaspects of its growth, processing and sale. The price mills must pay farmers for cane is set by the union government each year and does not have any bearing on the price of sugar.

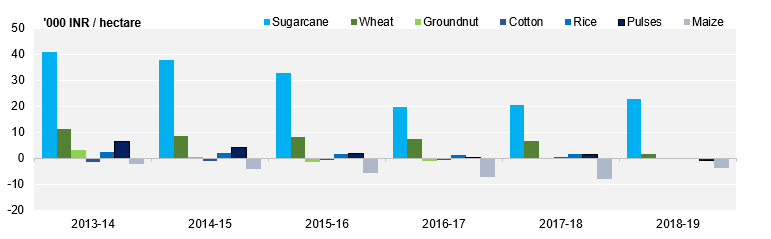

Cane Remains the Best-Returning Crop in India

Cane is the best-returning crop in the country – cane farmers are an important source of votes. This means Indian sugar cane acreage has been rising. The only year in the last decade when India has not produced excess sugar came after two successive monsoons failed, leading to poor cane growth.

India has Produced Surplus Sugar in 8 of the Last 9 Years

This seems unlikely to change in the future. Rather than address the oversupply of cane, the Indian government is instead hoping to develop a domestic ethanol industry similar to the one in Brazil. This suggests cane prices will not be liberalised in the near future.

The government also increased the level of regulation on the sugar industry in 2018.

- Each mill is now told by the government how much sugar they can sell domestically each month.

- The government sets the minimum domestic sugar price.

- The government has also set a 5m tonne export quota backed by subsidies for cane growers and inland logistics.

This means India’s oversupply of sugar is pushed onto the world market, which has been negative for price.

The longer term effect is that farmers have no incentive to switch away from cane cultivation except for in years where water is scarce. We’re in the hands of the weather.

Thailand

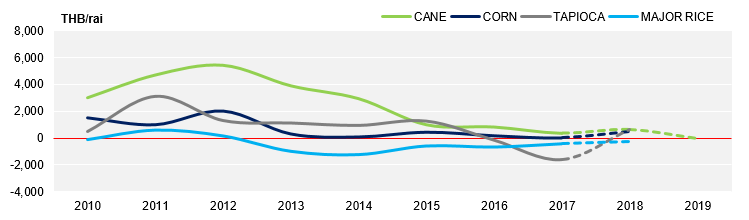

In 2018 the Thai government reformed the sugar industry to align it more with the world market. Fixed domestic prices and quotas were abandoned under the threat of a Brazilian WTO challenge.

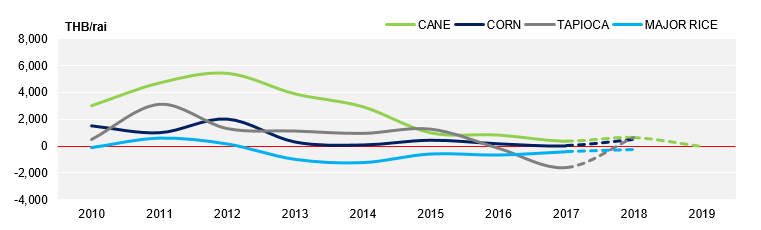

Mills and farmers used to share revenues from export and domestic sales, with farmers taking 70%. World market returns were derived from a benchmark price set from salesof parcels of raws by a government/industry/farmer committee. While there was always a world market element to cane prices, in the past the fixed domestic price softened the effect of a weak world market from farmers. Therefore, cane has long been the best-returning crop for Thai farmers.

Cane Has Been a Profitable Crop for Thai farmers

However, world market levels have fallen far enough that, combined with floating domestic market prices, farmer returns from cane are negative. Other crops like cassava arenow more profitable. 2019’s provisional cane price is being estimated at around THB 700/mt, the lowest in more than a decade.

Erosion of farmer returns isn’t acceptable to the government, who are now looking at subsidising the farmers through a THB 50/mt payment. Ostensibly, this will be to cover cane transport and fertiliser costs. However, the end effect is to soften the price signal to farmers, potentially reducing the incentive to reduce cane acreage. We also suspect that reduced interest loans and other grants may be offered.

China

China was once the world’s largest importer of raw sugar. However, the government began to restrict imports from 2016 in an attempt to support the domestic market. This was supposed to ensure mills remained profitable enough to pay farmers for cane. Chinese cane prices are among the highest in the world.

However, Brazil has challenged the Chinese administration of their sugar imports at the WTO so it looks as though China will now relax its import restrictions in 2019.

The government is now looking at ways to directly support cane farmer income through payments, though the Ministry of Finance has not yet decided how this should actuallywork in practice. Regardless, from a farmer point of view the price signal to grow less cane is lost.

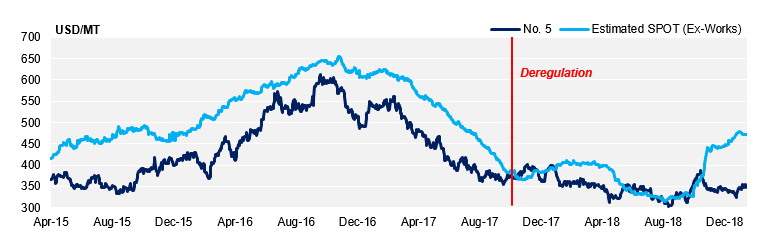

The EU

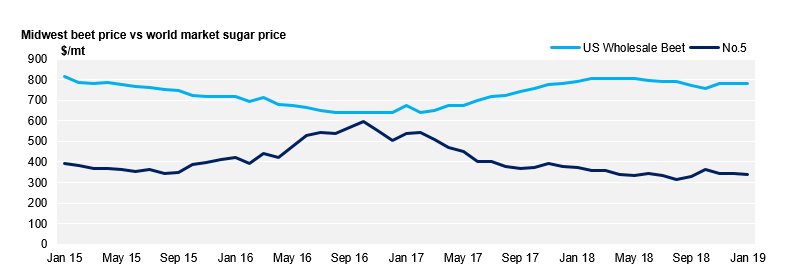

Beet growers in North-Western Europe are among the most efficient sugar producers in the world. Nevertheless, major producers have reported losses in 2018. The European market was deregulated in late 2017 and domestic market prices followed the world market lower.

EU spot prices vs No.5

While the European Commission has no interest in re-regulating the sector, several individual member states are offering beet growers support. Poland, Hungary, Italy and

Spain may subsidise beet farming through a measure called Voluntary Coupled Support. Meanwhile, Belgium, Poland and a host of smaller beet-growing countries may allow farmers to use a class of banned insecticides called Neonicotinoids to preserve agricultural yields.

The USA

A new Farm Bill was signed into law at the end of 2018, preserving the Sugar Program for another 5 years. Under the program American cane and beet farmers receive a range of support, including minimum domestic prices, low-interest non-recourse loans and restrictions on sugar imports. This means that American sugar prices today are roughly double world market levels.

2019 Production and Stocks

We don’t think there will be a large reduction in cane and beet acreage in the 2019/20 season; there’s too much support for growers.

We can only identify two major sugar producers where an acreage reduction may be significant; the EU and Thailand.

Beet prices paid to European farmers in 2019 will be significantly lower than in previous years. Beet is an annual crop and so lower prices could have an immediate impact on acreage. In Thailand the strength of cassava returns may be high enough to overcome any government top-up payments for cane.

Cane Has Been a Profitable Crop for Thai farmers

We understand the Thai government is concerned enough about falling farmer returns that they are considering making direct payments to cane farmers. An election may be held this year, which would make these payments politically important; rural voters wield disproportionate power in Thailand.

There is potential for India acreage to reduce too, depending on how quickly farmers get paid for their cane this year. Initial reports suggest farmers are being paid late for their cane which may encourage some replanting to other crops.

However, there will be a general election this year in India, which will probably be held in May. Current projections are for a hung parliament, and farmer votes could be important. Prime Minister Modi has recently hinted that the government may spend heavily to preserve farmer incomes ahead of the election. There is a risk this spending includes payments to sugar cane farmers.

Elsewhere, if acreage won’t drop we’re in the hands of weather or catastrophe.

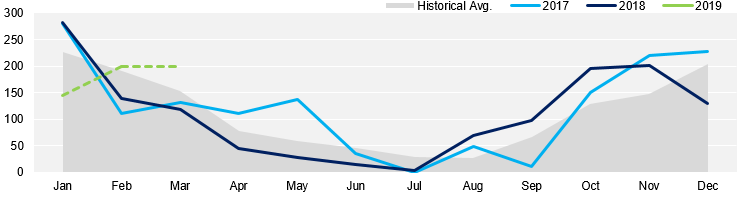

Q1 of last year was dry in CS Brazil, which damaged cane productivity. December 2018 has also been dry and if this extends into Q1’19, the cane will have experienced two successive years of dry weather during its growth and maturation phase. This could lead to downgrades of estimates for the harvest due to begin in May – we

currently think 552m tonnes of cane will be harvested in 2019, but dry weather could easily reduce this figure.

CS Brazil Monthly Rains (mm)

Likewise, cane in India and Thailand received below-average rainfall from the monsoon in 2018. Cane is a resilient crop, so the effects of this dryness may not be widespread

in 2019’s crop. However, a second below-average monsoon could lead to widespread sugar production shortfalls in 2020 (but not 2019).

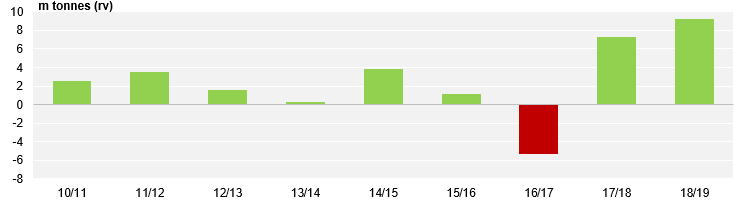

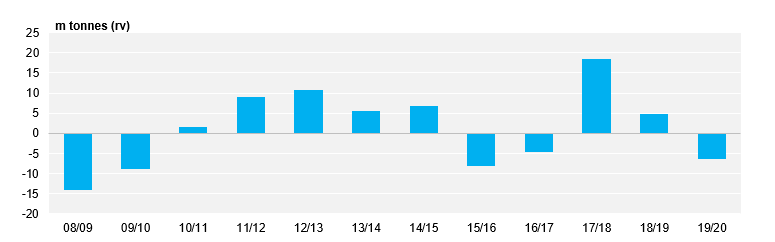

We therefore forecast that global sugar production in the 2019/20 harvest will be below consumption. This will be the first time this has happened since 2016/17, and raises the possibility that sugar prices may have reached a bottom.

Annual Change in Global Sugar Stocks

Whether this is true or not, and how quickly the market transitions to higher levels, depends on how quickly the world draws down sugar stocks. Our current forecast suggests there is plenty of stock to cover the shortfall in production; we see the global stock to use ratio falling from 35% to 31% across the season.

Global Stocks-To-Use Ratio

In particular, Indian stocks remain at record levels, and this sugar can easily be exported to the world market if international prices exceed domestic prices. Today this

would occur at around 13c/lb.

Indian Sugar Stocks Have Risen From Minimal Levels to Approach One Year’s Supply at their Peak

Brazilian mills can revert to maximum sugar output if sugar prices are strong enough. Today this would occur towards 15c/lb.

These two factors are likely to limit the upside potential of the sugar market in 2019.

The Retreat of Globalisation

The advance of globalisation seems to have slowed in the past few years. 2019 could show continued evolution of this trend.

The much-maligned WTO is likely to be kept busy; already Brazil has challenged China’s sugar import quota administration and Australia has raised a point of order over

historic Indian cane prices. A further challenge against India’s recent export quota is also likely to be forthcoming.

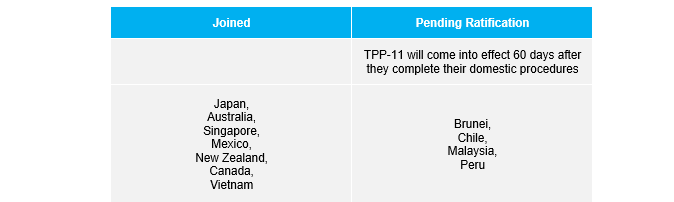

Furthermore, the Trans Pacific Partnership has begun despite the USA’s withdrawal from the pact. This means we are likely to see increased flows of Australian sugar into Japan in 2019 as Australia will have a duty advantage versus other raw sugar suppliers under TPP.

On top of this, the NAFTA agreement between the USA, Mexico and Canada was renegotiated without major changes to sugar; the agreement has been re-born as USMCA.

On the other hand, disruption is easy to find, and bilateral agreements continue to sprout in the place of more overarching trade deals. Brexit has dominated the UK’s political

chatter for more than 2 years. As it stands, the UK will leave the EU at the end of March. What happens next is still unknown. We don’t even know what tariffs will be applied to sugar trade when the UK departs.

The UK is a deficit sugar market, and so sugar imports will be required. Meanwhile, the UK’s departure is likely to leave the EU in sugar surplus once more. Logic dictates

that we could see increased EU sugar exports to the UK, but without knowing any further detail, it’s not clear if logic has any place in Brexit discussions currently.

The partial fragmentation of global trade into regional and bilateral deals means that more sugar than ever is now being traded with reference to the world market prices,

but that understanding how these benchmarks relate to actual physical sugar trade will be complicated. As always, on the ground, detailed expertise will be critical to succeeding in the markets.

Sustainability/VIVE

One area of the sugar market which will undoubtedly continue to grow in 2019 is sustainable sugar. Consumer demand for increased visibility of the ingredients in their

food and the packaging the food comes in has prompted a shift in the procurement patterns of industrial buyers of sugar.

Czarnikow is at the forefront of delivering sustainable sugar through VIVE. This is a voluntary, continuous improvement sustainability programme for sugarcane and sugar beet

supply chains, covering all operations and activities for producers through to end users. We expect the volumes of sustainable sugar traded around the world

to continue to increase, and Czarnikow is utilising its unique position within supply chain to drive this change. Join us today!

Low-Sulphur Marine Fuel

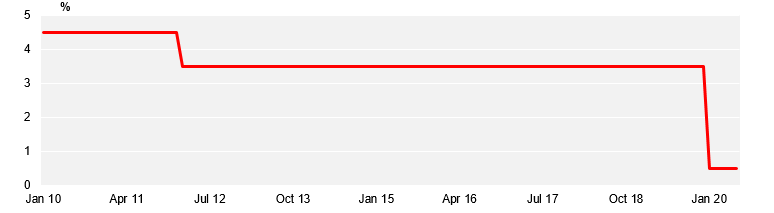

On the 1st January 2020 the level of sulphur allowed in marine fuel will drop from 3.5% to 0.5%. This change was agreed by the International Marine Organisation (IMO) in

an attempt to reduce the industry’s greenhouse gas emissions.

IMO Sulphur Limit in Marine Fuels

The market is expected to begin the transition at the end of 2019. Ships will either need to burn low sulphur fuels, or continue to burn higher sulphur fuels with exhaust

cleaning systems. Backfitting exhaust scrubbers is time-consuming and costly, so we think vessel owners will favour using low sulphur fuels for the existing fleet.

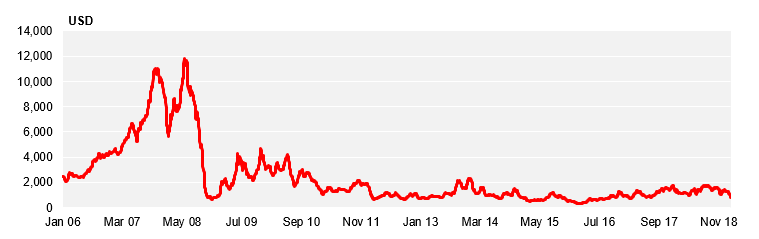

The IMO assessed the fuel oil market in 2016, reporting that enough low sulphur fuel oil (LSFO) would be available for the change. However, the fuel oil supply chain is complicated and there could be trade routes where LSFO is not readily available. This may lead to an increase in bunker prices and therefore drybulk freight rates.

Baltic Drybulk Index

Freight is a significant component of the delivered price of sugar. If rates rise this tends to lead to increased regionalisation of the sugar market, meaning that buyers

tend to source sugar from close-by origins. We saw this effect in 2008 when the drybulk freight market rose to record highs; expensive freight meant that it was harder for Brazilian VHP to compete with Thai raws into East Asian markets, for example.

Conclusion

We expect prices to bottom at some point in H1’19, if they haven’t done so already. However, reaching a low isn’t the same as establishing a new uptrend. Given the weight

of stocks and level of government intervention around the world, we think it’s more likely the sugar market enters a period of choppy transition, probably between 10c/lb and 15c/lb at today’s FX levels.

Part of the difficulty for price is the sugar “story” in 2019 is likely to become more complicated. This is thanks to the increasing number of trade agreements, the

increased desirability of sustainable sugar, and key external events such as changes in energy prices and changes in quality of marine fuels.

At Czarnikow we have more than 150 years’ experience of trading the sugar market, we trade 5% of the world’s sugar, and we help 550 clients with every aspect of the sugar market. Why not talk to us today to see how we can help you?