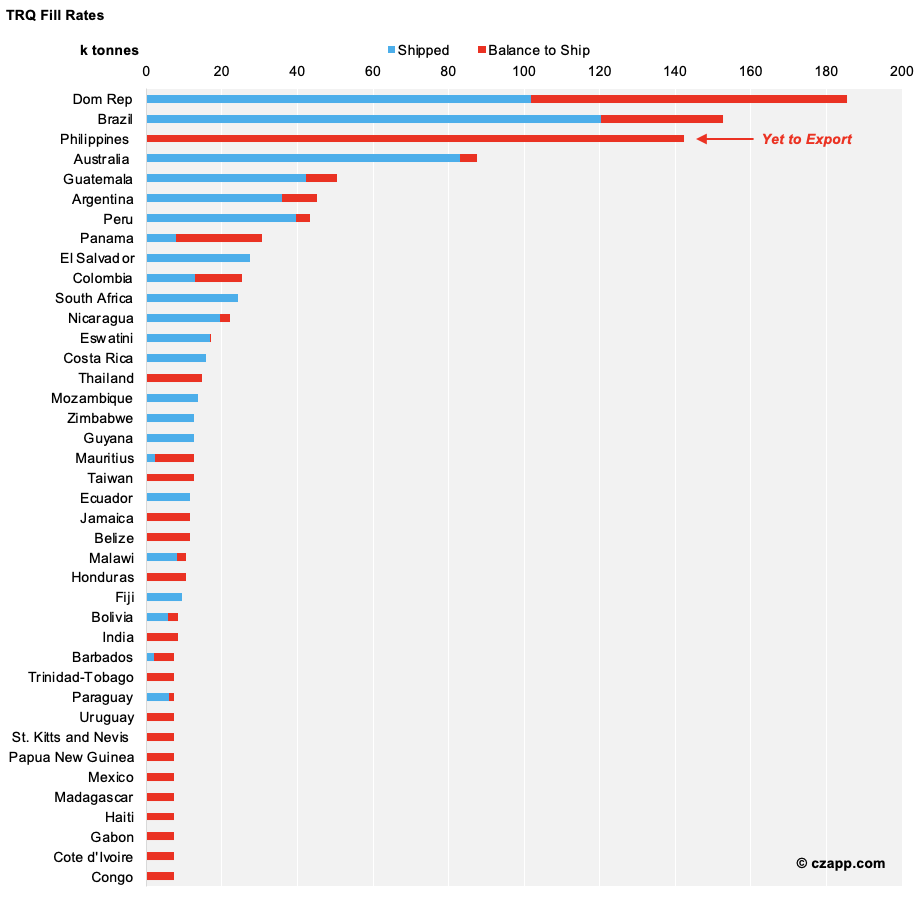

Note: The US can import 1.117m tonnes of raw sugar each year via the Raw Sugar Tariff Rate Quota (RSTRQ).

- In March, the USDA said the US sugar market would be well supplied this season.

- However, some key suppliers are yet to export any sugar to the US.

- Domestic prices are at a five-year high as a result, which suggests the US’ supply might not be as robust as first thought.

The US’ Raw Sugar Imports in 2020/21

- The US has imported 630k tonnes of raw sugar so far this season.

- This means it’s already filled 56% of its RSTRQ and is adopting a similar import pace to last season.

- However, unless the USDA redistributes certain quotas, 155k tonnes of the RSTRQ may remain unfilled.

- This is not that unusual and is largely because some quota holders are no longer producing sugar.

- But there are also instances this year where it doesn’t financial sense for some suppliers to export.

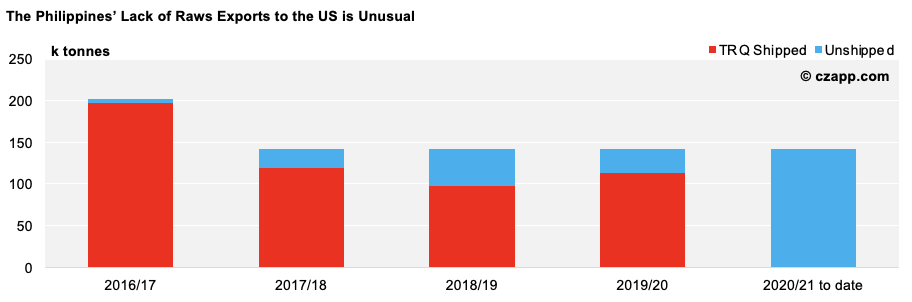

- The Philippines, for example, has not yet exported any raws to the US as its high domestic prices (> 1,000 USD/mt) have made this unprofitable.

- This shouldn’t be a problem as the USDA’s stock estimates in March suggested that the US sugar market would be well supplied this season.

- However, the No.16 is at a five-year high at present, which gives conflicting indications.

- Such high prices could mean the US needs more sugar, making the Philippines’ shortfall quite significant.

- However, the No.16 is a very illiquid market and only represents a small portion of US supply.

- All will become clear in the coming months as the USDA makes decisions surrounding export flows.

- Today’s WASDE Release could even give us further insight – stay tuned for updates on Czapp!

Has the Baltimore Sugar Refinery Fire Affected Demand?

- The raw sugar storage shed at Baltimore Sugar Refinery caught fire last month.

- However, we don’t think this will weaken the US’ raw sugar demand in 2020/21 because the refinery was back in action just two days after the blaze began.

- The damage was almost exclusively endured by the refinery’s raw sugar storage shed, and luckily, they had a secondary storage facility ready and waiting.

- The refinery should therefore continue to run at its usual capacity for the duration of the season.

Other Opinions You Might Be Interested In…

Explainers You Might Be Interested In…