- Kansas Hard Red Winter Wheat is having a wacky year.

- Price behaviour has been unusual – for the flat price, the spread with Soft Red Winter Wheat and the spread with corn.

- What does this mean for the most-popular wheat type grown in the US?

What’s Happened to Kansas Wheat Prices?

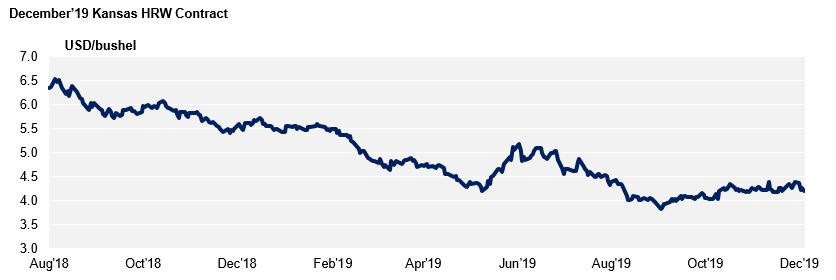

It’s been a strange year. The December’19 contract has traded lower than any previous Kansas HRW December contract for over 10 years, reaching a low of $3.81/bu on the 3rd September. The flat price has since recovered back over $4/bu.

This is because the world is awash with wheat. The US Department of Agriculture (USDA) estimates global wheat stocks will be 288m tonnes at the end of 2019/20. This is 37.6% of annual production (765.6m tonnes). This is a multi-year problem. Last season this ratio was 38%, and the year before it was 37%.

What’s Happened to the Spread Between Kansas Wheat and CBOT Corn?

The premium for Kansas HRW over CBOT Corn for the December’19 contracts traded to 11c/bu. A more normal spread would be anything from 50c/bu to $1.50/bu. Again, this spread has now recovered towards more normal levels above 50c/bu.

This trend was driven by the oversupply of wheat mentioned above, combined with the torrid year the US Corn crop is having, largely driven by adverse weather. Today, the US Corn harvest is still not finished and so we still don’t know how large the final crop will be. This uncertainty is keeping the CBOT Corn price relatively high. At 11c/bu premium to CBOT Corn, HRW will feature in feed rations, replacing Corn, so this is not a long-term place for HRW to find itself.

What’s Happened to the Spread Between Hard Red Wheat and Soft Red Wheat?

The Kansas HRW vs CBOT Soft Red Winter Wheat (SRW) spread for December’19 contracts has traded down to a lowly -$1.14/bu. This spread normally trades at around parity to 20c/bu premium, not a discount! It certainly hasn’t been this low for many years, if ever. The spread remains weak today.

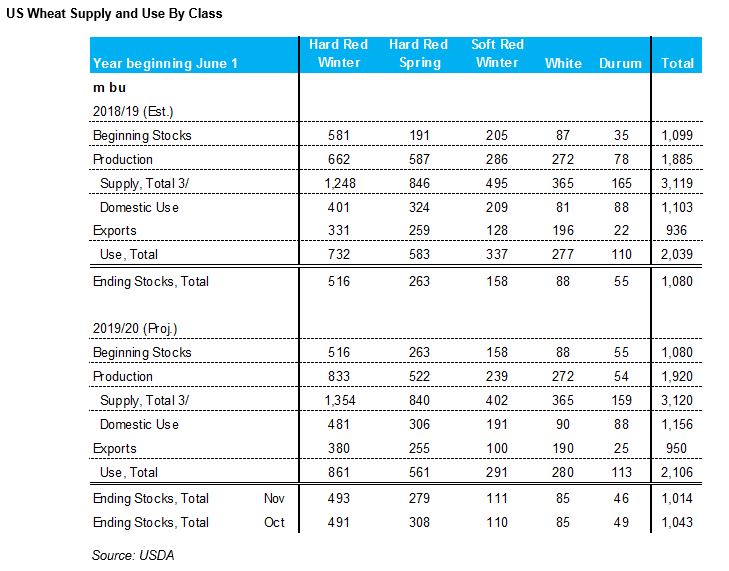

This is because SRW saw a small harvest in 2019 and dwindling end of year stock predictions – see the USDA table. It is thus logical that the relative price of SRW is high in comparison to HRW…..for now.

What Happens Next?

As with all agricultural commodities, we need to watch the weather. There’s a lot going on. We have excessive cold, snow and rain in parts of the US, Canada and Europe. There’s also extraordinarily hot, dry and drought conditions in Australia and dry followed by wet in Argentina.

Even where the weather is good, other major wheat suppliers have political issues to contend with. In South America we have currency volatility in Brazil and export availability questions going forward in Argentina. The quantity, quality and reliable availability of wheat globally is difficult to define today.

On the demand side there is no stability in the global economic outlook. We have the ongoing US/China trade war painfully slowly trying to inch towards some sort of phase one agreement. The mood changes with anything from tweet master Trump. Any deal should probably be a good deal for the grains market.

In Europe we have Brexit, as consumers sit on the side lines awaiting a resolution. In the last few weeks Iran has been making noises about needing to import up to 3m tonnes of wheat this crop year, as opposed to the projected 100k tonnes. This is a bolt out of the blue. Russia or others could supply this but to the detriment of exports elsewhere.

Then there is African Swine Fever. Since the first reports came out of China, where marginally over 50% of the global pig herd were based, there has been culling on an enormous scale. The numbers culled are guesswork at best, the Chinese Government suggests 40%!

The spot market price of pork in China has more than doubled since Sept 2018. Meat exports from South America, North America, Europe and other Asian countries have all risen to help feed the huge population of China as a result. The demand from feed mills around the world needed to boost meat production over the coming months and possibly several years until the Chinese pig herd is back to the levels needed is currently an unknown. How much extra wheat/grains are needed is not daily headline news but in time the numbers will come out. The final figure may be bigger than imagined!

Where Are We Going With Kansas HRW?

The weather is always an unknown, but global wheat stock estimates will be down for the end of 2021 if plantings and harvests do not get easier in the coming months. The US wheat acreage is estimated to be the lowest in more than 100 years for the 2020 harvest!

We think we should (relatively speaking) see higher acreage of SRW planted in the USA in the coming season, and fewer acres of HRW, driven by today’s price differential.

We also expect to see more feed demand globally to help meat production to feed the population of China in the wake of African Swine Fever.