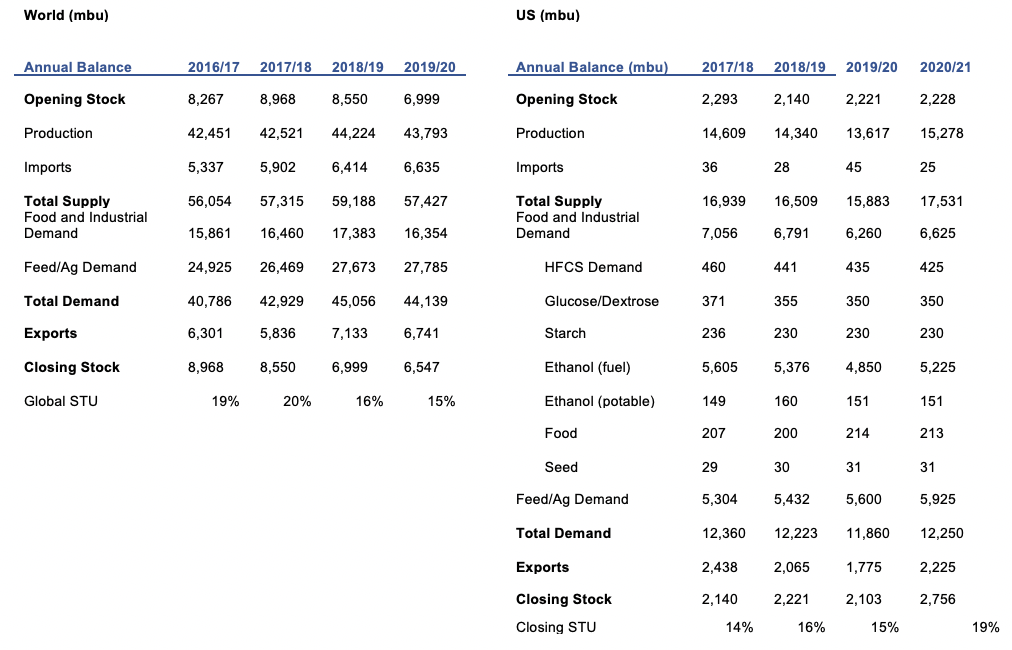

- The November WASDE was bullish for corn and soybeans with a significant reduction to the US’ ending stocks.

- On a global scale, corn stocks were cut by 9m tonnes, soybeans were cut by 2.2m tonnes, and wheat was cut by 1m tonnes.

- The bulk of the reductions came from the US, but in corn’s case, the USDA also reduced Ukrainian production by a sizable 8m tonnes and EU production by 2m tonnes.

Price Action

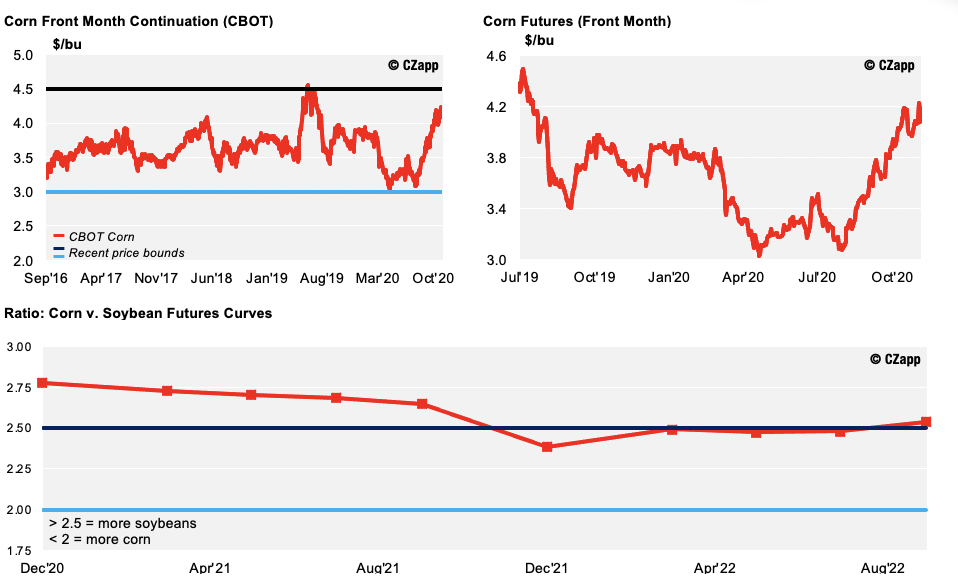

Forecast: Our average price forecast for 2020/21 (Sep/Oct) remains unchanged, in a range of 3.4 to 3.8 USD/bu. The average price since the beginning of the crop (Aug/Sep) is running at 3.86 USD/bu.

Market Commentary

In last week’s WASDE Release, the USDA cut its corn ending stocks estimate by 465m bushel (bu); this took the market up by 4% in the space of a day. However, profit taking during the second part of the week offset most of the gains and the week closed just about positive.

Last Tuesday’s WASDE further surprised the market with a cut of 2.6 bushels per acre (BPA) to corn yields leaving acres unchanged. The 325m bu increase of corn exports due to China’s buying programme (regardless of the 7.2m tonne import quota) also shook the market. These were the big changes, but there was also a 75m bu reduction to feed usage.

The USDA lowered its corn yield estimates from 178.4 BPA to 175,8 BPA. Soybean yields were also reduced from 51.9 BPA to 50.7 BPA. Both numbers were lower than the expected averages of 177.7 BPA and 51.6 BPA respectively. It was even lower than the more pessimistic estimates of 176 BPA and 50.8 BPA respectively. Both markets rallied after the publication.

The funny part is that last Wednesday, the Chinese Agricultural Outlook Committee kept corn production and imports unchanged when it is clear they have a shortage. They said their harvest is virtually complete and there was no material impact from the typhoons, with their production estimate remaining firmly 264.7m tonnes, compared to 260.6 last year. Imports were forecast at 7m tonnes, compared to 7.6m tonnes last year. The market does not believe this official figure as local prices are at a five-year high.

Let’s talk about what’s happening with the China Phase One Trade Agreement. As it stands, 36.5 billion USD worth of corn should be purchased by the end of 2020, with a further 43.5 billion USD forecast for 2021. So far this year, just 13 billion USD have been purchased. As such, flows from now until the end of the year should remain very strong if China are the fulfill their agreement with the US. Some market rumours suggest that the Chinese Government are asking President-Elect Joe Biden for renegotiation, but there has been little talk on this from the US. Any renegotiation would be bearish, but the reality is that China needs to continue buying corn.

The US’ net sales fell to 978k tonnes, compared to 2.2m tonnes the week before. The reduction comes as China and Mexico both bought less, but despite this, sales remained above the market expectation of 650-850k tonnes.

The US’ corn harvest reached 91% completion last week, compared to the five-year average of 80%. With this, the USDA’s data should be pretty much accurate at this point. The US’ soybean harvest achieved 92% completion.

The French corn harvest reached 98% completion last week, compared to 83% this time last year. The Ukrainian corn harvest hit 72% completion.

Brazil’s soybean planting reached 56% completion, compared to 42% the week prior. The first corn crop in Brazil is 64% planted, compared to 54% last week. Corn planting in Argentina is 31.2% complete, with almost no progress made from the week before, where it stood at 30.9%. Rainfall in this region remains lower than average due to La Niña. The weather forecast is dry for the coming days in Southern Brazil and Northern Argentina, but Central and Northern Brazil should receive some rai.

On the wheat front, the November WASDE was neutral, with US stocks down 6 million bu due to higher consumption but unchanged acreage and yields. Global wheat production was also unchanged. In the Northern Hemisphere, wheat planting is almost complete. However, the last 60 days have been Russia’s driest in 40 years. Very little rain is forecast in the Wheat Belt (Western Australia) for the rest of the month. The US Plains are in a similar boat, so we could still see even lower wheat yields. US Wheat planting is 93% complete, compared to the five-year average of 91%. Planting has finished in the Ukraine and Russia. French wheat planting is 88% complete, up from 70% this time last year.

In summary, the November WASDE was bullish for corn and soybeans with a significant reduction to the US’ ending stocks. On a global scale, corn stocks were cut by 9m tonnes, soybeans were cut by 2.2m tonnes, and wheat was cut by 1m tonnes. The bulk of the reductions came from the US, but in corn’s case, the USDA also reduced Ukrainian production by a sizable 8m tonnes and EU production by 2m tonnes

Despite the large reduction to both corn and soybeans, the global grains supply and ending stocks should grow in the crop that has just started. The corn supply is significantly tighter than it was just six months ago when US stocks were forecast close to 3 billion bu, but we still have a stocks-to-use ratio of 11.5%, which is decent.

The market continues to worry about La Niña’s potential impact to South American crops. The question of Chinese corn buying remains at the forefront as well. In any case, everything points to continued Chinese buying and the weather risk is supportive, meaning there should be limited downside risk through the end of the year, but this is mostly depending on rainfall in South America.

Supply

WASDE Projections

Weather in Main Corn Growing Regions

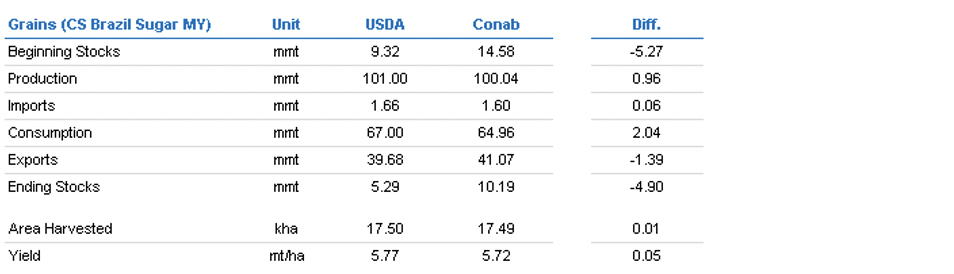

Brazil Balance

China

Demand

EU