- Global sugar production is hardly growing, whereas consumption is increasing by around 1% each year.

- The EU’s been a key supplier, but growing beet is now more challenging.

- Sugar beet prices may need to climb to around 35 EUR/mt to see EU beet acreage increase.

Global Sugar Production is Barely Growing

Global sugar production has barely grown in the last decade. Meanwhile, consumption has been growing at around 1% per year. The world therefore needs 14m tonnes more sugar than it did 10 years ago.

Across this series, we’ll assess the feasibility for cane and beet expansion in some of the world’s largest sugar producing regions: India, Brazil, Thailand, and Europe.

Can the EU Help?

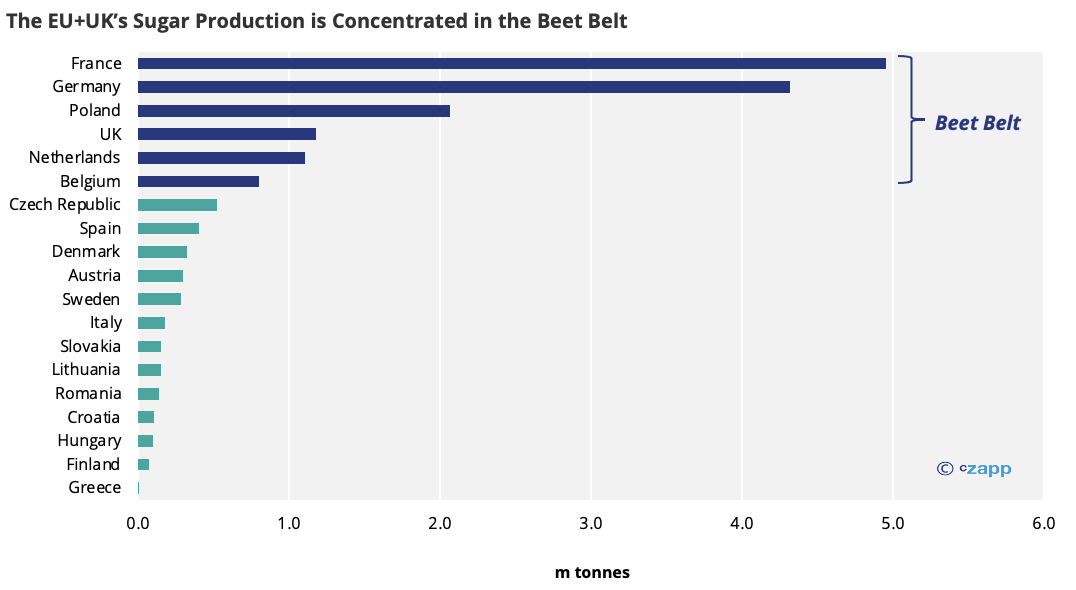

EU sugar production is concentrated in the North-West of Europe, often referred to as the ‘Beet Belt’.

80% of the EU’s sugar is produced here as the weather and soil conditions suit beet cultivation.

For the rest of this piece, we’ll focus on the Beet Belt and the UK, as this area has the capacity to expand, provided the price incentives are there.

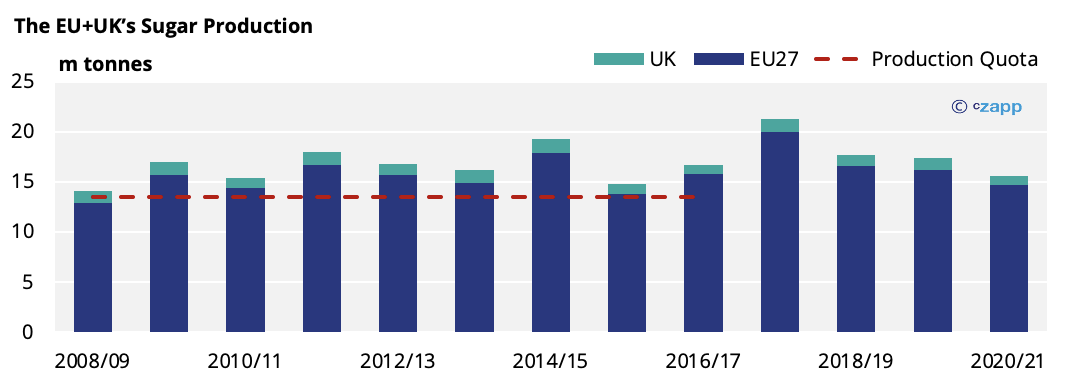

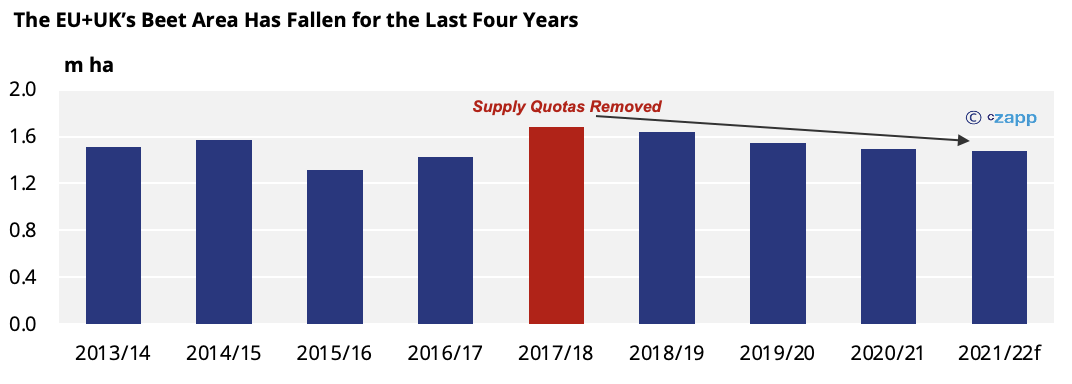

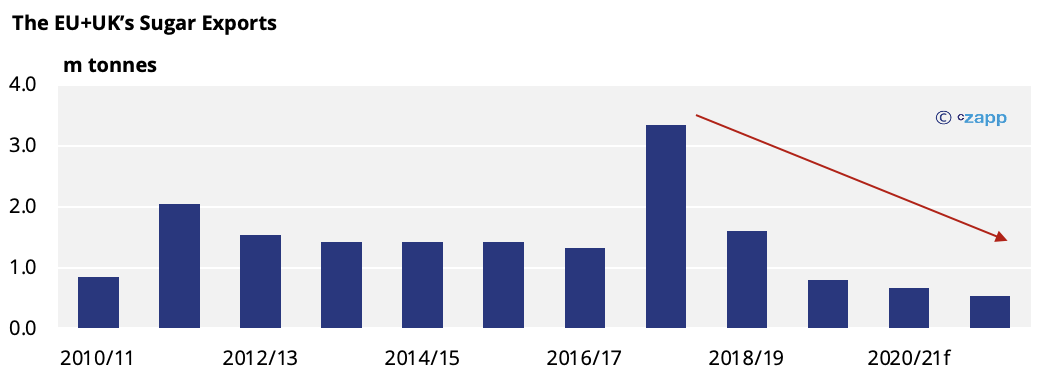

In 2017/18, the EU produced 21m tonnes of sugar; a record for the region. The EU could still produce this amount of sugar if enough beet is planted.

Since then, though, its production has declined, and we don’t think the EU+UK producing such an amount within the next 10 years at current prices.

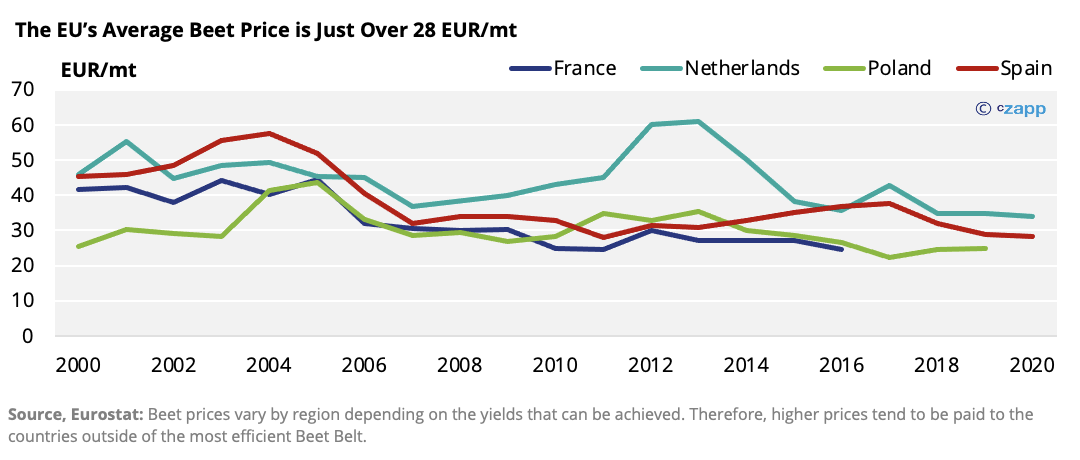

This is largely because beet prices haven’t increased and are much lower than they were in the early 2000s. With this, some farmers now struggle to profitably plant beet. Nevertheless, beet plays an important role in crop rotation, meaning many have continued to grow it, despite the poor returns.

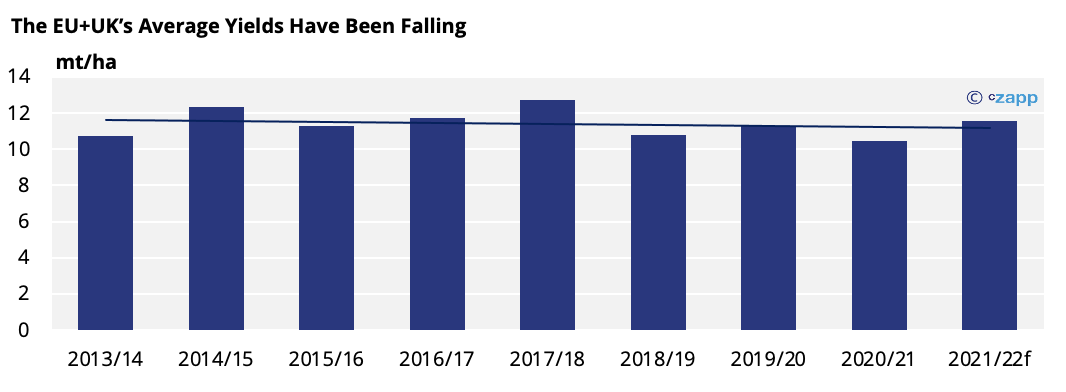

Aside from the low prices on offer, yields have also been falling. The region has been hit by extreme weather conditions and bans on certain pesticides, including neonicotinoids, which protect against Beet Yellows Virus (BYV), have been banned. BYV resulted in crop losses of 20% or more for some farmers in 2020/21; the outbreak was so bad that the French government overturned the ban, but only until 2023. This all means farmer returns have become increasingly uncertain in recent seasons, making growing beet a less reliable option for farmers.

Despite all of this, there are some more positive signs for the European beet industry.

The Dubai based refinery, Al Khaleej, has recently been given the go ahead to build a new beet factory in Spain. This factory will be able to produce as much as 900k tonnes of sugar from beet each year once operations commence in 2024. At full capacity, this would increase Spanish sugar production from 400k tonnes to 1.3m tonnes per season. However, beet prices will need to be high enough to encourage increased beet production.

How High Must Prices Go for Production to Expand?

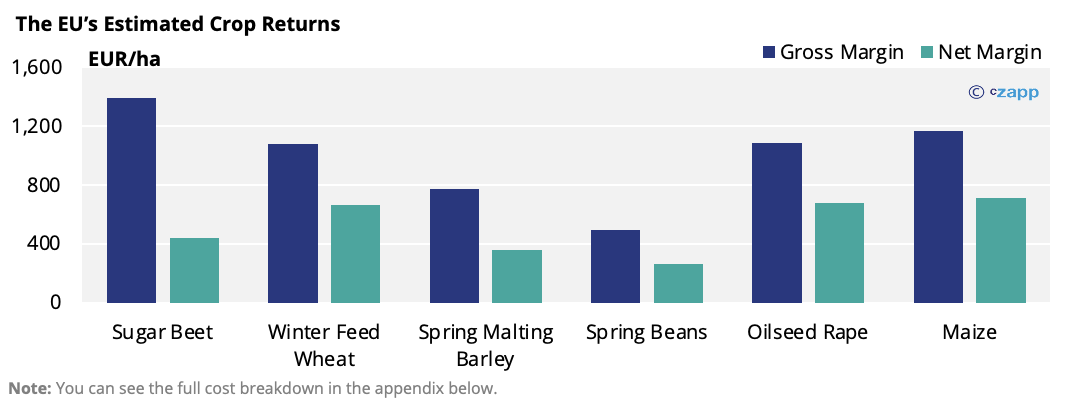

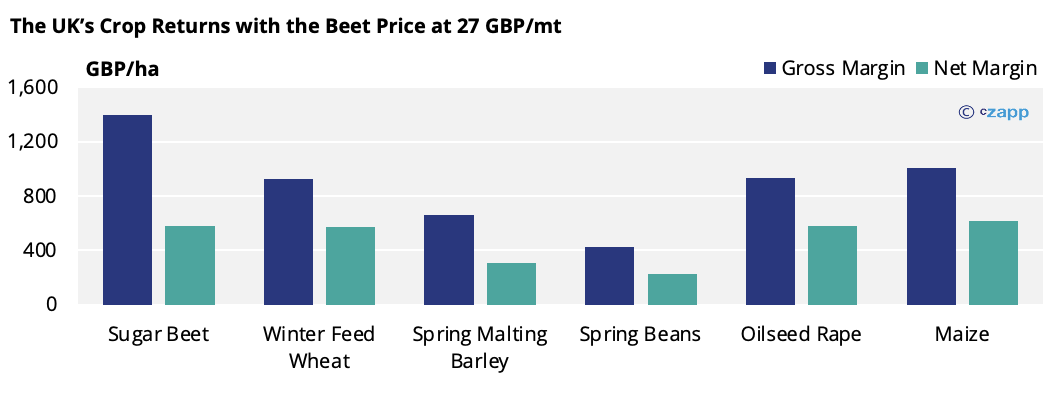

With the current beet prices and average yields, we think farmers in the Beet Belt can make around 430 EUR/ha of beet. However, other crops, including winter wheat, oilseed rape and maize pay far more.

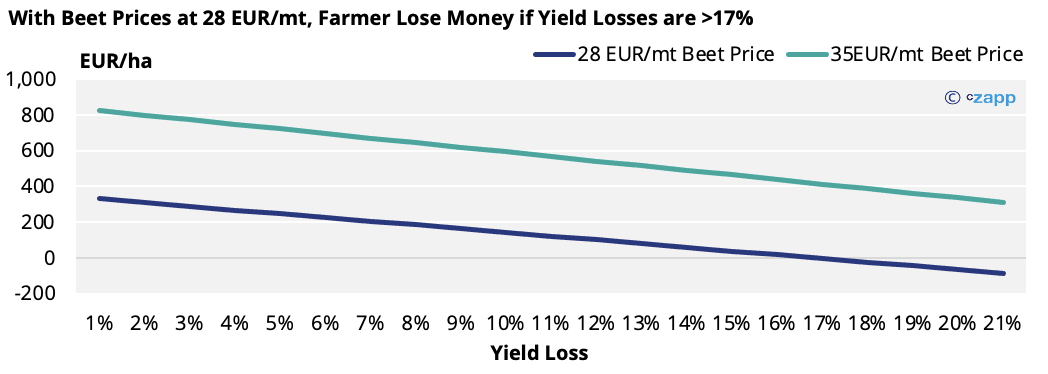

Also, BYV outbreaks are now a significant risk every season and, as farmers tend to be risk averse, they’ll want to ensure they’re not at risk of losing money.

With the beet price at 28 EUR/mt, farmers would lose money if they suffered crop losses of more than 17%. With this, sugar producers across Europe are under more pressure from farmers to increase the prices offered for beet. As a result, some French sugar producers will increase their beet payment by 4-5 EUR/mt for 2022/23 to around 31 EUR/mt.

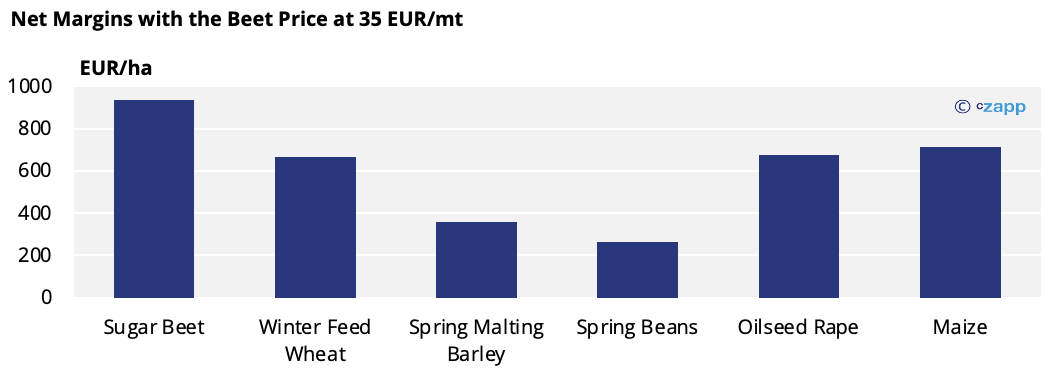

However, we believe farmers need closer to 35 EUR/mt to ensure profitable production, even if they experience severe losses. With normal yields, farmers could earn 900 EUR/mt or more, making beet the most profitable crop.

It’s a similar story in the UK: beet prices have not been high enough for farmers to profitably plant the crop in recent years. Therefore, the beet price for 2022/23 has been increased by 33% to 27 GBP/mt (31.50 EUR/mt), up from 20.30 GBP/mt this season. With this, beet offers the best gross margin but, due to the higher fixed costs associated with the machinery required, the net return is similar to that of other crops.

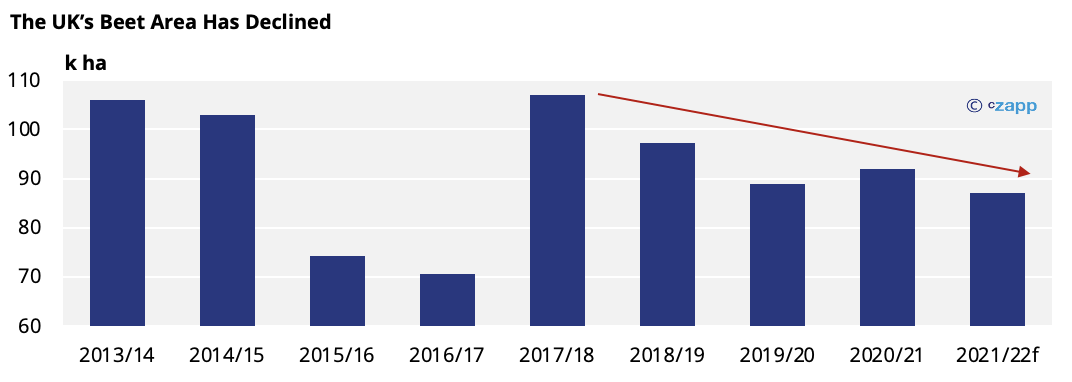

UK farmers also don’t need to worry as much about BYV now there’s a BYV assurance fund, which compensates growers for losses caused by the disease. This should be enough to make up for the some of the area losses in recent seasons, with area perhaps rebounding to 2018/19’s level.

Crucially, we think an even higher beet price would be required for the beet area to return to 2017/18’s high.

This all indicates that beet prices in Europe will need to approach 35 EUR/mt or more before planting is increased dramatically.

Will Sugar Producers Pay Up?

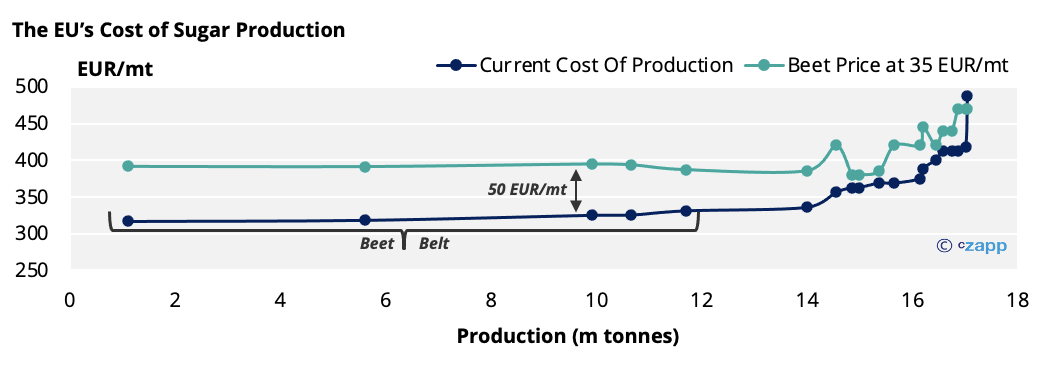

For sugar producers, the beet price accounts for 65% of their cost of production. So, any increase in the beet price reduces their margins; a jump from 28 to 35 EUR/mt would increase their cost of sugar production by about 45 EUR/mt (53 USD/mt), assuming sucrose yields of 16%. With this, the Beet Belt’s cost of sugar production would increase to about 390 EUR/mt (460 USD/mt), similar to that of Russia.

EU sugar production would also become far less competitive at this level, with it no longer being considered one of the world’s cheapest sugar producers. CS Brazil can produce raws for 250 USD/mt, with refiners then needing around 120 USD/mt to operate profitably; this totals 370 USD/mt, far below the EU’s 460 USD/mt cost of production.

In theory, with current prices, producers could pay the higher beet costs, but it would significantly reduce their margins. However, as the beet price is negotiated several months in advance, producers must be sure they don’t get caught out by falling sugar prices. Exports also need to viable, so the EU sugar market doesn’t become oversupplied and cause domestic prices to collapse. At current prices, we think the No.5 would have to trade nearer 600 USD/mt for an extended period if the EU is to export 3m tonnes of sugar or more each season again.

Other Insights That May Be of Interest…

The World Needs More Sugar…Who Can Help?

The World Needs More Sugar…Can India Help?

The World Needs More Sugar…Can Brazil Help?

The World Needs More Sugar…Can Thailand Help?

Explainers That May Be of Interest…

Thailand’s White Sugar Industry