Insight Focus

Brazilian Government Attempts to Implement Restrictive Measure on the Use of Tax Credits. This would Increase Exporters’ Costs and Is Paralyzing the Brazilian Grain Market

Provisional Measure 1227

The nightmare that haunted Brazilian exporters at the beginning of June, when Provisional Measure 1227 was issued, seems to have come to an end on the 11th. MP 1227, “affectionately” nicknamed by the ag sector as the “End of the World MP”, was launched without any prior notice on June 4th, with immediate effect. It aimed to compensate for losses resulting from the payroll tax exemption, a tax break on the payrolls of the sectors that employ the most in the country, totalling R$ 26.3 billion (USD 4.9 bi), implemented by President Dilma Rousseff during her term in 2011.

The Impact on Exporters

At its most controversial point, Provisional Measure 1227 restricted the use of PIS/COFINS tax credits, social contributions levied on the gross revenue of all Brazilian companies, which can vary between 3,65% and 9,25%, depending on the tax regime adopted by the company. These credits were implemented in 2002 as part of a set of measures to reduce the tax costs of the production chain and make Brazilian products more competitive in international trade. Thus, exporting companies can accumulate PIS/COFINS credits and offset them against other taxes.

In practice, exporters would be prevented from using these credits, having to resort to their own resources for tax payments, increasing their expenses, and consequently reducing their margins. Given the immediacy proposed, they would experience abrupt changes in their cash flows and a reduction in working capital.

Grains and Oilseeds Are Among the Most Affected

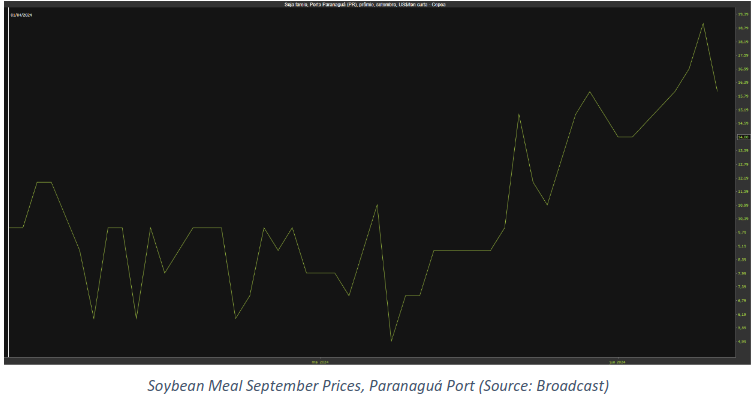

Although valid for the entire export chain of the country, commodities, given their characteristic of lower margins and higher volumes, would suffer a special impact. For crushers, for example, the industry has 65 billion reais in accumulated PIS/COFINS credits, according to ABIOVE (Brazilian Association of Vegetable Oil Industries). In the biodiesel sector alone, currently 70% derived from soy, the impact would total R$ 13 billion (USD 2.4 bi). The margins of crushers, currently around 3%, would simply disappear, as it would be practically impossible to pass this cost onto soybean meal, for example, making operations unviable.

Of these R$ 65 billion, almost 40% are related to trading companies, which would initially have to borrow expensive money from the market, drastically reducing their working capital capacity and causing buyers to pass the problem onto producers, already affected by low prices this season.

To keep prices minimally competitive in international trade, companies would also have to distribute these expenses in the prices of products destined for the domestic market, contributing to an increase in domestic inflation.

The confusion halted the Brazilian grain and oilseed export market in the first week of June, with very few buyers offering prices in the Brazilian market and, due to uncertainties regarding Brazilian export policy, redirecting purchases to countries such as China, which according to the USDA, acquired 208 thousand metric tons of US soybeans during the period.

The Rejection

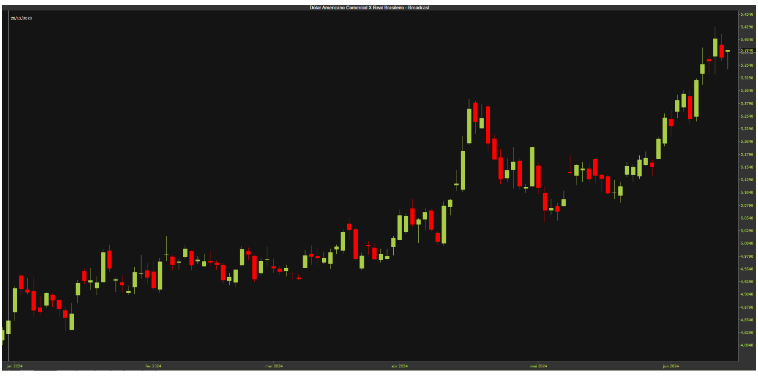

The strong mobilization of representative entities of the affected classes and political representatives of agriculture eventually led to the return of the measure by the President of the Senate, Rodrigo Pacheco, on June 11th. This rare act of “returning” a measure without even being put to a vote among congressmen represented significant discontent with the act and had an “educational” character in response to the Executive Branch’s stance. The tax imbroglio coincided with a devaluation of the Brazilian currency, leaving prices trying to find a balance point between the Real’s depreciation and the invalidity of MP 1227.

USD x BRL, Source: Broadcast