- Demand for tomato paste has increased massively throughout the coronavirus pandemic.

- Lockdown has meant more consumers are dining at home and in search of both convenient and comforting foods.

- This demand should continue to grow as increased at-home food consumption may well be the norm for the year to come.

Demand Soars as Fewer People are Eating Out Due to COVID

- Global demand for tomato paste has been stronger than ever during the coronavirus pandemic.

- Lockdowns have left far fewer people able to eat out, and with this, there’s been a natural increase of in-home dining.

Can Producers Cope with the Surge in Demand?

- As the world’s tomato producers begin processing their summer crops, we are left wondering whether they have been able to prepare for such a surge in demand.

- Fortunately, it seems they were able to.

- Global production of tomato paste will total approximately 39m tonnes this year, and the harvests that are currently underway look promising.

The Harvests Are Underway and They Look Promising

- China is the world’s largest fresh tomato producer, producing approximately 59.6m tonnes each year, 6.9m tonnes of which are processed into tomato paste.

- A few years back, Chinese tomato exports accounted for around a third of global tomato trade.

- However, the rate of exports has been on the decline ever since as the cost of production and processing continues to rise.

- In recent years, more countries have also restricted the entry of Chinese tomato products, meaning much of what is produced today is domestically consumed.

- China’s crop commenced at the start of August and is set to total 6.9m tonnes; this is spread between its four major producers.

- This means they will have a larger surplus than they did in 2019, when they produced around 6m tonnes of tomato paste.

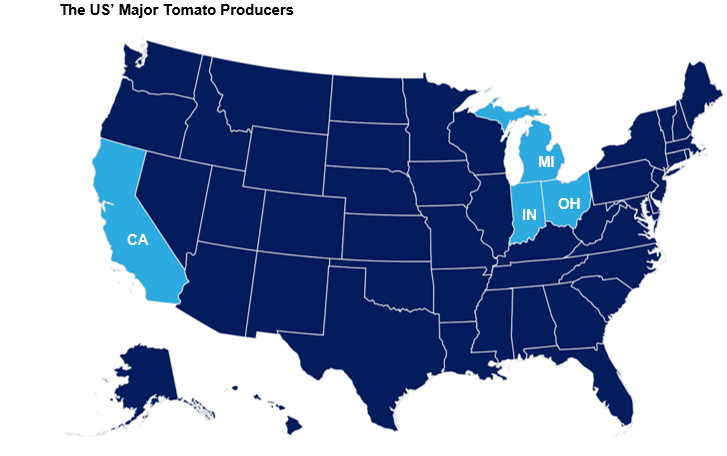

- The USA is another of the world’s largest fresh tomato producers, with production usually exceeding 14m tonnes each year.

- In 2019, around 9.75m tonnes of fresh tomato went towards processed tomato products.

- California is the leading tomato producer in the USA; Indiana, Michigan, and Ohio are other major producers.

- California’s harvest is now underway, totalling 1.9m tonnes to date.

- US processers are seemingly reluctant to make additional sales for delivery in 2020 until they know for sure what the total will be.

- Egypt produces approximately 5m tonnes of fresh tomato each year, making it the fifth largest producer globally.

- In early July, Egypt started to process its summer crop and the factories should reach full capacity this week.

- The harvest looks promising both from a quality and yield perspective.

- Spain produces approximately 3m tonnes of fresh tomato each year, and this season, Spain experienced its hottest weather for 60 years in the first half of July.

- The processing industry consists of around 20 companies, some of which process up to 850k tonnes of fresh tomato each year, and others less than 5k tonnes.

- Most of what is processed goes towards tomato paste production.

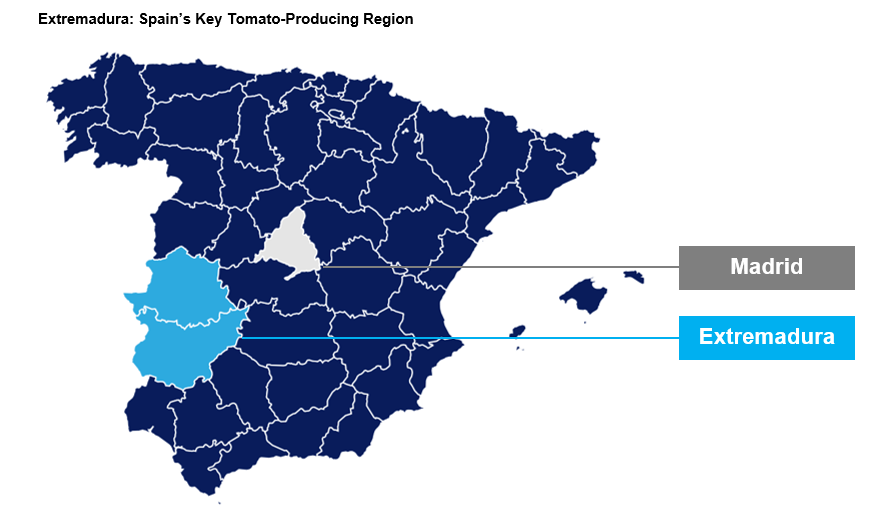

- Extremadura is the key producing and processing region; temperatures soared above 40°C here most days in July.

- These persistently high temperatures could negatively impact the crop as planting came slightly late this year due to stormy weather.

- Consistent heat can lead to what’s known as ‘flower abortion’, whereby the flower (i.e. tomato) will fall without producing fruit due to its inability to fructify.

- Despite this risk, a number of processors are already sold out and their crops haven’t even started.

- 2.96m tonnes are already contracted for the 2020 season. These processors have a total processing capacity of close to 3.29m tonnes.

- Portugal is one of the world’s smaller tomato producers, and its crops come in varying sizes each year.

- It produced 1,410k tonnes of tomato paste in 2019.

- The harvest has been successful so far, with fresh tomato production set to total 1.3m tonnes.

- It will be running at full capacity this week and the weather is looking warm and dry, reaching highs of 27° on Wednesday; this may be burdensome for the crop as Portugal has experienced below average rainfall so far this year.

- Portuguese producers have very little room for crop losses, as the crop is already in very high demand.

Will This Demand Be Sustained?

- It seems likely that demand for tomato paste will continue to rise going forward, as the threat of second waves of COVID-19 are rife and localised lockdowns seem likely.

- It will certainly be a long while until people are dining out to the same degree that they were in 2019.

- With this, increased at-home food consumption will remain the norm for the remainder of 2020 and into 2021.

- With tomato crops looking promising in most of the key production regions, this demand should be met, but there’s very little room for manoeuvre.

Other Opinions You May Be Interested In…

Pineapple: More Crop Woes for Thailand

Lemon: Trouble on the Horizon for European Processors

Mango: Will Mexico’s Crop Relieve Tight Global Supply?