- The Tomato Paste industry continues to show remarkable growth each year, despite COVID.

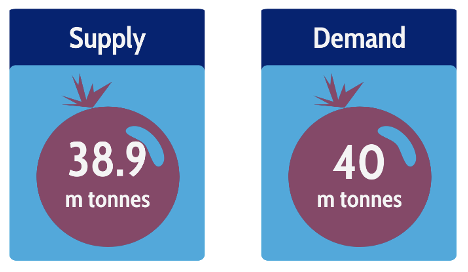

- We think the world will produce 38.9m tonnes in 2021.

- Pricing has concluded in some places, with the EU racing ahead.

Tomato Industry Shows Strong Growth

- Over the past 20 years, the Tomato industry has grown at more than 4% each year (Compound Annual Growth Rate).

- This year, we think 38.9m tonnes of Tomato will be processed globally.

- Demand should sit marginally above this, at 40m tonnes.

Tomato Pricing is Well Underway

- Pricing has concluded in the EU (Italy, France, Spain, Portugal, Greece and Hungary), the USA (California), China, and Turkey.

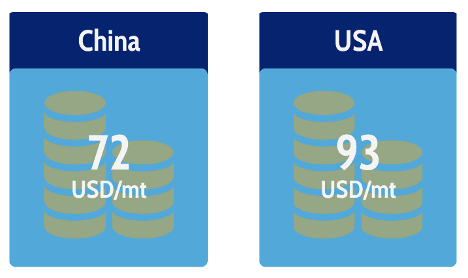

- Processing Tomatoes in 2021 (valued on 2nd April) will be 7% more expensive than the average price between 2018 and 2020 (84 USD/mt).

- Chinese Processing Tomatoes remain the cheapest, at approximately 72 USD/mt.

- This year’s reference price for Californian Processing Tomatoes sits at approximately 84.5 USD/short ton, which is just above USD 93/MT, and up 6% year-on-year.

- European sales have largely benefited from the COVID-19 pandemic.

- China was more severely affected, however, with foreign Concentrate Puree sales dropping by more than 8% (74kmt) in 2020.

- This drop was fuelled by an unfavourable exchange rate, but exorbitant ocean freight rates also played a part.

- Turkey, Ukraine, Peru, Russia and, to lesser extent, Chile felt the brunt of this.

- China’s new crop will commence in August and prices for the new season will be available from the end of the month.

- We’re anticipating a further increase as the planted area should be down 20% following a freeze.

Regional Crop Updates

- The EU may well have sold 85% of its tomato crop by the end of June; most processors are already sold out.

- Processors that committed volume in 2020 and 2021 (to date) will be able to honour these contracts.

- Prices are higher year-on-year, between EUR 100-150, depending on the volume.

- This comes as raw material costs are up following poor production and strong demand.

- Energy, packaging, and steel drum costs are also up and causing disruption on final pricing of tomato paste.

- Deliveries for 2021 crop should start in September.

- China should produce around 4.8m tonnes of tomato this year; as mentioned, this is down 20% year-on-year.

- This, together with increased packaging (30%) and steel costs, should also drive prices higher here too.

- China’s 2021 crop will commence in August and prices will be available at the end of June.

- We think they’ll be above 815-870 USD/mt for 36-38 brix on an FOB basis.

- Egypt’s Summer crop has commenced, as has Tomato Paste processing, achieving a colour level above 2.1 A/B, which bodes well for processors as this meets the demand of many food producers.

- Egypt has already exported almost 35k tonnes of Tomato Paste, up by almost 9% year-on-year.

- The steel market has impacted packaging costs and has considerably influenced the recent price increase.

Other Opinions You Might Be Interested In…

Explainers You Might Be Interested In…