Insight Focus

As tariff strife enters its second week, uncertainty remains. For the agricultural supply chain, the situation is as volatile and murky as ever – although some early winners and losers could already be emerging. While EU farmers may benefit from reduced natural gas prices and Chinese farmers reap the rewards of food self-sufficiency policies, US farmers could be left out in the cold.

Tariffs Update

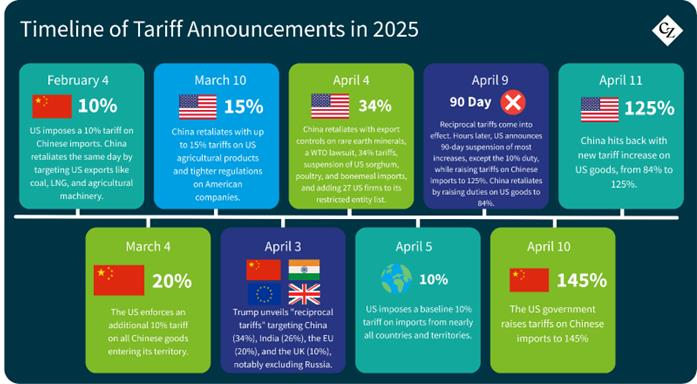

The US tariff situation is unfolding quickly, with new developments every day. Right now, tariffs for Chinese-origin imports to the US are sitting at 145% after a major escalation of tensions.

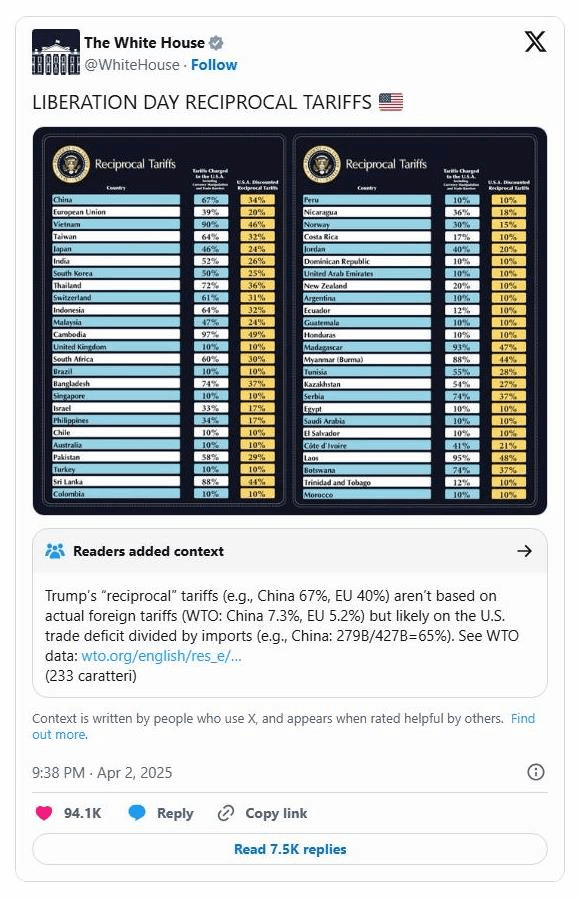

After roiling global markets, the US president paused tariffs on other countries, reverting to the 10% “baseline rate” after he said many were willing to come to the negotiating table. Some exceptions apply, with rates of 25% still applying to EU aluminium and steel and EU cars. The original rates are shown below.

However, China was not one of these countries, and its decision to slap retaliatory tariffs on the US was the US president’s justification for raising rates to 125% and subsequently 145%. China raised its tariffs on US products from 84% to 125% on Friday.

Over 75 countries have announced intentions to negotiation with Trump. These include:

- South Korea: Trade envoy Cheong In-kyo told Reuters last week that there was room for negotiation with the US. Cheong has already flown to Washington to meet with US Trade Representative Jamieson Greer. Reuters also reported that Trump spoke with interim South Korean President Han Duck-soo to discuss potential shipbuilding and energy deals.

- Japan: Japan’s Economic Revitalization Minister Akazawa Ryosei will visit Washington for three days this week for talks with Greer and US Treasury Secretary Scott Bessent. However, Prime Minister Shigeru Ishiba has ruled out the possibility of big concessions for the US.

- India: India is reportedly rushing to sign a trade deal with the US within the 90-day window wherein higher tariffs have been paused. There was surprise when India was hit with 26% tariffs in the initial rollout.

- Vietnam: Hanoi has said that it has agreed to begin negotiations with the US after a meeting between Greer and Vietnam’s Deputy Prime Minister Ho Duc Phoc in Washington. Due to its status as a major manufacturing hub, Vietnam’s trade surplus with the US was over USD 123 billion, prompting Trump to levy initial tariffs at a rate of 46% – one of the highest.

- Taiwan: Taiwan became the first to hold direct tariff talks with the US. Taiwan is a major semiconductor manufacturer and, despite claims over the weekend that certain electronics and semiconductors could be exempted from the tariffs, the US president rolled back on these claims on Monday with a post on Truth Social that warned nobody is “getting off the hook”.

- Israel: Benjamin Netanyahu has already met with President Trump and has vowed to completely eliminate the country’s trade deficit with the US. Israel was initially hit with a rate of 17%.

Meanwhile, talks between the EU and US have reportedly broken down, meaning the EU could be facing higher tariffs imminently.

EU, Australia Inadvertently Reap Benefits

Not only have global stock markets been shaken as the trade war rumbles on, but several industries have been paralysed. The S&P 500 tanked by about 12% between “Liberation Day” and April 8 before the pause was announced on April 9 and a recovery was seen. As a result, pension values tumbled and there was a huge sell-off of US government bonds – which is now benefitting German debt.

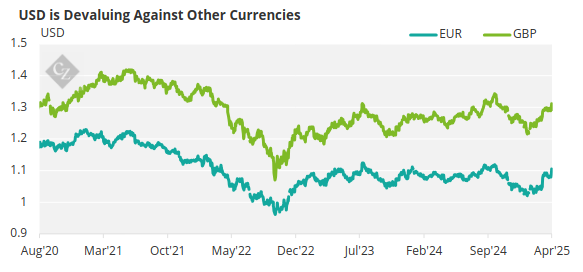

With the US rapidly losing its status as a safe haven, more and more economists are beginning to speculate over a rapid increase in de-dollarisation. Mark Sobel, a former US Treasury official told the Guardian that there has been greater use of the Canadian and Australian dollars, as well as in the Swiss franc and Japanese yen.

The euro would be the obvious contender to take over from the US dollar with about 20% of global foreign exchange reserves – in second place to the US, which holds about 60%. The Chinese yuan is unlikely to gain much ground, said Sobel.

Source: St Louis Fed

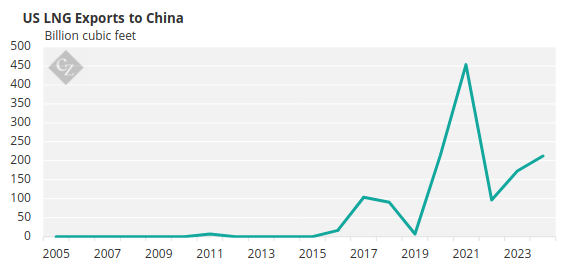

Another casualty seems to be US LNG. China – which imports over 4 million tonnes of US LNG annually – placed an immediate halt on all LNG imports from the US, causing chaos in the industry. In the past five years, Chinese LNG imports from the US have surged.

Source: EIA

An analysis by John Menadue, former Secretary of the Department of the Prime Minister and Cabinet of Australia, suggests that Australia could step in to fill the gaps as a Chinese supplier – and the stray cargoes caught in the crossfire could be rerouted to Europe, which has been left vulnerable by the Russia-Ukraine war.

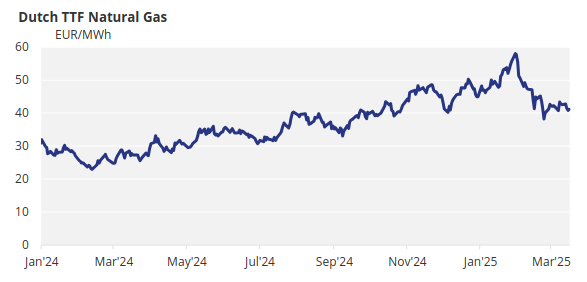

This might be good news for European farmers, who have struggled for the past few years with extremely high energy prices.

But this is decidedly bad news for US farmers, who are already feeling the pressure. Heavy rainfall in Texas has caused huge damage to crops such as cotton, sorghum and corn. These farmers also rely on immigrant workers for labour – and they have stopped showing up for work amid the Trump administration crackdown via Immigration and Customs Enforcement (ICE).

Brazil Winning Soybean War

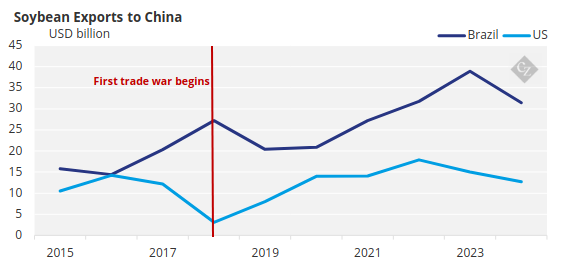

In fact, as the US tariffs continue to be absorbed, one of the biggest losers is likely to be the US agricultural sector. Already competing with Brazil on grains exports, the tariffs into major grains buyer China effectively prices the US out of the market.

The US has been losing ground as the world’s breadbasket for decades. It accounted for about 60% of all global exports in the early 2000s and has now gone to 31%. As for Brazil, it has grown from a 5% share to a 22% share of global exports in the same period.

Brazil is expected to break its record this year in shipments to China as a bumper crop is forecasted. However, Chinese buyers have struggled with quality issues recently due to flooding in the Rio Grande and logistics delays due to congestion.

China Launches Food Security Plan

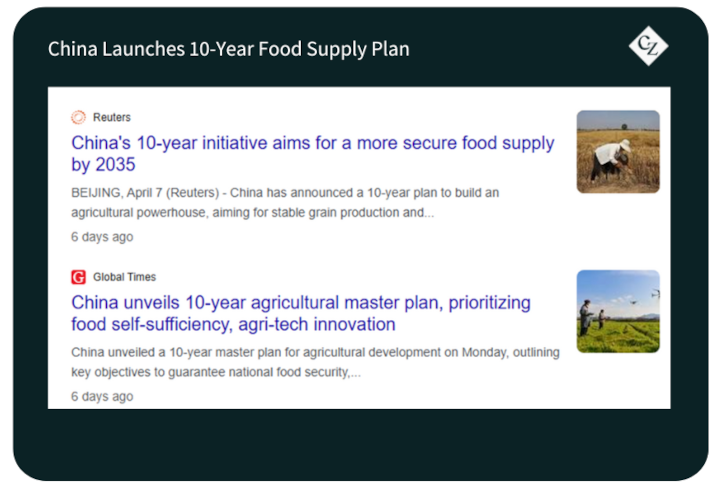

China is known for its determination to guarantee national food security. Not only is it the largest global stockholder of certain grains such as wheat, but it also regularly rolls out policies aimed at encouraging domestic food production.

Last week, Beijing unveiled a 10-year plan aimed at modernising agriculture and increasing output. One of the most ambitious strategies is to significantly ramp up the production of grains by 2027.

This announcement, combined with the US tariff war, pushed up several notable Chinese agricultural stocks. Beijing Dabeinong Technology, a biotech firm that produces seed and feed, pork producer Wens Foodstuff and animal feed company Wellhope Foods all rose last week.

Shipping Industry Impacts

The sale of CK Hutchison Holdings’ Panama Canal assets is at risk after the Chinese government became involved – potentially in response to the ongoing trade war. CK Hutchison agreed to sell 90% of its interest in the Panama Ports Company, which includes the ports of Balboa and Cristobal to global investment company BlackRock and MSC’s port operating arm Terminal Investment Limited (TiL) for USD 2.8 billion.

The ownership of the Panama Canal has become increasingly political since the entry into office of President Trump, who has been vocal about “taking back control” of the strategic waterway.

And now, Panama’s Attorney-General has opened an investigation into the contract renewal that took place in 2021. The AG’s office said it will file lawsuits against the government officials who authorised the contract and said it could be revoked if irregularities were found, jeopardising the entire sale.

And from Panama to Poland, a strategic Baltic grains port has been caught up in the uncertainty. CK Hutchison also owns Gydnia Container Terminal – one of the 40 assets included in the BlackRock sale agreement. Beijing’s objection to the deal could cause it to collapse.

Shipping Feels the Strain

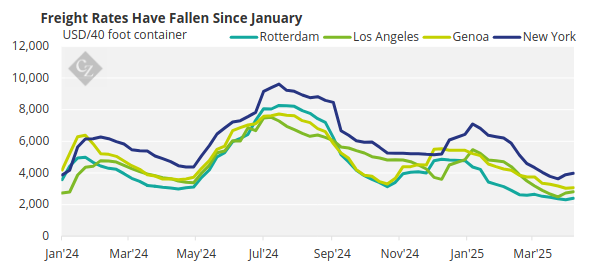

Amid such huge uncertainty, global shipping has all but ground to a halt. According to container data analysis firm Vizion, US import bookings plunged 20% between January and March in anticipation of the tariffs. In addition, bookings dropped by a further 64% for the week of April 1-8 compared with the March 24-31 period.

Global TEUs booked were down 49% in the period, while overall US exports slumped 30%.

Source: Drewry

In Other News…

- US ports are bracing themselves for tariff impacts. According to Reuters, Los Angeles and Long Beach – on the US pacific coast – are the most exposed to the tariffs since they are the most convenient entry port for Chinese goods.

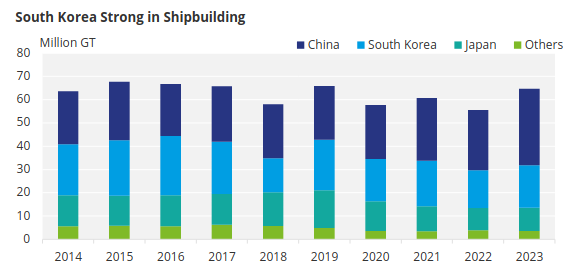

- US sanctions on Chinese ships could prove to be a boost for South Korea. According to UNCTAD data, South Korea is the second largest shipbuilder – and its products now have the competitive edge.

Source: UNCTAD

- In a long-awaited move for shippers, the IMO has agreed on global carbon pricing. The policy will be formally adopted in October. Details of the agreement can be found here.