Insight Focus

The US election may reshape soybean markets. Uncertain tariffs and biofuel policies leave US agriculture vulnerable. Key decisions could drastically shift global demand.

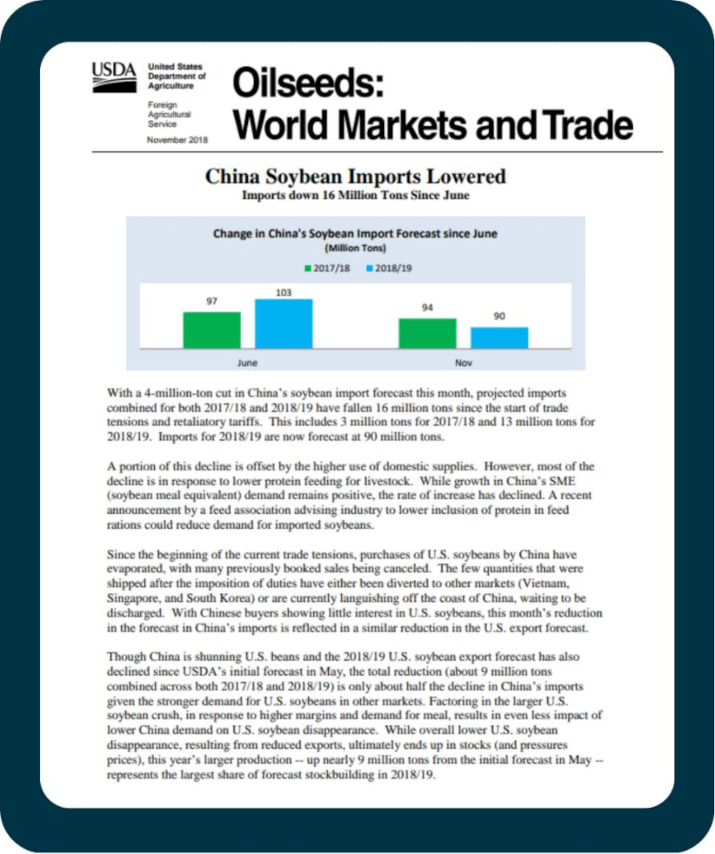

I started to highlight some of the USDA’s text from its November 2018 Oilseeds: World Markets and Trade to emphasise certain key points for the reader and then decided against it. Every word counts in the author’s opening paragraphs. The writer succinctly captures the look and feel of the global and US soybean market during the Chinese embargo of US imports.

Could those same words from 2018 foreshadow the next phase for today’s domestic and global soybean markets, given the outcome of last week’s US presidential election?

The Road Ahead for US Soybean Markets

The die is cast, the election is over, appointments for senior cabinet positions continue, undersecretaries are being named, and we in the agricultural space (specifically our company, White River Nutrition and our peers in the US soybean processing industry) await the finalisation of the Trump team’s tariff policy.

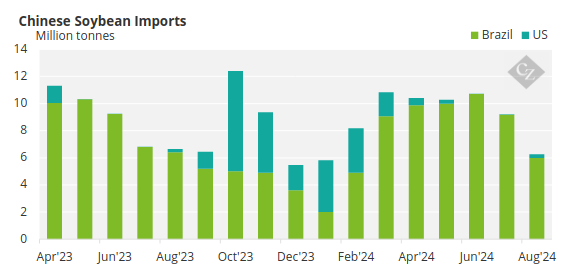

The Chinese gave the US soybean grower a taste of embargo earlier this summer with unusually limited, nearly zero, purchases of new crop US soybeans, maybe as a potential warning for policy makers in the Trump campaign? Or was the mini-embargo part of a larger commitment to an October BRICS summit so China could tout its greater reliance on Brazil for soybean origination at the expense of US origination?

Source: UN Comtrade

Or maybe it was a bearish perspective on soybean prices given an excellent US growing season that unfortunately finished with significant drought that clipped the top edge off a projected record yield and production?

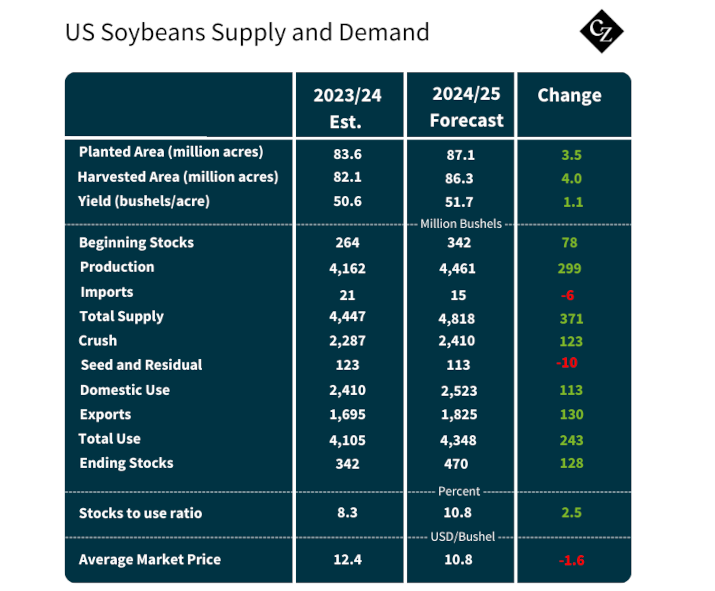

Whatever the reason for the mini embargo, it is now over, and the Chinese are making up for lost time with outsized purchases of US soybeans for nearby shipment (while continuing to buy Brazilian soybeans at the same time). The table below details the USDA’s November World Agricultural Supply and Demand Estimate (WASDE) soybean report, which reduced yields from the record.

Source: USDA

So, what to do while a new administration ascends to power in early January with a potential focus on penalising the Chinese trade imbalance with the US via tariffs? Wait. For what? For the Trump Administration to finalise the tariff policy for Chinese products and successfully apply it, and for the Chinese to respond in kind.

It is then that we in the US soybean warehousing, exporting and processing industries will discover if the past, as detailed in the above USDA November 2018 report, is prologue to the future, or instead if history will, as Mark Twain suggested, rhyme with the past but not repeat exactly.

Key Developments to Watch in the Soybean Market

While we wait, we spend the time considering other significant “soybean” issues. Given that the USDA has effectively provided its final view of the global soybean and soy product supply and demand balance for the 2024/25 crop year via the November WASDE (does anyone actually read the USDA’s December WASDE reports?) and will not seriously update forecasts again until the major early January reports, we have time to consider other potential market-moving developments. In order of importance, they are:

- Final policy decisions on US biofuels (45Z and 40A for the pros) especially in light of a new administration. This administration is widely regarded to view biofuel’s policy with a jaundiced eye. There is also the potential for an unwinding of the Biden administration’s Inflation Reduction Act.

- Indonesian palm oil production and advancing biofuels policy.

- Weekly details on US soybean oil export sales (analysts continue to underestimate the robust sales).

- Brazilian growing conditions (recently much improved) and evolving biofuels policy.

- Argentine growing weather (dry-ish to start the growing season but not a concern).

- Daily glimpses into the expanded BRICS alliance’s potential success, with China leading 2024 members toward economic interdependence that could bolster the Brazilian/Chinese soybean pipeline at the expense of US exports.

- The US dollar’s stability at current values.

- Global conflicts that cannot seem to animate the petroleum markets potentially suddenly animating them.

- US corn demand and the price relationship between corn and soybean meal and the potential for much higher inclusion rates of soybean meal into animal diets.

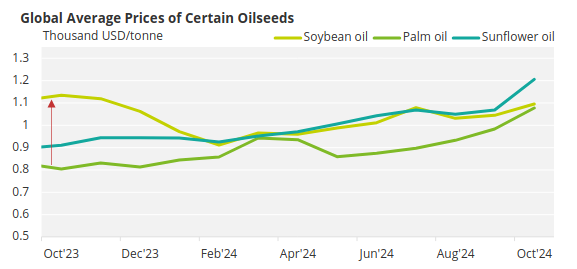

It is said that a picture paints a thousand words and this one is a beauty in that regard: study it closely and consider it in thirds. The below chart from this month’s USDA Oilseeds: World Markets and Trade captures:

- The market’s expansive interpretation of US biofuels policy in regard to renewable diesel production that set off a once in a lifetime bull market in US soybean oil prices. This led them to structurally break the historic relationship to other global vegetable oils.

- The subsequent collapse (mean reversion) in US values relative to other vegetable oil, including used cooking oil (not featured) as the US renewable diesel industry began to source primarily Chinese feedstocks at the expense of US soybean oil production.

- The current palm bull market that has palm prices now trading at a significant premium to soybean oil (a highly unusual move).

Volatility? How about two once-in-a-lifetime type moves in a singular one-year chart!

Source: World Bank

Biofuels and Trade Dynamics

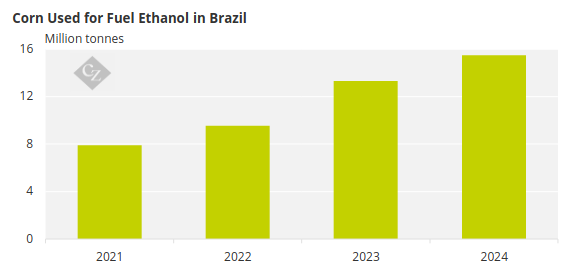

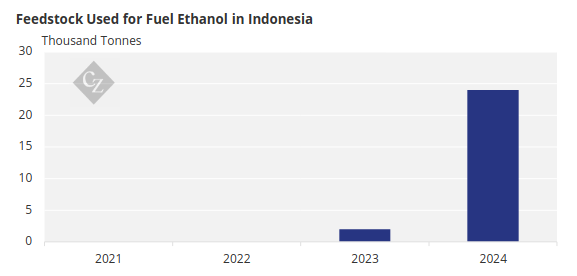

While US policymakers, politicians, and the citizens who vote for them struggle to solidify US biofuels policy, other countries with leading agricultural production are advancing with predictable policies. The use of corn (ethanol) and soybeans (biodiesel and renewable diesel) for road and aviation fuel would allow industry to move forward with CAPEX projects to support an expansive biofuels policy.

Both Brazil, the world’s largest soybean producer, and Indonesia, the world’s largest vegetable oil producer, continue to promote higher blends of agricultural feedstocks in their road fuels through legislation.

Source: USDA

Source: USDA

This expanding demand is starting to have a meaningful impact on global trade flows and prices, with Indonesian palm oil prices and US soybean oil export sales both surging.

This leads to the following questions:

Could the Trump administration target not only China for import tariffs but, in an effort to support US farmers and the farm states that backed his candidacy, also target the entire BRICS organization, now closely aligned with China and under its influence? This raises the question: should the US distinguish between China and the other BRICS members when it comes to tariffs?

Could import tariffs, which have primarily focused on industrial goods, now also apply to Chinese used cooking oils, Brazilian ethanol and Argentine biodiesel—products that have continued to flow freely into US markets, displacing US farmers and agricultural processors?

Could a targeted BRICS agricultural tariff policy from the Trump administration lead to a significant increase in the use of US-grown feedstocks (corn and soybean oil) for biofuels, replacing foreign supplies for renewable diesel now subject to Trump-imposed tariffs?

Could the Trump team see value in penalising California’s deliberate preference for foreign agricultural fuel and biofuel feedstocks at the expense of Midwestern farmers’ economic success and the region’s agro-industrial job growth. Remember, the first Trump administration attempted to challenge California’s fuel policy autonomy.

My answer is the same for all four questions: I don’t know. Could a targeted BRICS agricultural tariff regime make US agriculture great again in short order? Yes – the impact to demand for domestic corn and soybeans would be YUGE!

Next steps: Wait and see.