Insight Focus

President-elect Trump has proposed tariffs on Mexican goods to the US. This might include sugar. A 25% tariff would make Mexican sugar unviable in the US.

New Taxes on Mexican Sugar Arrivals into the US?

Shortly after the election, American President-elect Trump suggested that he would seek to apply a 25% tariff on all goods entering the US from Canada and Mexico once he’s inaugurated in January 2025.

There are no further details, but in theory “all goods” includes sugar which currently trades duty-free between Mexico and the US under the Suspension Agreement of the USMCA.

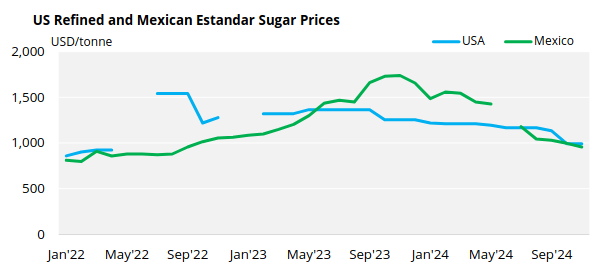

The proposed tariff would probably stop all flows of Mexican sugar to the US. Already in recent weeks prices in the two markets have converged.

- Mexican Estandar sugar prices today are close to USD 1,000/tonne.

- American (Midwest) refined sugar prices today are around USD 990/tonne.

Whereas in September there was a USD 270 differential between the two products, which accounted for transport costs, processing and packaging, today there is none. Increasing the price of Mexican sugar by 25% would make the margin even more negative, making the trade unviable.

Negotiation Ploy or Serious Threat?

There are several possible outcomes.

The most likely is that the full tariff isn’t applied. Trump has made the announcement two months ahead of his inauguration and loves the art of the deal. The Mexican government and incoming US Administration have two months to thrash out a deal in private before Trump becomes President. Perhaps enough concessions on border security and opioid flows will be made to reduce the scale of the tariff, or to reduce its scope so it doesn’t include sugar.

Most people in the USMCA sugar market believe at this stage that nothing will happen as it’ll be adverse for both countries’ sugar industries. However, we don’t like this argument as it suggests that President-elect Trump will place economics over political leverage.

US Sugar Market Scenarios

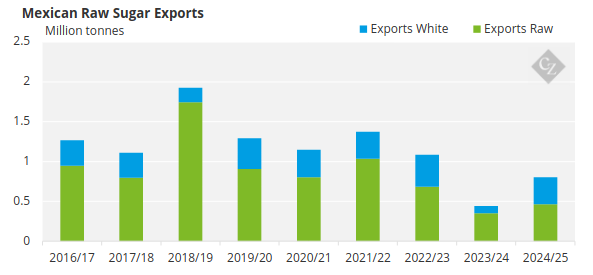

If the full 25% duty is applied to sugar, the US sugar market will face an unexpected sugar shortfall each year. In 2022/23, Mexico exported around 1 million tonnes of sugar to the US market. In 2023/24, it was a little less than 500,000 tonnes.

US sugar prices would probably rise, at the very least to a level at which duty-paid sugar imports become viable. After all, refiners would want to make new sales based on duty-paid sugar imports given the increase to their feedstock costs!

The US market is quite used to supply via duty-paid sugar arrivals; around 1 million tonnes of sugar entered the country duty-paid in 2023/24. The USDA would also presumably need to expand the duty-free raw sugar tariff rate quota, with countries like Brazil, Australia and Guatemala benefitting.

We question whether Trump would want a Lula Administration to be a major winner of the 2025 Trade War – the question extends beyond sugar and into other commodities like corn and soy.

Mexican Sugar Market Scenarios

Meanwhile, the Mexican sugar industry would have excess sugar to handle. This would risk depressing local prices.

An obvious retaliatory measure would be for the Mexican government to put tariffs on corn syrup imports from the US. This could increase domestic sugar consumption, notably among the soft drinks industry.

But regardless, Mexico would have increased world market sugar availability and would need to look to export quickly. In overall terms, the increase in Mexican availability would largely offset the decrease in world market sugar availability from US TRQ quota holders like Brazil and Australia. However, the timing, quality and ease of exports from Mexico would be very different.