Insight Focus

PTA and PET Futures tumbled before the Tomb Sweeping holiday close on Thursday. Further sharp declines are expected as crude oil prices fell sharply Friday. Asian PET resin export prices are expected to follow suit, potentially testing 12-month lows.

PTA Futures and Forward Curve

PTA Futures were down across the board last week, as crude and upstream prices tumbled, with the main May contract falling by nearly 2%. With markets closed Friday due to Tomb Sweeping holiday, Chinese futures failed to capture further declines in the commodity markets.

Having reached above USD 74/bbl in recent weeks, Brent crude oil tumbled below USD 67/bbl on Friday in the aftermath of new US trade tariffs. OPEC+ has also decided to increase production more than initially planned, adding further downward pressure on prices.

In response, Goldman Sachs cut its oil price forecast for 2025 by 5.5% with an average of USD 69/bbl this year, and USD 62/bbl in 2026.

By Thursday, the PX-N CFR average weekly spread widened by just a few USD/tonne. The PTA-PX CFR spread narrowed to average of USD 76/tonne last week, down USD 3/tonne on the previous week.

Although PTA inventories remain high, warehouses receipts are gradually easing from their recent peak volume. Coupled with a fresh slate of PTA shutdowns in April, the market looks to be moving towards inventory reduction, supported by high polyester operating rates.

The PTA forward curve is now in flux, and relatively flat beyond May’25. With the near-term drop in pricing, the May’25 contract held a RMB 42/tonne premium over the current month’s contract. Sept’25 has just a RMB 16/tonne premium over May’25.

MEG Futures and Forward Curve

Main month MEG futures contracts were also down by Thursday’s close for the Tomb Sweeping holiday, albeit it not as sharply as PTA. Main May’25 contract dropped 0.3%, further declines are expected.

East China main port inventories increased by 1.7% to around 711,000 tonnes with only a slight variation in arrival and offtake rates.

Although high polyester production continues to support MEG demand, the downstream textile industry is likely to be impact by the US latest tariffs, resulting in more cautious buying by traders.

Increased scheduled maintenance in April has helped alleviate supply pressure but demand concerns are expected to weigh on market sentiment going forward.

The MEG futures forward curve remains flat, the May’25 contract at a RMB 44/tonne discount over the current month. Sept’25 contract is at a RMB 63/tonne premium over May’25.

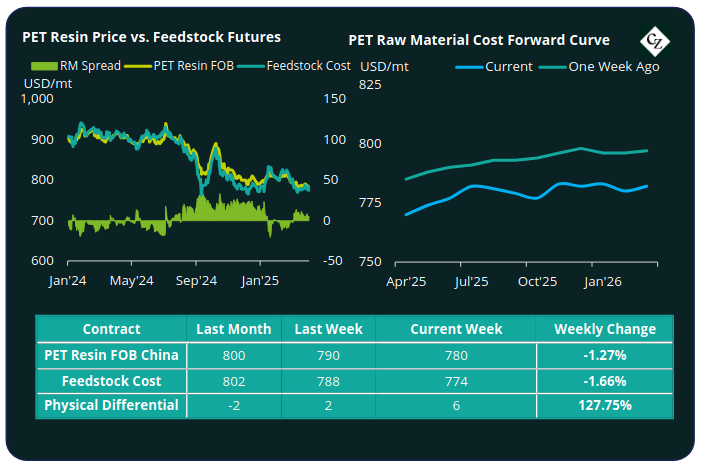

PET Resin Export – Raw Material Spread and Forward Curve

Chinese PET resin export prices fell to an average of USD 780/tonne FOB China by Friday, down USD 10/tonne on the previous week. Further downside is to be expected if weakness in crude and upstream prices persists.

The average weekly PET resin physical differential against raw material future costs softened to a weekly average of positive USD 4-5/tonne last week, down less than USD 1/tonne. By Friday, the daily differential was positive USD 6/tonne.

The raw material cost forward curve remains flat, with May’25 at just USD 4/tonne premium over the current month, and Sept’25 holding just a USD 5/tonne premium over May’25.

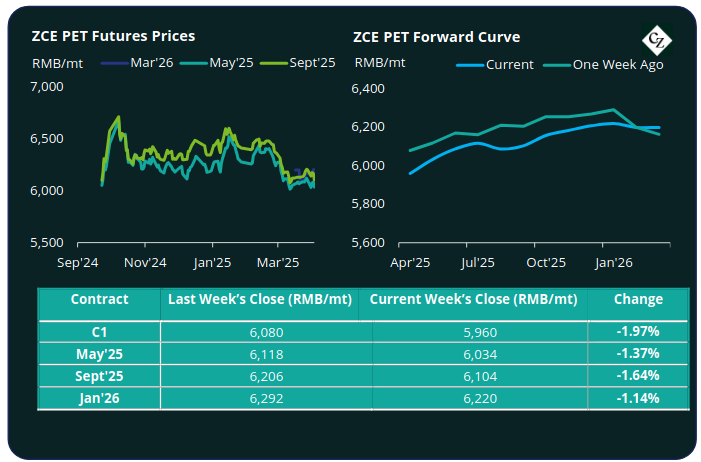

PET Resin Futures and Forward Curve

PET Resin Futures also fell sharply with main contract months down between 1.4% and 2%.

May’25, the current main month with the highest liquidity, fell 1.37% to RMB 6,034/tonne (USD 830/tonne), down around USD 10/tonne from last Friday.

The average weekly premium of the May’25 PET Futures over May’25 Raw Material Futures decreased to USD 16/tonne, down USD 4/tonne. By Thursday, the daily premium was USD 19/tonne.

The PET resin futures forward curve kept relatively unchanged in shape. Sept’25 held a RMB 70/tonne (USD 9/tonne) premium over May’25.

Concluding Thoughts

Despite the PET resin market fundamentals remaining steady, supported by improving seasonal demand and a gradual recovery in domestic bottle-grade PET resin operating rates, all eyes are on crude pricing once again.

With the Chinese exchanges close Friday due to Tomb Sweeping holiday and the wild swing downwards in crude on Friday, expect this week to be highly volatile.

Overall, Asian PET resin prices are expected to follow tumbling upstream costs with the current news cycle around US tariffs still developing.

Close attention should also be paid to changes in ocean freight rates. A downward correction in the global economic outlook and disruption in trade volume may help soften freight rates on certain lanes. However, carriers are ever adept at seizing every opportunity to increase rates.

For PET hedging enquiries, please contact the risk management desk at MKirby@czarnikow.com.

For research and analysis questions, please get in touch with GLamb@czarnikow.com.