Insight Focus

Former US President Donald Trump has proposed a 10% tariff across all imported goods and a 60% tariff on goods imported from China. Given that the US and China are major trade partners, what will the implications of a second Trump presidency be?

US Ports on Alert

Former President of the US and Republican presidential nominee Donald Trump recently proposed a 10% tariff across all imported goods and an astronomical 60% tariff on goods imported from China while on his campaign trail.

Gene Seroka, Executive Director of the Port of Los Angeles (POLA), the busiest container port in the U.S., addressed this issue during a recent media briefing. He noted that, should these tariffs be implemented, POLA will seek to diversify its business portfolio geographically, as it did following Trump’s previous tariff actions in the spring of 2018.

At the end of 2022, 57% of POLA’s business was tied to China. By the end of 2023, this share had dropped to 53%, and by mid-2024, it had decreased to the low-to-mid 40s. “That means that we picked up traction in Southeast and South Asian nations, and we’ve done more for cross-border activity in and out of Mexico and the manufacturing and retail communities there,” said Seroka. “We’ll continue to do just that.”

Like the port of Los Angeles, many North American ports could also experience a shift in their sources as shippers diversify away from China, looking to countries in South and Southeast Asia, Mexico and Central America.

Shippers’ React to Proposed Tariffs

Shipping analysts predict that if Trump wins the election, there will be a significant surge in demand as companies will rush to import long-life inputs and goods from countries affected by tariffs, particularly China. Some market specialists, however, believe that US importers have already begun increasing their volumes due to fears of Trump’s tariffs.

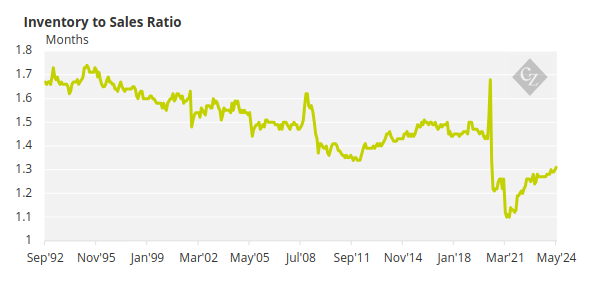

According to data from the St. Louis Fed, US retailer inventories have climbed significantly since the lows of 2021.

Source: St Louis Fed

Although the November elections are still months away, the possibility of a Trump victory is prompting some sectors to pre-ship goods to avoid any future tariffs, according to Matt Priest, President and CEO of Footwear Distributors and Retailers of America.

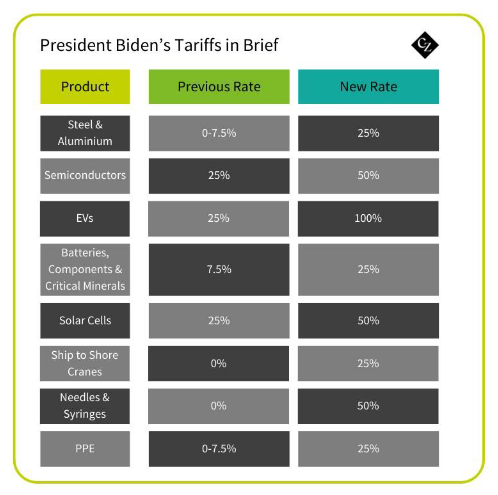

Even the actions of the current administration are influencing import volumes. Priest noted that after President Joe Biden announced tariffs on certain imported goods in May, including a 100% tariff on electric vehicles from China, importers have increased activity to get ahead of these tariffs.

American importers and exporters are looking to bring in products earlier to avoid tariffs and mitigate geopolitical risks. They also aim to ensure they do not face a space crunch, claimed Gene Seroka during the POLA media briefing.

Trump’s Tariff Strategy in Question

Alan Wolff, former Deputy Director-General at the World Trade Organization (WTO) and current fellow at the Peterson Institute for International Economics, commented on the proposed tariffs, stating that this “indiscriminate imposition of tariffs” would not merely constitute a trade war with China, but a war against trade itself.

“Unlike the Biden tariffs, the Trump plan is for increased tariffs on all products from all countries,” he said. “It is not just America First; it is America Alone.”

There are question marks over whether the proposed tariffs are arbitrary. “Why 10%? Why all countries?” wondered the former WTO official. “There is no other reasonable explanation than that Trump considers all trade to be ‘unfair’ in some respect, or at least disadvantageous.”

The lack of clarity surrounding Trump’s rationale over imposing the tariffs raises the risk that there are more protectionist policies to come, which could create a knock-on effect for other economies. “Many uncertainties surround Trump’s proposals,” said Wolff.