Insight Focus

The annual statement made no mention of the carbon market, despite expectation for UK ETS reforms. The government later confirmed UK CBAM will start in 2027.

The annual autumn budget statement from the new Chancellor, Rachel Reeves, brought no news of potential reforms to the UK ETS despite sustained optimism in some quarters that changes to the market might be trailed in the annual update.

Drax Coal Fired Power Station in UK

UK Sets 2027 Start for CBAM

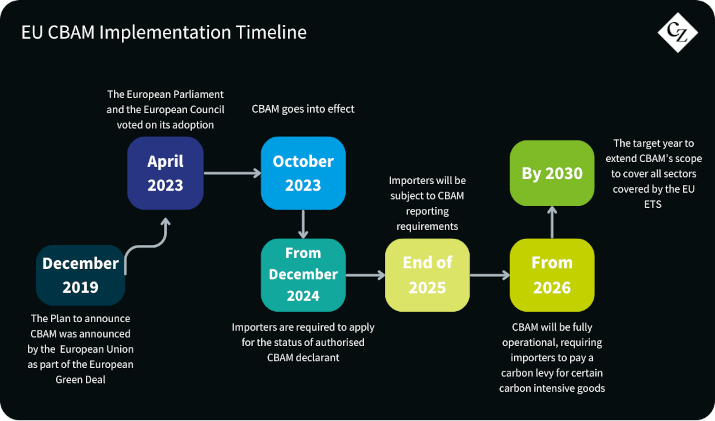

Shortly after the budget statement, the government published its response to a public consultation on the introduction of a Carbon Border Adjustment Mechanism, which it said will take effect in 2027.

The launch of Britain’s carbon border charge will come one year after the EU’s own CBAM starts its compliance phase. Brussels has been collecting data from EU importers for two years and is developing the processes for compliance in time for a 2026 launch.

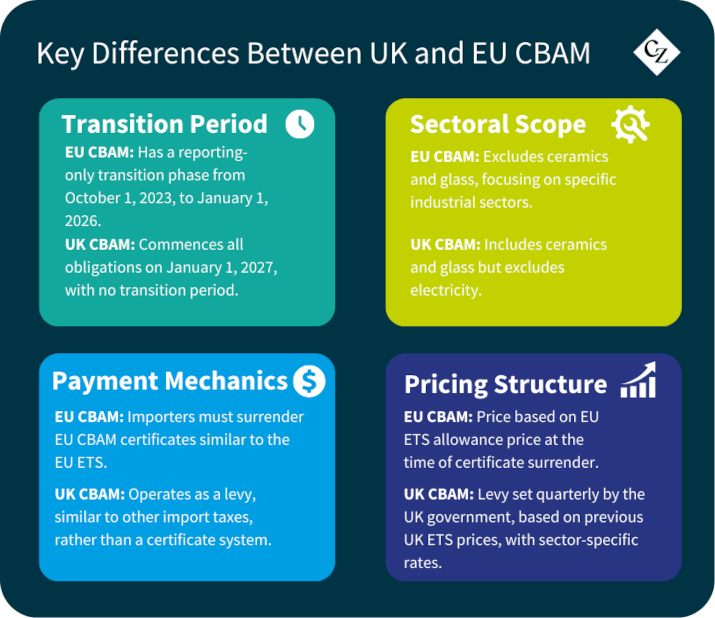

The UK’s CBAM will initially apply to imports of aluminium, cement, fertiliser, hydrogen, iron and steel, which are all covered by the UK ETS, are energy-intensive and subject to carbon leakage. The government’s response indicated that its CBAM will also apply to indirect and certain precursor product emissions.

Importers will be required to purchase and surrender UK CBAM certificates equivalent to the calculated carbon content of their imported materials.

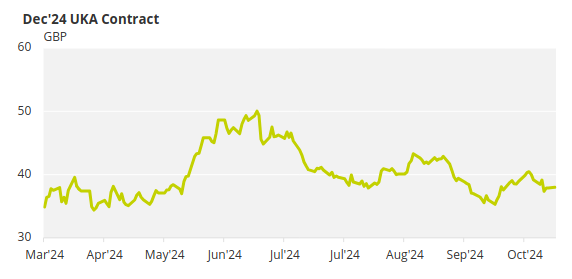

These certificates will be priced according to the average UKA auction price in the preceding quarter, with an adjustment to the price made to account for the free allocation of UKAs to domestic producers, as well as the GBP 18/tonne Carbon Price Support that is charged to power generators and passed through to industrial consumers.

Along with the start of CBAM, domestic producers in the same industrial sectors will begin to receive fewer free UKAs each year, ensuring that a “level playing field” between UK and foreign manufacturers is maintained.

The 2027 start date of the CBAM also means that the government will delay the adjustment of the UK ETS market parameters which had been scheduled to take effect from 2026. This will allow the synchronising of changes to free allocation with the start of CBAM.

Market Interest in Supply Adjustment Mechanism

The previous Conservative government had carried out consultations on numerous potential changes to the market, including expanding the scope of the cap-and-trade system to include the waste sector, integrating greenhouse gas removals into the market, and implementing a supply adjustment mechanism analogous to the EU’s Market Stability Reserve (MSR).

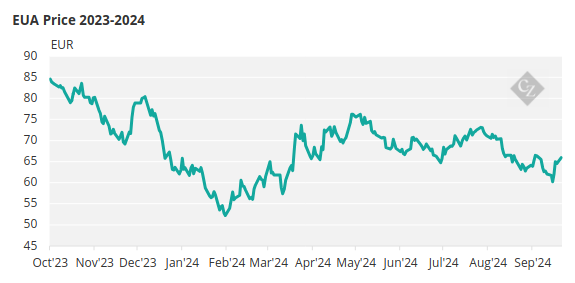

Of these, the potential addition of a supply adjustment mechanism (SAM) has generated most comment among market participants, who believe it could trigger a steep recovery in prices that at one point in 2023 fell to as little as 46% of the value of EUAs.

Source: ICE

According to the previous government’s consultation document, the SAM would be triggered by fluctuations in supply of allowances rather than price. This follows the EU’s method, which aims to maintain market supply within a well-defined channel.

When supply exceeds the upper threshold of the channel, the SAM would withhold allowances from the market, most likely by reducing the volume of UK Allowances being sold at auction for a period of time. Similarly, when supply falls below the lower threshold, the SAM would inject additional supply into UKA auctions.

The EU ETS introduced its MSR in 2018, and the system began operation in 2019. EUA prices began to rise almost as soon as the launch of the system was announced, climbing from single-digit prices in 2017 to nearly EUR 30/tonne in 2019, as speculative traders anticipated the tightening of supply.

The UK government has yet to publish its response to the SAM consultation, which will give a preview of the likely parameters the mechanism takes.