Insight Focus

UKA prices fell last week after having rallied more than 60% since January. Investment funds now hold the largest ever long position. Bullishness about a new Labour government subsided as markets understood talks to link UK and EU carbon markets could take years.

UKA Rally Loses Steam

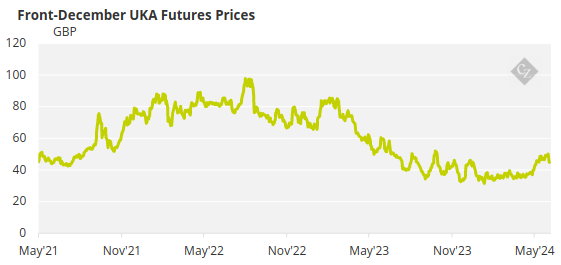

UK Allowance (UKA) prices plunged by as much as 11% last week as traders offloaded long positions. The market reached a key psychological level amid speculation that an incoming Labour government might speed up moves to reform the UK ETS and link it to the EU’s carbon market.

UKA futures for December delivery rose to an eight-month high of GBP 50.45 on Wednesday as investment funds boosted their long positioning to the highest level in the market’s 36-month history.

But the rally failed to consolidate, and the rest of the week saw sustained selling in high volume, as prices tumbled to end the week at GBP 44.82.

The decline in prices stemmed from growing concern that proposed reforms to the UK ETS were taking too long to formulate. In addition, policy decisions by the government suggested it was backing away from ambitious climate goals.

Specs Bet on Labour Government

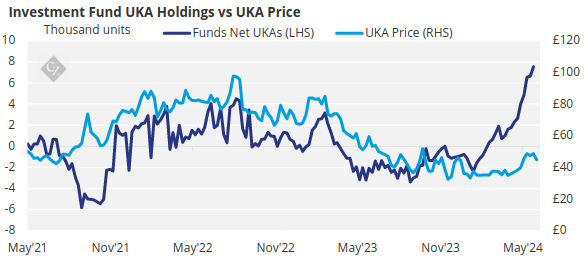

Prices fell to an all-time low of GBP 31.30 at the end of January on the back of steady selling. At the start of February, investment funds held a net short position of 2.4 million tonnes.

As the spring unwound, the political focus began to shift towards the improving prospects of the opposition Labour party and was sent into high gear by the May 22 announcement of the poll date.

Data from the ICE Futures Europe exchange show investment funds’ long UKA positions rising from 3.1 million tonnes on February 2 to a maximum of 9.3 million on May 17.

Over the same period, investors’ short positions dropped from 5.1 million tonnes to 1.1 million tonnes.

Source: ICE

The shift to net long positioning reflected increasing optimism that an incoming Labour government would seek to link the UK market to its European neighbour, in an effort to shield industrial and power companies from the impact of the EU’s Carbon Border Adjustment Mechanism.

Market Links Will Be Longer Term

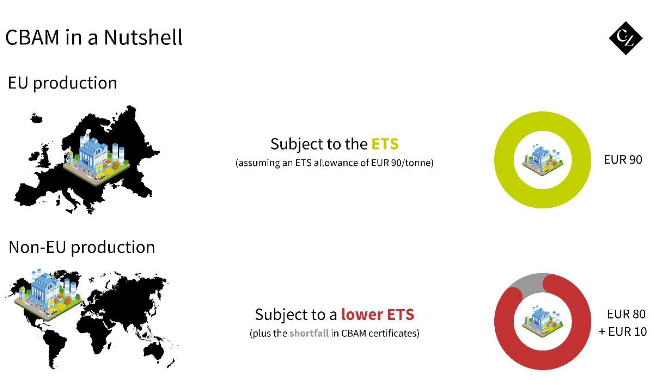

CBAM will penalise imports of carbon-intensive goods from outside the EU by making them pay the equivalent of the EU ETS carbon price to cover the carbon dioxide emissions embedded in their manufacture. Countries whose carbon prices are lower than the EU’s will be required to make up the difference in cost.

This widening view was reflected in reports by the Financial Times that Labour intends to align the UK ETS with the EU’s ETS and CBAM once the party is in government.

However, carbon market analysts have pointed out that any linking of the two markets will be fraught with difficulty, since the two markets have been on diverging courses since the UK set up its system in early 2021.

The EU ETS’ introduction of CBAM and the gradual phasing out of free allocation to many participating installations, as well as the extension of the market to include maritime emissions have widened the scope of the European market — changes the UK ETS is yet to match.

The current Conservative government has completed consultations on similar reforms but is yet to propose any legislation to upgrade the UK ETS.

In order for the two markets to operate in sync and for the obligation to pay CBAM charges to be removed, the two markets must adopt matching goals. In addition, the main parameters of allocation and the overall cap will need to be closely aligned, so that allowance prices are similar.

Britain’s market is about 10% the size of the EU ETS both in terms of the number of covered installations and total emissions. It presently covers most of the same industrial sectors but is yet to expand the scope to cover maritime emissions, which came under EU ETS rules this year.

The European market has already linked to the much smaller Swiss market (in 2020, after 10 years of negotiations), while an initiative to connect the EU market to a planned Australian ETS was abandoned in 2014 after the Australian government cancelled its plans to launch a cap-and-trade system.