Insight Focus

UKA prices are already down 12% year-to-date and nearing record lows on continuing policy uncertainty. EUAs have jumped 25% in a month amid speculator-fuelled rally. Some traders see profit in UKA-EUA spread to come.

UKA Prices on Decline

UK carbon allowance prices have slumped at the start of 2025, with the benchmark December 2025 futures price for UKAs settling at its second ever lowest level on January 17, as market participants appear to have lost confidence that the government intends to pursue reforms to the UK ETS in the short term.

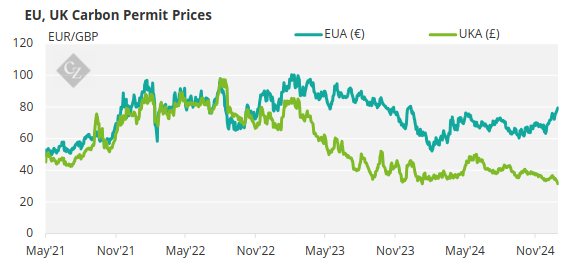

The UK ETS started in 2021, and prices climbed swiftly in sync with rising EU allowances, reaching a record high of GBP 99/tonne in August 2022.

This early strength in the UK market was widely attributed to compliance entities swapping their previous holdings of EUAs – accumulated while the UK was still part of the EU market – for new UK Allowances. The demand for UKAs to replace those EU permits kept UKAs at a premium to EUAs for the first 18 months of the market’s history.

But once the UKA-for-EUA swap was exhausted, the market began to focus on fundamentals, and from early 2023 UKA prices started to fall much faster than their EU counterpart, reaching a record low of GBP 31.30 at the start of 2024.

Source: ICE

UKA Surplus Sparks Market Uncertainty

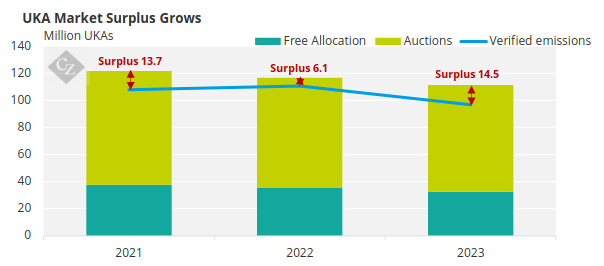

By this time, the previous Conservative government had seen the need to introduce a supply management tool to tackle a growing surplus of UKAs, which built up almost from the start of the market.

Government data show that in each of the first three years of the market, covered installations surrendered fewer UKAs than had been handed out, accumulating a market surplus totalling more than 34 million UKAs – or a third of a year’s covered emissions – by 2023.

Source: GOV.UK

In December 2023, the UK ETS Authority announced a public consultation into measures to reform the market, including a cap adjustment and the introduction of a Supply Adjustment Mechanism (SAM) analogous to the EU ETS’ Market Stability Reserve.

This consultation concluded in March 2024, and since then there has been no regulatory proposal to introduce a SAM. To be clear, there have been several smaller, technical proposals dealing with free allocation of UKAs and an extension of the market’s first phase by one year to 2026, but the high-level policy decisions on what the market cap will be after then, and whether the market will adopt a SAM, remain unknown.

After last year’s general election, optimism grew amongst market stakeholders that the incoming Labour government would move swiftly to propose changes to the market parameters, and indeed there have been several consultations launched, again on technical matters.

The initial optimism led to a rally in UKA prices, with the front-December contract climbing from its early-year low of GBP 31.30 to as high as GBP 50.45 in June 2024.

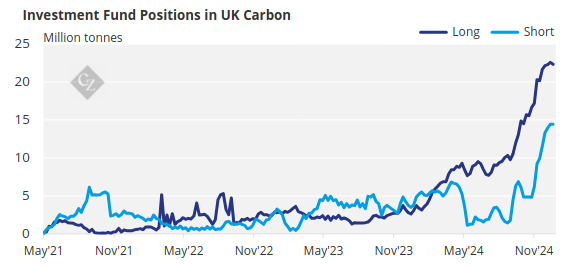

This period of optimism was characterised by a gradual reduction in speculative investors’ short positions in UKAs – investment funds cut their total short holdings to 1.3 million tonnes from as much as 6.6 million in June.

More recently however, funds have shifted into boosting both their long and short holdings. As the chart below shows, funds now hold their largest ever positions on both sides.

Source: ICE

This may reflect both an aggressive shorting of UKAs as short-term policy optimism fades, but a more bullish long-term outlook – with market players believing that policy changes will, eventually, come forth.

The slump in UKA prices has also piqued the interest of EUA traders, who have begun to explore the possibility of buying the UKA-EUA spread.

EU carbon has soared by 25% since the middle of December, largely seen as a speculator-driven rally helped by a volatile and uncertain natural gas market. Meanwhile, UKAs have fallen 12% since the start of this year alone.

Many traders are now starting to see profit in the spread trade as both markets are increasingly viewed as reaching the limits of their recent trends.