Insight Focus

The UKA discount to EUA has narrowed to a 10-month low. Investment funds now hold their largest net long on record. The UK and EU will meet mid-May to discuss linking their carbon markets.

UK Carbon Prices Rebound

UK carbon prices have enjoyed a steady recovery over the last three months as market participants are increasingly betting that the UK and EU will link their two emissions trading systems.

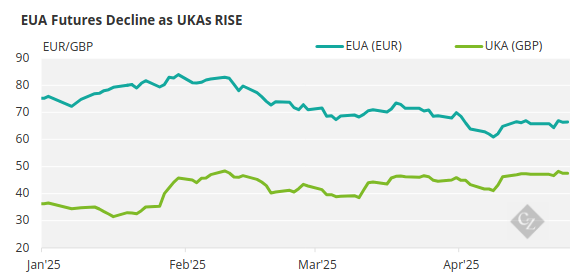

Since reaching a record low of GBP 31.10/tonne in January, December 2025 UK Allowance (UKA) futures have rallied to as high as GBP 49.00/tonne, a recovery of 58%. For comparison, EU Allowance (EUA) prices have fallen 17% from EUR 80.50/tonne to EUR 67/tonne over the same period.

Source: ICE

The growing speculation that the two markets are likely to be joined stems chiefly from the clause in the Trade and Cooperation Agreement, signed in 2020 – before the UK ETS was launched – that committed the two parties to “giving serious consideration to linking their respective carbon pricing systems in a way that preserves the integrity of these systems and provides for the possibility to increase their effectiveness.”

UK Carbon Price Journey

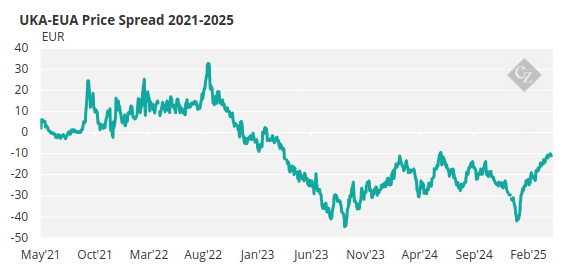

UKA prices reached their high watermark in the summer of 2022, as demand from UK-based power and industrial companies to swap EUAs for UKAs reached its peak. The two markets maintained a close link, with UKAs pricing slightly above EUAs due to the strong demand.

But once the demand to exchange EU for UK allowances was exhausted, and in the absence of any meaningful discussion of the linking question, UKA prices embarked on a steady decline that eventually reached the low GBP 30s/tonne in late 2023.

The decline reflected both the loss of that initial “swap” demand, but also a growing perception that the market was oversupplied with UKAs. Data from the government showed that in its first three years of operation, the market had a surplus of supply over demand of 34.4 million UKAs.

During this period, UKA prices fell steeply and increased their discount to the EUA price to more than EUR 40/tonne in 2023.

Source: ICE

The election campaign of summer 2023 and the subsequent installation of a new Labour government triggered renewed optimism among carbon traders that the government would make meaningful reforms to the market. This triggered a brief recovery in UKA prices from the low GBP 30s/tonne to as high as GBP 50/tonne in mid-June 2024.

In its final year of office, the previous conservative administration had launched a number of public consultations relating to potential changes to the market, and the incoming Labour regime has issued several more, but there have as yet been no formal proposals to tighten market supply.

As 2024 wound to a close, futures prices again sagged back to the low GBP 30s and in January hit their all-time low of GBP 31.10/tonne.

But shortly after that, the first in a series of news articles and public statements appeared to suggest that the current government is serious about pursuing a policy of linking the UK and European markets. Articles in both the mainstream and trade press have relayed government officials saying that linking is on the agenda for both the UK and EU governments, and that it will be discussed at a summit meeting in May.

The discount of UKAs to EUA prices, which had moved between EUR 10 and EUR 40 over the course of 2024, has started to shrink and has now risen back to EUR 10, driven by steady growth in speculative positions.

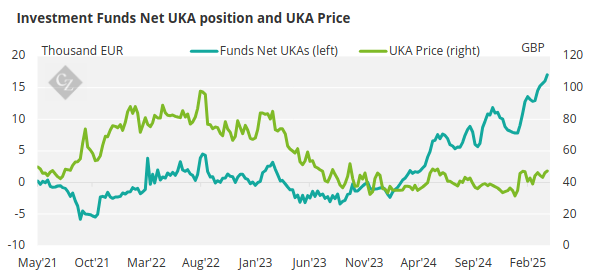

Data from ICE Futures Europe showed that as of April 17, investment funds held a net long position in UKAs of 17 million tonnes — the most ever. Traders also highlight that fund positioning represents about a third of the total market open interest.

Source: ICE

Uncertainty Grows Ahead of UK-EU Carbon Summit

With just under three weeks until the UK-EU summit, the market is focusing more than ever on headlines and statements, and some stakeholders have expressed concern that there is so much speculative money invested in UKAs.

A disappointing or inconclusive outcome to the meeting on May 19 may lead to a steep sell-off, while any agreement to develop a linking proposal may only be the start of a multi-year process.

The two emissions trading systems are developing in different directions, and the UK would likely need to make some significant adjustments to its plans for reform in order to bring its market closer into line with Europe’s. This likely explains the delay in making any formal proposals.