Insight Focus

UKA prices have jumped from GBP 31.10 to as high as GBP 47 in less than two weeks. Trading has been buoyed by reports that market linking will be on agenda in spring EU-UK summit. EU market took 10 years to complete link with Swiss ETS.

UK Carbon Prices Soar

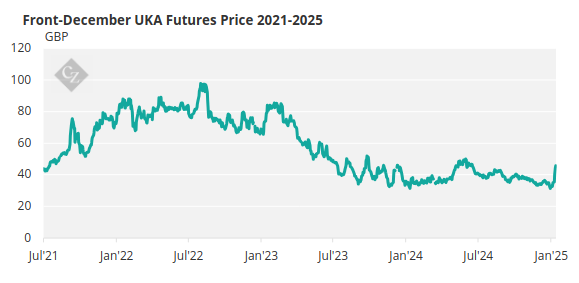

UK carbon prices have leaped 48% in just two weeks after falling to a record low, as speculators have rushed to build long positions amid mounting speculation that the government is set to discuss linking the British and EU carbon markets.

December 2025 UKA futures had been falling steadily after touching a 2024 high of GBP 50.45/tonne in June that reflected optimism that the incoming Labour government would move swiftly to reform the British cap-and-trade system, and open talks with the EU on linking the two systems.

But as the autumn progressed with no sign of policy decisions – other than consultations on technical changes to the market’s operation – traders began to lose confidence that changes would be tabled in the short term.

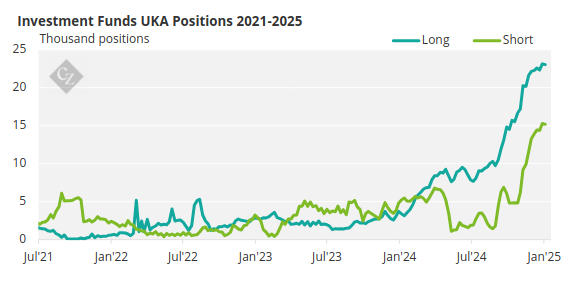

Investment funds remained optimistic, however, and commitment of traders (COT) data show that speculative players continued to amass large long positions in UKA futures, as the chart below shows.

Yet while funds were building a record long position in UK Allowances, they were also positioning themselves for further losses. Both total long and total short positions reached record highs at the same time in the week ending January 17, one business day before UKAs reached a new record low of GBP 31.10/tonne.

The new low generated a small bounce that kept prices in the low- to mid-GBP 30s/tonne, until on January 28, an article in the Financial Times reported that UK prime minister Sir Keir Starmer had asked to discuss UK-EU ETS linking at a summit scheduled for March or April.

This revival of the linking narrative sparked a massive rally in UKA prices which is continuing as February starts. The benchmark UKA futures price soared by 13% on January 28, and followed with further gains which added up to a 48% rally – or more than GBP 15/tonne – in the nine trading sessions since the record low was reached.

On Friday the main futures contract settled at GBP 45.81/tonne.

Consequences of Linking Markets

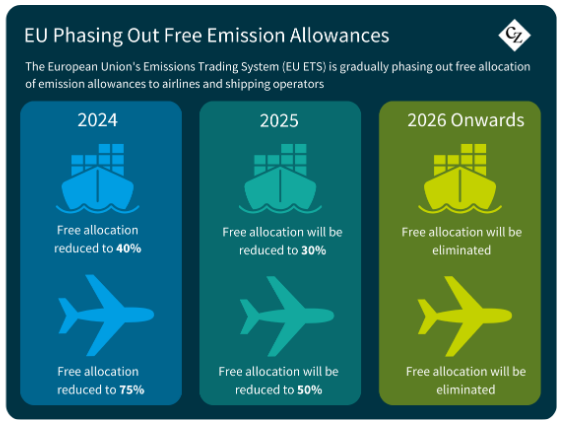

Linking the two markets would likely require the UK to reshape its carbon market to adopt similar parameters and institutions as the EU system – including introducing a supply balancing mechanism to maintain tightness in supply, as well as covering the same industrial sectors with similar emissions reduction goals.

Adopting similar parameters would also drive prices closer together as the two markets reflected similar goals and supply/demand fundamentals, and it is this prospect that has made UKAs such an attractive trade in the last two weeks.

Some European traders have suggested that UKAs might be benefiting from a spread trade that buys UKAs and sells EUAs – which are seen as heavily overbought. The spread between the two futures contracts reached nearly EUR 42 on January 17 and has been narrowing sharply since then, to end the month of January at just under EUR 30.

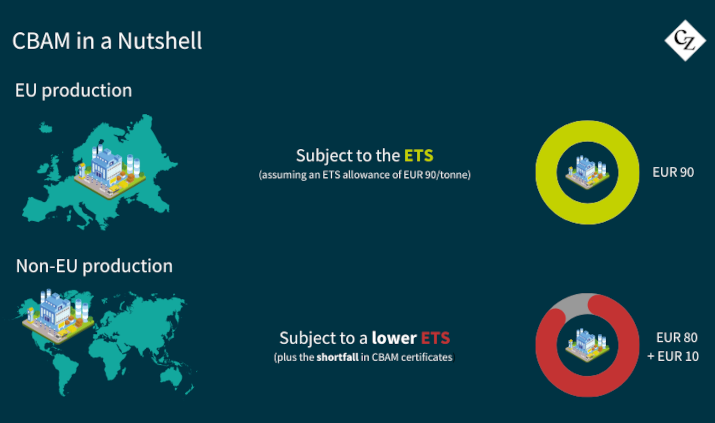

One other significant benefit of linking would be to exempt UK exporters from the EU’s Carbon Border Adjustment Mechanism, which requires imports from third party countries to pay a similar carbon price for emissions generated in the production of selected imported goods.

While the European Commission has not yet elaborated how it will assess third-country carbon pricing systems, it would be safe to assume that a linked market, operating with closely aligned parameters, would be exempted from any CBAM charges.

But the process of linking markets would likely take several years to carry out. Not only would regulations in the smaller UK market need to be adjusted to closely follow those of the EU ETS, but political decisions regarding governance and legal jurisdiction would need to be taken.

There is a precedent for market linking: in 2020 the Swiss ETS was formally linked to the EU market, allowing companies in either system to buy and surrender permits from both ETS mechanisms for compliance with their national obligations.

Negotiations took nearly a decade to complete, though it’s likely that a UK-EU agreement would be much quicker, since both parties have cooperated in emissions pricing before.

Some cautious voices have pointed out that since the UK ETS launched in 2021, the two systems have been developing in different ways and adopting different goals, which will require considerable work to bring together.