Insight Focus

- UK carbon prices have fallen by more than 15% this year.

- They now trade at a discount to EU emission allowances.

- Industrial output has declined in the last 24 months.

UK carbon prices have fallen by more than 15% in 2023 and the current benchmark December 2023 futures contract now stands at around £60/tonne, compared to a year-to-date high of £85.55.

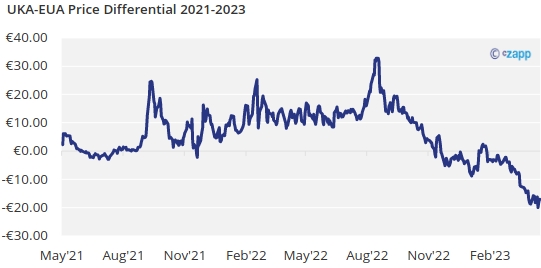

More relevantly, UK Allowance (UKA) prices have flipped from trading at a premium of as much as €32 to their European counterpart, the EU Emission Allowance (EUA) to a discount of as much as €20 this year.

Why have British carbon prices fallen so much in the last eight months?

The first major cause of the decline has been a drop in incremental demand for UKAs as British power plants have completed exchanging their historical inventory of EUAs for UKAs.

When the UK ETS launched in 2021, UK-based power generators and some industrials held a stock of EUAs purchased against future emissions. Since utilities sell much of their power generation up to three years in advance, this “hedging” represented a way to lock in the profit from future operations.

However, EUAs are not eligible under the UK ETS, and so covered installations needed to swap EUAs for UKAs. This demand for additional UKAs over and above regular annual requirements drove UKA prices to a high of £97.75 in August 2022,

This peak in UKA prices also coincided with the UK contract’s largest premium to EUAs – €32.77. From August onwards, the premium of UK allowance prices over EUAs went into decline, which culminated only last week with a discount of nearly €20.

The second cause of the UKA decline is a lack of regulatory clarity in the British market compared to Europe. Earlier this month the European Council put the final seal of approval on the “Fit for 55” initiative, a set of wide-ranging reforms of the EU ETS that will see the EU’s market take on a 62% emission reduction target for 2030, as part of the bloc’s economy-wide 55% goal.

The UK government is also in the process of developing a reform programme for its carbon market. An initial consultation was circulated in March 2022, detailing options on tightening the market cap by 30-35% over the 2021-2030 period, by cutting the number of allowances to be made available to the market from 2024.

The consultation also sought views on including waste incineration installations in the system, allowing carbon removals into the market and whether or not the UK should introduce a carbon border adjustment mechanism along the lines of the EU’s recently-approved mechanism.

However, with their exception of some announced changes relating to aviation and some proposed changes to data rules, there has been no response yet to this consultation. Market participants have talked of a growing “policy gap” between the UK and EU markets, explaining that the delay in announcing reforms leaves the UK market with a growing surplus that is depressing prices, while EU prices have held up much better amid the prospect of further tightening of supply.

The third main factor is a growing surplus. With the UK market having launched in the middle of the Covid pandemic, and with industry more recently staggering under the impact of soaring energy costs, industrial output and power generation have declined over the past 24 months.

At its inception the UK ETS was judged to be balanced to short in terms of market balance, with the supply of allowances marginally able to meet the combination of annual demand as well as demand to swap previously-purchased EUAs for UK allowances.

However, the downturn in industrial activity due to the pandemic, followed by Russia’s invasion of Ukraine and the impact on energy prices, both caused a sharp reduction in demand for UKAs, effectively turning the tight market into an oversupplied one.

The UK regulator has yet to release official data on verified emissions from UK ETS installations in 2022, but in 2021 plants reported total emissions of 107 million tonnes, well below the 126 million permits that were issued to the market that year.

Data from the UK government show electricity supply from UK-based generators fell by 8% in January and February 2023 compared to a year earlier, while traders reported that imports from Europe, in particular from France, rose. Consumption of natural gas across the board in 2022 fell to its lowest annual level this century, government data also showed.

The drop in domestic generation from sources such as coal and gas, combined with increased imports, as well as the significant drop in industrial gas use has also weighed on demand for UKAs from all sectors.

While the market eagerly awaits news on potential reforms to the UK ETS, some experts are starting to emphasise that the UK economy’s fragile state may persuade the government to soft-pedal its reforms, for fear of increasing the cost burden on industry at a time of macroeconomic vulnerability.

Trevor Sikorski, head of carbon analysis at consultants Energy Aspects in London, noted “a rising risk that the UK government will water down some proposed changes to the UK ETS, whether by moderating the ambition of the cap or delaying the start date for changes to the cap.”

“We continue to expect UKAs to trade at a discount over the next few years due to comparatively looser fundamentals in the UK market than the EU market,” Sikorski wrote in a report this month.