Insight Focus

The UK proposes including domestic maritime emissions in the carbon market, covering vessels over 5,000 gross tonnes. It raises questions on the treatment of voyages to Northern Ireland. Additional consultations will address free allocation for closing plants and carbon removals.

UK Government Proposes Expanding UK ETS Coverage

The British government has launched a second public consultation on including domestic maritime emissions within the scope of the UK ETS and has indicated it will amend free allocation rules to claw back unused UKAs from plants that cease operating.

The consultation proposes to include emissions from domestic voyages carried out by vessels of more than 5,000 gross tonnes starting in 2026. Coverage would also include emissions generated while vessels are at berth and from port operations.

Source: GOV.UK

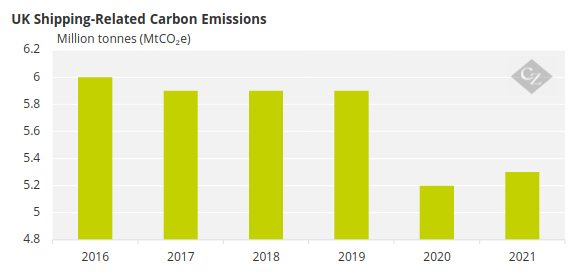

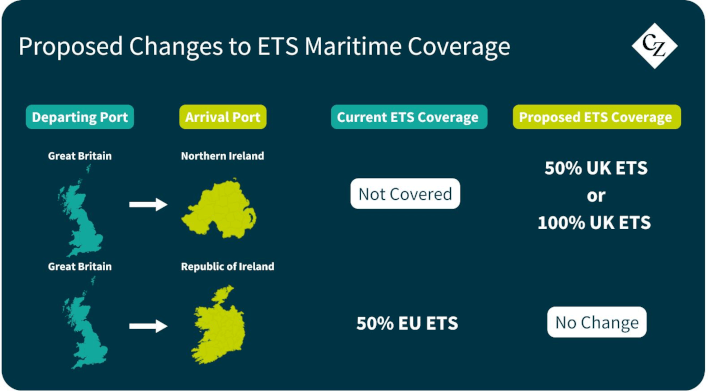

All eligible voyages would be required to surrender UKAs covering 100% of their emissions from covered voyages each year. The additional demand for UKAs would be accommodated by adding 2.4 million tonnes of UKAs to the market supply in each year between 2026 and 2030. Within the scope of this expansion, the government is considering how to treat ships sailing between Great Britain and Northern Ireland, since there is a risk of a “perverse incentive” to redirect ships to the Republic of Ireland. The document points out that voyages between the UK and the Republic of Ireland are already subject to the EU ETS rules, which require 50% of the emissions to be covered by EUA purchases.

Covering 100% of the emissions between Great Britain and Northern Ireland would create a discrepancy that would encourage vessels to sail to the Republic instead. The consultation also seeks views on whether voyages to and from Northern Ireland should therefore be subject to only 50% coverage under the UK ETS.

Broader Maritime Emissions Considerations

The government is also studying whether to expand its coverage of maritime emissions to cover 50% of emissions from voyages between the UK and European Economic Area ports.

This would match the scope of maritime emissions coverage under the EU ETS, which charges ships for 50% of their emissions for voyages to and from non-EEA ports.

The consultation also covers several other questions:

- Whether the UK ETS should cover methane and nitrous oxide emissions from maritime activities

- Potential exemptions for armed forces, border patrol, police, government research and coast guard vessels, as well as certain Scottish ferry services for remote island and peninsulas

- Point of regulation

- How to account for biofuels and sustainable fuels used

The government proposes to review the regulations in 2028 and would at that time consider whether to reduce the threshold for vessel coverage to 400 gross tonnes.

UK ETS Free Allocation and CO₂ Transport

Separately, the government has responded to an earlier consultation on rules governing the free allocation of UKAs to industrial plants in their final year of operation before permanent closure.

Under existing rules, a plant may dispose of any unused UKAs awarded to it for the full year. Now, the UK ETS Authority is proposing a change to the rules whereby “operators’ free allowance entitlement in the final year would be based on actual activity levels.”

Plant operators would be required to submit a report on total emissions in the final year of a plant’s operations, and its free allocation would be adjusted to reflect this. Any remaining unused UKAs would be required to be returned to the Authority.

Additionally, a separate consultation is calling for views on how to regulate “CO2 sent for permanent storage via non-pipeline transportation”.

Carbon removal is gaining momentum as a new technology to address climate change, and already a number of large consortia are advancing plans for large industrial projects to gather, transport and store CO2 in offshore reservoirs.

The EU and UK are separately drawing up rules that would allow companies to subtract CO2 stored permanently from their compliance obligations under the respective emissions trading systems.

However, “[UK] sites without direct pipeline connections will require non-pipeline transport (NPT) to access carbon capture and storage, sending CO2 by road, rail or ship,” the consultation explains. But “the UK ETS currently lacks a framework for operators to deduct CO2 transported to storage via such methods from their reportable emissions.”

The consultation covers CO2 transport by road, rail and ship and is seeking views on how to account for and regulate the storage of CO2 by these methods, including how to account for emissions made during transportation.