Opinions Focus

- Ukrainian exports in the final week of Sep were the largest since the export corridor began.

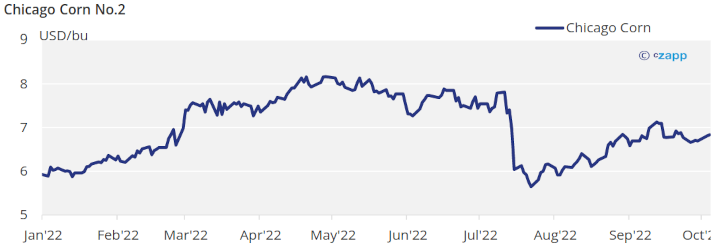

- Nevertheless the corn market has been flat in the last week.

- However, wheat has rallied.

Forecast

No changes to our average price forecast for the 22/23 (Sep/Aug) crop in a range of 5,8 to 6,3 USD/bu. The average price since Sep 1 is running at 6,8 USD/bu.

Market Commentary

Another flat week for Corn with mild gains in Euronext, and weekly rally for Wheat in both geographies. Negative macro sentiment combined with tensions in the Black Sea increasing were the major elements.

The week started negative for Corn due to favorable weather both in the US and Europe. By the end of the week we had the USDA quarterly stocks report which showed lower Corn stocks than expected causing a Friday rally which only helped to recover earlier loses and the week finally closed flat.

Quarterly stocks for the old crop were 1,38 bill bu lower than the 1,51 expected. The number was in any case 12% higher than last year. Planted and harvested area were marginally revised lower to 93,3 and 85,3 mill acres respectively vs. 93,4 and 85,4 of the Sep WASDE. We think this is immaterial to the market.

If we had problems of barge transportation in Europe a few weeks ago, is now the US with the Mississippi suffering from low water levels limiting barge loadings. This should result in basis in the Gulf increasing.

Quarterly stocks for the old crop were 1,38 bill bu lower than the 1,51 expected. The number was in any case 12% higher than last year. Planted and harvested area were marginally revised lower to 93,3 and 85,3 mill acres respectively vs. 93,4 and 85,4 of the Sep WASDE. We think this is immaterial to the market.

If we had problems of barge transportation in Europe a few weeks ago, is now the US with the Mississippi suffering from low water levels limiting barge loadings. This should result in basis in the Gulf increasing.

But despite this big crop Wheat rallied as farmers in Russia are eligible to be called for military action in Ukraine which together with Russia’s annexation of four Ukrainian regions increased fears of potential supply disruptions.

US winter Wheat is 31% planted in line with last year and the five year average. Wheat planting in Ukraine is 15% complete.

The USDA quarterly stocks report showed this year’s production is marginally higher than last year at 1,65 bill bu much lower than expected.

In the weather front the US Plains is expected to see some light rains and warm weather while the Corn belt is expected to see frost. Brazil is expected to continue receiving rains. And Europe is also expected to receive some rains together with freezing temperatures during the night but not enough to damage crops.

The Corn market continues to be tight with smaller crops both in the US and in Europe, and of course in Ukraine. Brazil is helping with a bigger crop but globally we have stock draw in Corn. Is not the case for Wheat which should see a stock build mainly thanks to a bumper Russian crop, but global trade flow is being disrupted due to the war in Ukraine. But the stock build in Wheat is smaller than the stock draw in Corn thus resulting in a stock draw combining both grains. If we add supply disruptions out of Ukraine and Russia, supply is simply tight.

We can continue to have some weather volatility in the short term, but overall we expect prices to remain supported.