- China has bought 300k tonnes white sugar from Pakistan.

- This sugar is expensive; $375/mt FOB, but might enter China duty-free.

- This might displace other origins from China, so is bearish for the world market.

Pakistan China Free Trade Agreement

- China has bought 300k tonnes white sugar from Pakistan.

- This sugar is expensive; $375/mt FOB, but might enter China duty-free.

- This might displace other origins from China, so is bearish for the world market.

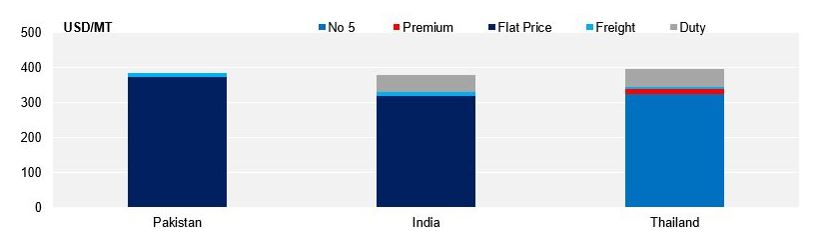

Pakistani Sugar Will Be Competitive on a Landed Basis

- 200k tonnes of this sugar will come from the state of Punjab and is being sold at $375/mt FOB.

- This is expensive given that containerised Thai refined sugar is currently offered at No.5 + $10, equivalent to $335/mt FOB today.

- And the zero duty doesn’t quite make Pakistani sugar the cheapest on a landed basis in China.

- We had previously expected Pakistan’s domestic surplus to be kept in-country seeing as the Imran Khan administration had ruled out offering further export subsidies.

- However, this sugar is now being shipped, which is negative for the world market.

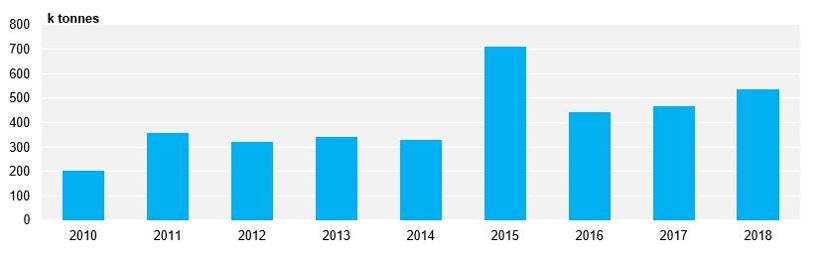

China’s Annual White Sugar Imports

Increased Demand?

- It is still unclear how much sugar China will import in 2019.

- We understand that Quota has been issued to refiners and state-owned enterprises, and we have seen raw sugar vessels nominated to China from Brazil in recent weeks.

- Cuban raws are also sailing to China under the usual 400k tonne annual government to government deal.

- However, refiners have not been allocated their 2019 out of quota import licences (AILs) yet.

- Part of the delay may be because Brazil has challenged Chinese administration of its sugar import programme at WTO, and a proper Chinese response to the challenge is due imminently.

- We expect China to award 1.5m tonnes AIL this year, giving a total of 2.9m tonnes sugar imports, including 2.45m tonnes raws imports and 468k tonnes legitimate whites imports in 2019.

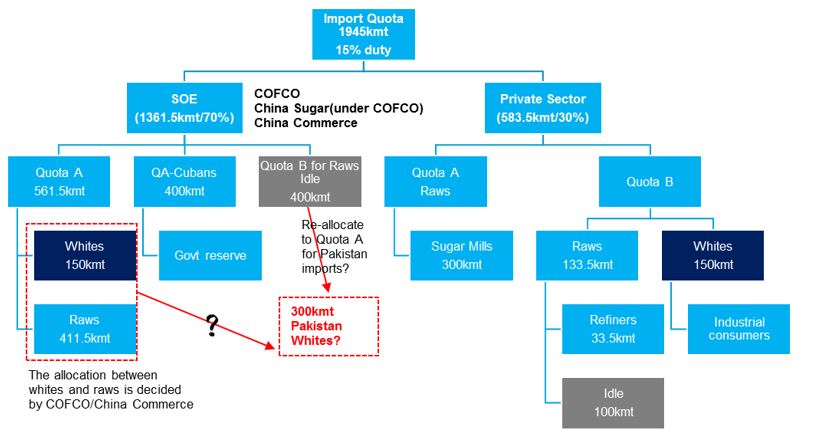

China’s Import Allocations

- However, we don’t yet know under which programme Pakistani sugars will enter.

- Will they be allocated as quota sugars? Or will a new government to government quota similar to that given to Cuba be created?

- Our instinct is that the total legal sugar import allocation will not be increased from the 2.9m tonnes above.

- Therefore, the sugars shipped to China from Pakistan will displace those from other world market origins such as Brazil.

- This is negative for the world market; it adds to the sugar oversupply.

The Politics: Protecting Chinese Interest in Pakistan

- We understand that the 300k tonne sugar quota was included in the latest iteration of the Pakistan China FTA in return for Pakistani government support to build a high speed train link between the two countries.

- Pakistan is on the verge of bankruptcy; a team from the International Monetary Fund is in Pakistan now to negotiate a bailout package.

- Restrictions were recently placed in luxury goods imports to try to stem the outflow of foreign exchange reserves.

- Pakistani Prime Minister Imran Khan recently reduced uptake of Chinese investments into domestic railway projects, saying Pakistan couldn’t afford Chinese loan repayments.

- Pakistan currently owes China more than USD 10b for infrastructure projects.

- The headline project thus far has been the development of Gwadar Port, which links China’s Belt and Road Programme with its Maritime Silk Road.

Development of Gwadar Port

- China has recently reduced the interest on loans linked to Gwadar to 0%; Pakistan now only needs to repay the principal.

- However, the true value of Gwadar can only really be unlocked if China can link the port to its own borders via road or rail, hence China’s interest in a high speed rail link to Pakistan.

- Both governments acknowledge that a high speed rail link is unlikely to be completed before 2030.

- The 300k sugar quota awarded to Pakistan could therefore be a multi-year incentive to ensure Chinese investments are preserved and continued.