479 words / 2.5 minute reading time

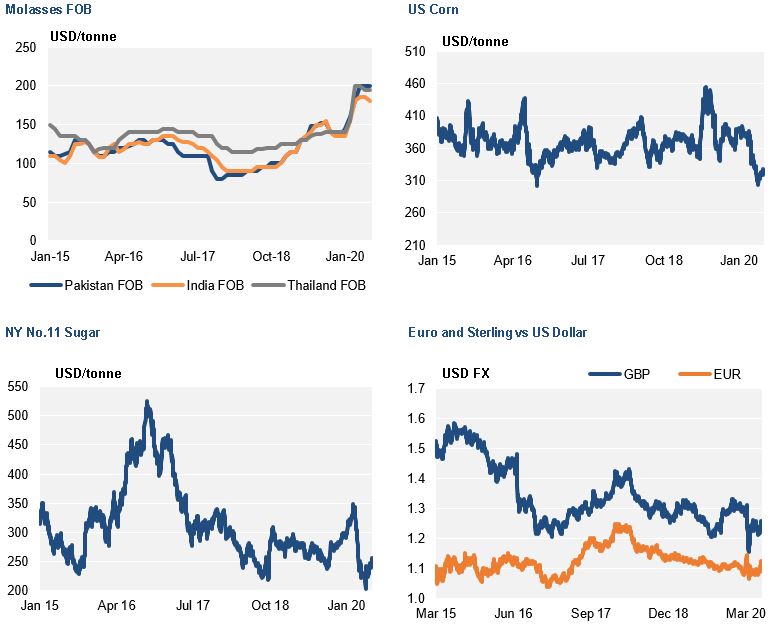

In our last note about the cane molasses market we noted that tight physical supplies are the dominant driver of higher prices. Over the last few months the relative low prices of sugar and ethanol and the spectacular crash in the crude oil price has further highlighted the exceptionalism of higher molasses prices. Despite the increase in the relative differential in prices it has not been sufficient to encourage further supplies of molasses onto the market.

There was undoubtedly a possibility that further molasses supply could be diverted from alternative markets such as ethanol to take advantage of relatively higher molasses values. Brazil was a prime candidate to potentially supply molasses on the world market, so far, we have not seen any cargo successfully exported.

Looking to the other main export potential with Southern Hemisphere crops, the Australian sugar crop is not going to be large enough to provide any additional cargoes outside of New Zealand and the US West Coast. Indonesia is on track to have over 400,000 mt of cane molasses for export and prices currently reflects the tight global market for cane molasses.

Northern Hemisphere crops are now fully off-crop and the main molasses export markets are generally sold out prior to new crop. We have seen the Thai cane molasses track back down towards the average global price level; it had increased to over $200 FOB which made it some of the most expensive molasses available for export.

Indian molasses discussions are now focused on the new crop and the monsoon season. Indian is starting off in a stronger position than last year, with reservoirs in Maharashtra closer to 50% capacity compared to 15% at this time last year.

The beet molasses markets in Europe will need to monitor the growing conditions closely over the next few months, we have experienced a very dry spring, the England has had its’ driest May in over 100 years. The EU has reduced the forecast for wheat and sugar beet yields, with the dry spring noted in France, Germany and Poland.

The forecasts for the US corn crop remain strong, however recent dry weather has been noted there but the planted area and level of production are at recent highs and it likely to be largest corn crop in over 30 years.

Summary The global molasses market continues to be characterised by tight short-term supply and despite the lower relative prices across competing commodities we have not seen any additional cane molasses encouraged into the export market. The Indian monsoon season is starting off on a stronger footing than last year which gives hope to recovery in sugar and molasses supply. European sugar beet markets will be watching the weather closely over the next few months with dry weather a concern.