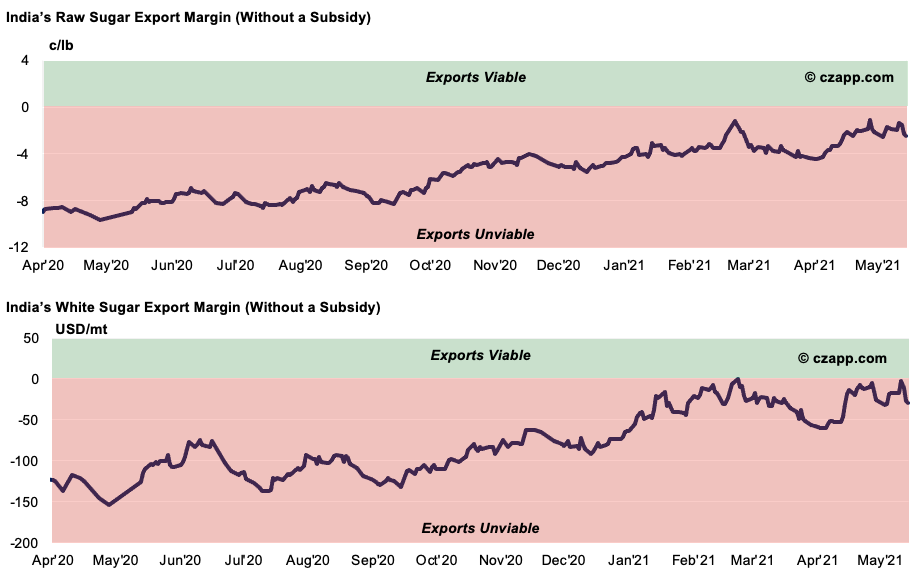

- India can now almost export sugar to without a subsidy.

- This follows recent world market sugar price strength.

- Exports become viable at close to 19 c/lb for raws and 480 USD/mt for whites.

Unsubsidized Sugar Exports for India?

- India will be able to export unsubsidised raws and whites if world market prices climb to 18.8 c/lb and 476 USD/mt respectively.

- Prices have been rallying and, at the time of writing, they’re each at 16.9 c/lb and 453 USD/mt, leaving just a small way to go.

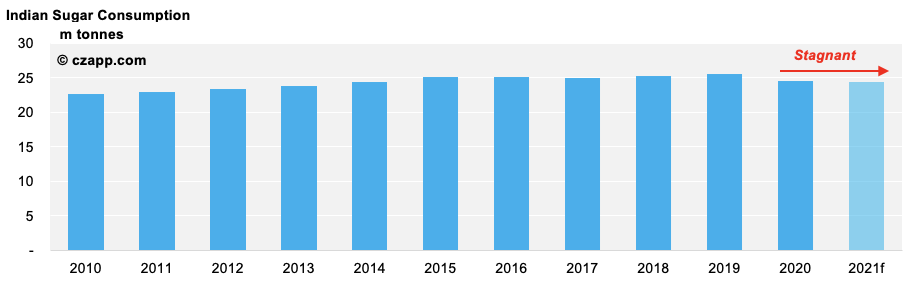

- These additional exports would help India as COVID hit sugar consumption in 2020 and it may not grow this year.

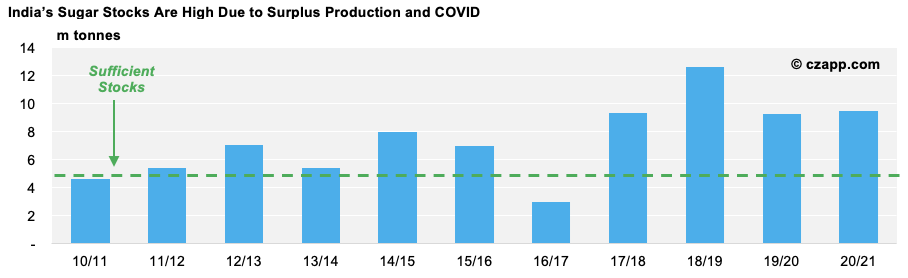

- The country’s stocks are high as a result, and it may be left with 9m tonnes of sugar at the end of the season; enough sugar for four months!

- In the past, having 4 to 5m tonnes of sugar left before the new season starts in October has been sufficient.

- Therefore, if unsubsidised exports become viable, we think India will export around 4m tonnes of sugar to ease its stocks.

What Will Unsubsidised Exports Mean for the World Market?

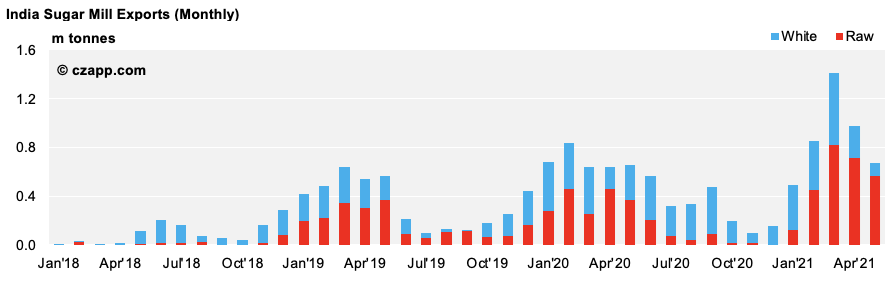

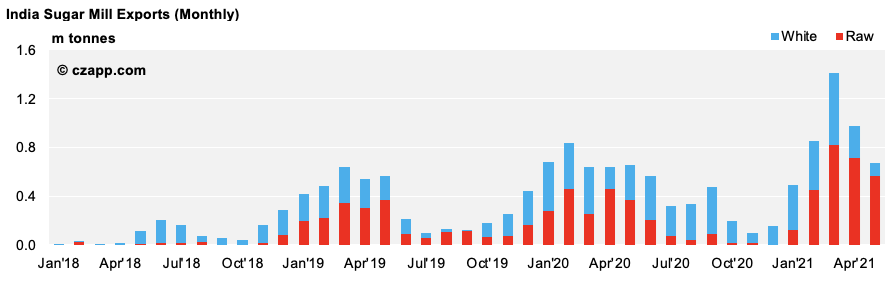

- To be clear, we don’t think India will export 10m tonnes of sugar this season; between October and April, it managed 4.2m tonnes.

- So, to export a further 4m tonnes by the end of September, it’d need to ship more than 1m tonnes of month, which seems unlikely.

- We’re therefore more likely to see this tonnage contracted through calendar year 2021, if it happens.

- The unsubsidised exports would predominantly consist of low-quality whites as the mills are no longer producing raws now the crushing season is almost over.

- Shipments will likely head to Central Asia and East Africa and shouldn’t change the market dynamics too drastically.

Other Opinions You Might Be Interested In…