Insight Focus

Urea prices have strengthened after India’s announcement of a new tender. Processed phosphate prices are expected to go up on the back of limited demand and longer CIQ processing times in China. Potash prices in the US are sliding with the rest of the world stable. Ammonia prices west of Suez increased this week on the back of production curtailments in both Egypt and Algeria.

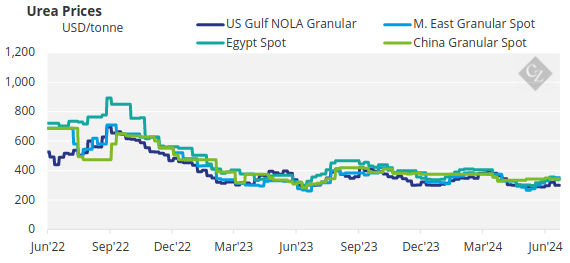

China Remains Out of Urea Market

The big news in the urea market this week was the announcement of a tender in India closing on July 8 for shipment by August 27. There was another shutdown of Egypt urea production due to gas issues.

Further, there is now confirmation that China will not enter the market any time soon. There may even be no urea exports from China for the rest of the year depending on pricing dynamics.

Despite supply limitations, overall demand is muted. European buyers are absent. Brazil is not willing to step up to any major buying yet although some parcels have been sold at around the USD 360/tonne CFR mark. Argentinian buyers are also taking a breather.

The key issue therefore will be how much India will buy for the months of July and August. If India secures around 1 million tonnes without the participation of China, it could send a signal that prices could well go down.

Current FOB levels in the Middle East are in the range of USD 330-350/tonne. Southeast Asian producers have been able to book tonnage at just above USD 350/tonne FOB. Indonesia is struggling to load and ship already concluded contracts due to bad weather at the load port in Bontang.

The outlook for prices is firm with India providing some much-needed demand for July/August. The lack of Chinese exports will help to bolster the price. North African values could also gain further ground as Egypt struggles to source gas supplies to operate.

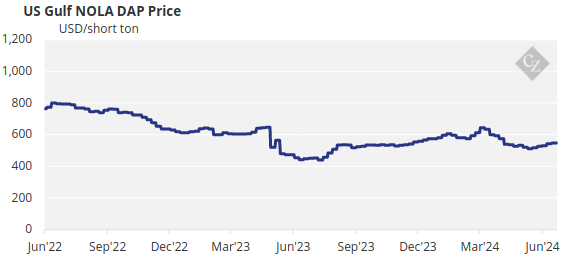

India, China in Processed Phosphate Standoff

There is a stalemate between India and China, with Indian buyers refusing to accept the higher processed phosphate FOB prices in China, which are now around the USD 540-550/tonne FOB levels. India bought a DAP cargo from Saudi Arabia at a reported price just sub USD 540/tonne CFR West Coast India, although both parties have yet to confirm the deal.

Indian DAP CFR prices have increased USD 30/tonne over the past few weeks. The issue is that India needs to buy DAP and Chinese exports are limited. There are reports that the export processing time (known as CIQ time) has been increased for some suppliers to 30 days from the 10 days previous. This could mean that shipments due in July would need to wait until August or even September. This would tighten the availability further of processed phosphates.

The MAP price in Brazil is assessed at USD 615/tonne CFR and it could be a ceiling price for now with crop prices going south.

Bangladesh will conduct its annual private import tender next week for DAP and TSP. It will be interesting to see how much is purchased and at what price.

Incitec Pivot of Australia sold a cargo of DAP to the US that appears to have a netback of around USD 545-550/tonne FOB Townsville. Freight to the US is estimated at around USD 45/tonne.

The outlook for the processed phosphate prices is strong on the back of limited supply with India most likely having to give in and pay up.

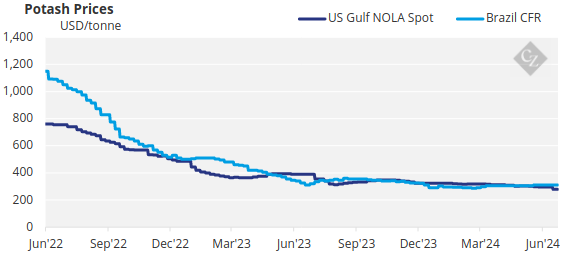

Russian Potash Pressures Market

The US stood out among global potash markets this week with prices sliding to their lowest since January 2021 as Russian volumes pressured values.

This week’s assessment of USD 270-280/short ton (USD 297-308/tonne) FOB is the lowest in close to three and a half years and prices are down 15% since the start of the year. NOLA potash rallied to a high of USD 812.50/short ton (USD 895/tonne) FOB in April 2022 after Russia’s full-scale invasion of Ukraine.

In Brazil, cargo arrivals are mounting up and products will start moving soon for the Safrinha season with values expected to remain broadly steady. This week, they remained stable at USD 310/tonne CFR.

Ample supply may restrict any price increases over the short term. Demand is not particularly strong, but it is steady when compared with phosphates and nitrogen. Brazil’s average assessed granular MOP prices have ranged between USD 308/tonne CFR and USD 313/tonne CFR for the past three months and they are unlikely to change much over the short term.

Demand in the market is steady due to good affordability, particularly relative to nitrogen and phosphates. Still, like in other markets, potash supply is more than sufficient. Southeast Asia is looking weak and the market there awaits direction from a contract settlement in India, which continues to elude all potash watchers. Europe is unchanged and out of season.

Potash prices are expected to remain stable to slightly soft as the market awaits the Indian potash contract. In Brazil, producers continue to push for higher levels, although upside remains limited. The US may remain under pressure from Russian supply.

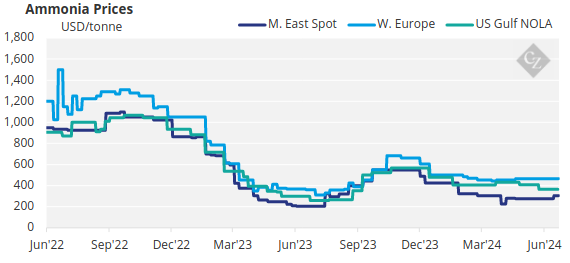

Ammonia Remains Fragmented

The ammonia market is awaiting the Tampa CFR settlement price for July. However, it is expected that the price will go up on the back of a recent sale out of Trinidad at a reported USD 15/tonne increase on the prior FOB level. Capacity curtailments in both Egypt and Algeria would also support a higher Tampa CFR contract price.

Countering this bullish sentiment is the distinct lack of demand from industrial buyers in the US, Europe and Northeast Asia. Seasonal factors indicate that this trend may continue.

The outlook for ammonia prices is assessed firmer in the West of Suez, reflecting the latest business transactions and deteriorating supply situation, but stable in the East of Suez on the better supply/demand balance.