Insight Focus

- Tour lowers rainfall-based expectations for region’s sugar crop.

- Weed control and less use of fertiliser hitting yields.

- Cane yields vary widely across the region.

When we finally had a chance to get out into Thailand’s sugarcane fields again, we found that the reality jarred with our expectations for next season’s crop.

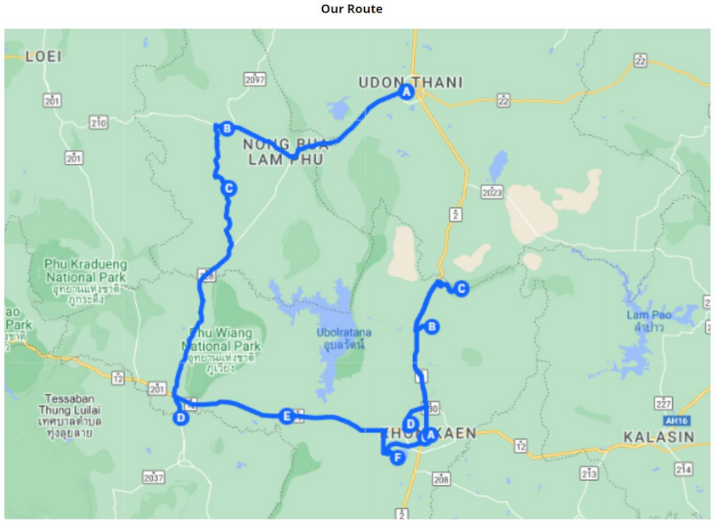

We toured the upper Northeast region. We drove more than 400 km over three days covering four provinces, Udon Thani, Nong Bua Lam Phu, Chaiyaphum, and Khon Kaen.

We were driving through heavy rain most of the time and barely able to see the road ahead, which should be good for the cane if not for our nerves. We were unable to reach some of the areas we were keen to visit because of the risk of becoming stuck in the middle of muddy cane field.

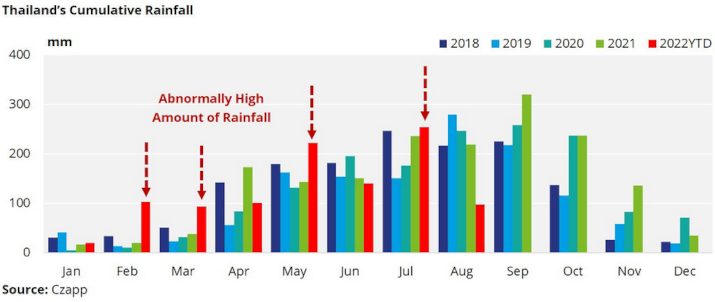

Before the trip we expected the agricultural yield to perform very well this year because of the high cumulative rainfall across Thailand, especially in the Nort east. So far, rainfall in Thailand at 1,031 mm (up 21.2% year on year).

However, the reality on ground was not as we had imagined.

The weed control is a major concern this year. The irregular rainfall pattern has given the weeds an opportunity to grow, causing the cane to become stressed. This issue has been compounded by the higher cost of herbicides and the ban on the use of paraquat. Substitutes for paraquat are less effective, and farmers lack knowledge about how to use them, causing some to decide not to apply them and let the weeds grow.

The surge in fertilizer prices means farmers are applying less or choosing to use lower-quality fertilizer together with manure.

Farmers also don’t want to rack up any more debt so they are resisting loans or pre-payments (which can be in the form of cash or inputs such as fertiliser and herbicides) from the mills.

This mean they are exposed to the market, and in some areas are facing an issue with “fake fertiliser” which is cheaper but has only one of the nutrients usually contained in compound fertiliser despite being marketed as this. The mills are in risky situation because it will reduce the quality of the cane that will be delivered.

As a result, we have observed a wide range of agricultural yield from an extremely healthy, newly planted cane to damaged, stunted ratoon cane.

Most Thai farmers (65-70%) are smallholders and those who do not have enough working capital are not taking up opportunities to achieve a high cane yield this year.

Given the increasing cost of cane production farmers are planning to switch more towards cassava next season, which is likely to affect Thai cane production in 2023/24. The cane price for 2022/23 is expected to be set at around THB 1,050–1,100 (USD 28.05-30.85) a tonne and is no longer incentivising farmers to plant. Previously, farmers would have been more than happy if the industry talked about a cane price of over THB 1,000/tonne.

We will continue our trip soon to the lower Northeast region of Thailand to be able to gain a complete picture of the Northeast which accounts for up to 50% of the total Thai cane crush.

Other Insights that may be of interest…

Farmer Diaries (Thailand): Sugarcane Growth Seen Below Maximum

China’s Agricultural Output to Drop on Substandard Fertiliser Use?