Insight Focus

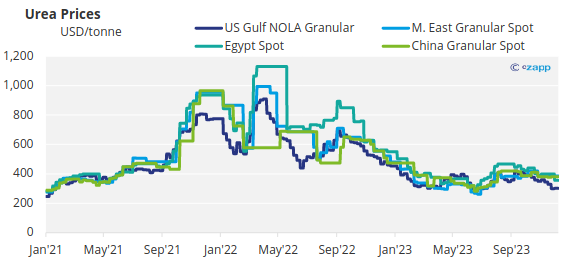

- Urea prices rose this week mainly due to increased freight rates.

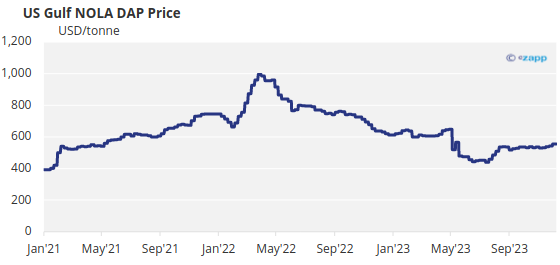

- Processed phosphate prices are also rising following Chinese export restrictions.

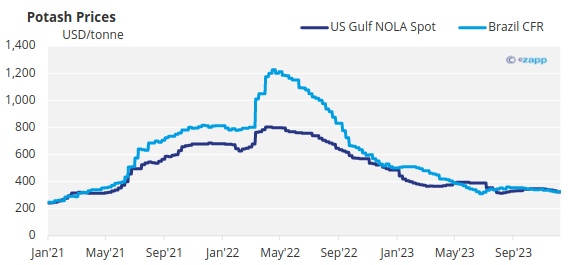

- Potash markets are dormant with Brazil granular MOP prices dropping.

Freight Lifts Urea Sales Prices

The sleeping giant of urea appeared to be coming alive this week with increased CFR values in Brazil, the NOLA/US and to some extent in Europe. However, CFR values were mostly induced by increased freight rates rather than increased demand so the question is whether this momentum could lead to higher demand as the year comes to a close.

Producers in Egypt were reported to have sold 130,000 tonnes mostly to Europe partly to cover short trader positions rather than increased demand. Producers in the Middle East are understood to be comfortable for December and part of January with current price indications of around the USD 325-330/tonne FOB mark.

India still remains void of any signs of an additional urea tender.

China has stopped issuing additional CIQ export licenses and appears to be taking a hardline approach to export with reports of containers already export-cleared having been taken off vessels. It is understood all of this is being done to help support lower urea prices in China. Urea prices in China this week increased on higher demand and the winter storage program.

Issues with the Panama Canal saw increased interest for Indonesian urea and this week’s tender ended with Pupuk Indonesia selling at USD 342.50/tonne FOB for a parcel most likely heading for Mexico.

January to November imports of urea to Brazil are reported at 6.37 million tonnes, which is on par with imports for the same period last year. Qatar was the largest importer at 1.29 million tonnes, followed by Oman/Iran at 1.24 million tonnes and Nigeria at 954,000 tonnes.

The key issue now is whether the urea price will maintain its upward momentum or fizzle once freight rates have consolidated. Underlying demand will be required in key markets for this to happen.

Indian Processed Phosphate Offers Well Below Workable

Processed phosphate prices are going up on the back of low stocks in key markets, tight supply as a result of export restrictions from China and higher freight rates. These factors are all pushing DAP/MAP prices up in US/NOLA and Pakistan.

Indian buyers look set to miss out on imports due to supplier unwillingness to budge on asking prices well below international levels. As a consequence, it is now expected that the Indian government will increase the Rabi season subsidies to prevent shortfalls in inventories. There are also elections coming up in India next year, so the government would want to secure support from farmers by making sure there is no shortfall in processed phosphate availability.

Pakistan is reported to have imported DAP this week at prices in the USD 620-630/tonne level. MAP prices in Brazil remain flat for the third week in a row in the USD 560-565/tonne CFR range.

OCP of Morocco is reported to have sold significant volumes of processed phosphates to East Asia and Oceania with MAP to Australia at around USD 660-665/tonne with freight rates reported as high as USD 75-80/tonne, up from USD 45/tonne a month ago.

Chinese combined DAP/MAP production for the January to October period is reported at 22.7 million tonnes vs 21.4 million tonnes the year before. Full 2022 production was 25.3 million tonnes vs 28.8 million MT in 2018. In other words, Chinese production is falling strongly.

Too Much Potash Chases Too Few Buyers

The international potash market is flat with no activity to report. The market is expecting to get some price guidance from India’s contract negotiations, which could be coming out following the FAI conference in India on December 6-8.

Weak demand in Brazil due to El Nino-related drought has seen a further reduction in granular MOP prices to as low as USD 310/tonne CFR. However, this price has yet to be confirmed by market participants, leaving the assessed weekly price in the USD 320-330/tonne range, down around USD 8/tonne from last week. Prices in Brazil have come down from USD 515/tonne from the start of 2023.

Standard MOP prices in Southeast Asia remain unchanged at between USD 310/tonne and USD 330/tonne CFR even as palm oil prices are coming down on a weekly basis. Malaysia’s imports of standard MOP between January to September are reported at 969,100 tonnes, down significantly on the 1.1 million tonnes recorded in the same period last year.

The outlook for the MOP price is bearish with too much product chasing few buyers in major markets.

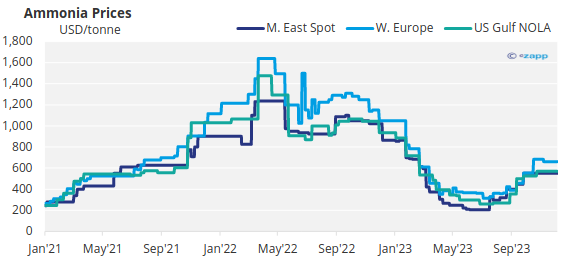

Mosaic-Yara Contract Fails to Support Ammonia

The global ammonia market faced a stalemate this week as buyers stepped away and producers were not willing to sell in a declining market. The Mosaic-Yara December Tampa rollover contract price of USD 625/tonne CFR seems to be having little or no impact on the market either way. The underlying market is negative, and it is expected that prices will fall as 2024 is emerging in the immediate horizon.

The European TTF forward gas price this week was USD 12.41/MMBtu, which indicates an ammonia cost of USD 474/tonne ex-works and a urea price of USD 352/tonne ex-works. Both prices exclude emission costs.