Insight Focus

Urea prices continue to rise ahead of price discovery on India’s 2.66-million-tonne tender. Processed phosphate prices remain steady as limited supply matches limited demand. Potash prices climb due to a Belarusian producer’s temporary production shutdown, while ammonia prices decline with ample supply and reduced demand.

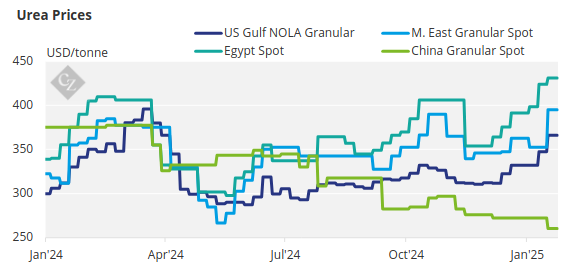

Urea Prices Climb, Trade Slows

The urea market has slowed this week in anticipation of the India tender, which saw 2.66 million tonnes offered. RCF, the Indian government’s buying agent, is seeking a total of 1.5 million tonnes to be loaded by March 5.

Offers for the east coast of India totalled 1.37 million tonnes, while the west coast figure was 1.189 million tonnes. As in previous tenders, the total offers do not reflect the actual net tonnage, as some are believed to be short positions rather than actual trader holdings. It is, therefore, possible that RCF will secure less volume than the anticipated 1.5 million tonnes.

Price discovery is expected to become official on Friday, January 23, with west coast India prices anticipated to range between USD 405–415/tonne CFR, while the east coast is expected to carry a premium to this range. Prior to the India tender, March Middle East paper prices found support within the USD 380–385/tonne FOB range. The current spot market reflects prices up to USD 405/tonne FOB.

Urea prices east of Suez have risen, with recent offers reaching as high as USD 415/tonne FOB from some Southeast Asian producers. Indonesia’s Kaltim held a tender this week, with the winning bid at USD 411.11/tonne FOB. Reportedly, Pupuk Indonesia sold up to four cargoes at this price.

In Australia, import activity has been strong during the December/January period, with several cargoes committed from the Middle East and some from Southeast Asian producers for February and March shipments, mostly on a formula basis.

The outlook for urea prices remains bullish with Iran and China out of the market, while the US, Europe, and Turkey lag in their import activities.

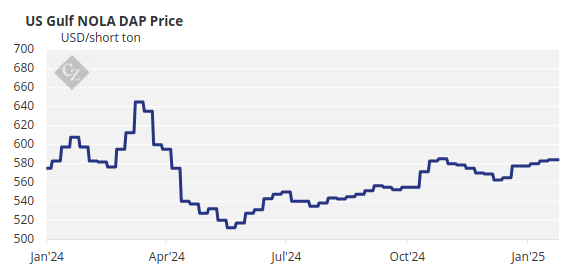

Global DAP Exports Decline

The DAP situation in India continues to worsen. Between April and December, DAP consumption fell 14% to 8.3 million tonnes, down from 9.7 million tonnes in 2023, driven by low stock availability and a shift to NP/NPK fertilizers. Full-year DAP consumption from January to December dropped 15% year-on-year to 9.4 million tonnes from 11.1 million tonnes.

Production also suffered due to high raw material costs via the phosphoric acid route, with April–December DAP production declining to 3.15 million tonnes from 3.4 million tonnes year-on-year. For the full year, January–December production fell to 4 million tonnes compared to 4.6 million tonnes in 2023.

Needless to say, Chinese export restrictions severely impacted India’s DAP supply, with exports to India plummeting to 678,776 tonnes in 2024 from 3 million tonnes in 2023. This ongoing issue may have long-term implications, though China is expected to re-enter the export market sometime in 2025.

China’s overall DAP exports to all countries fell 9.4% year-on-year, a 27% decline from 6.25 million tonnes in 2021. MAP exports in 2024 were down 1.6% year-on-year but significantly lower than 2021 levels, falling 47% to 3.78 million tonnes. However, China’s total processed phosphate exports increased by 5.6% to 10.98 million tonnes in 2024 from 10.41 million tonnes in 2023. Meanwhile, Pakistan has delayed DAP purchases, with activity expected to resume in March.

In Brazil, MAP prices have remained within the USD 630–635/tonne CFR range due to weak demand and low soybean prices affecting affordability. Conversely, NP/NPS imports to Brazil rose 36% in 2024 to 2.75 million tonnes, with China supplying 1.3 million tonnes, a 58% year-on-year increase.

Russian company ACRON’s total production in 2024 declined 6.8% to 6.64 million tonnes, down from 7.05 million tonnes in 2023, with NPK production at 2.29 million tonnes compared to 2.37 million tonnes the previous year.

The outlook for processed phosphate prices remains neutral, as limited supply is balanced by subdued demand due to affordability concerns in both Brazil and India.

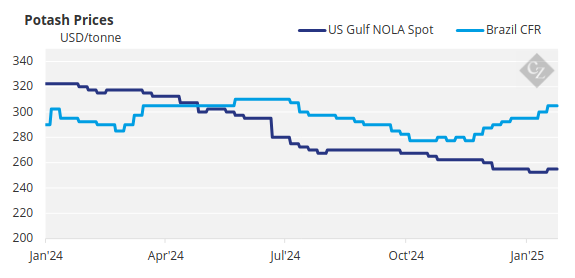

Potash Prices Rise Amid Production Cuts

Potash prices advanced in the US, Brazil, China and northwest Europe as producers attempted to push them to higher levels, while BPC announced a production cut of up to 1 million tonnes. The spotlight was on the US MOP market this week as prices firmed and demand surged following President Trump’s return to office.

The NOLA market jumped by an average of USD 10/short ton (USD 11/tonne) FOB. All attention is on February 1, when the new president may impose 25% tariffs on Canadian potash imports. In the meantime, prices are expected to maintain their upward trend. Import prices in Brazil firmed to an average of USD 312.50/short ton (USD 343.75/tonne) FOB.

Little business was concluded this week, with buyers reportedly in no rush to make purchases. Producers also adopted a slower approach, holding back offers and delaying deals in anticipation of higher prices next week. Producers are optimistic that a minimum of USD 315/tonne CFR in the week ahead is likely.

Northwest European buyers have stepped back into the market to purchase MOP for the season ahead. This has prompted producers to raise offers by EUR 10/tonne. Prices were assessed at an average of EUR 320/tonne CIF for standard MOP, with granular MOP at EUR 340/tonne CIF. Prices in the region are expected to align with the upward trend in global MOP prices.

The Southeast Asia market took a back seat this week as activity slowed ahead of the Chinese New Year. Rumours emerged that Pupuk Indonesia is expected to call a tender in the coming weeks for Q2–Q3 volumes. Still, the market is expected to remain muted next week.

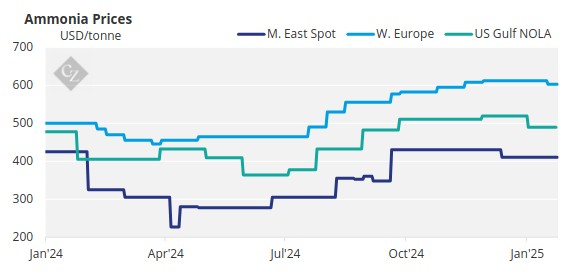

Ammonia Prices Poised for Further Decline

Despite most spot business continuing to take place on an undisclosed basis, the general consensus is that ammonia prices on both sides of the Suez have further room to decline, as evidenced by the nearly USD 40/tonne downward swing at Tampa for February.

That settlement – agreed by Yara and Mosaic at USD 500/tonne CFR – comes as little surprise given the relative oversupply and lack of demand observed across most markets.

Prices are likely to continue declining into February, with support in most regions – except perhaps northwest Europe – being consistently undermined by weak demand and ample supply.