Insight Focus

India’s urea tender delay pushes global prices lower. Prices are falling across regions due to the delay. Meanwhile, phosphate prices rise with declining Chinese exports. Potash prices edge up, despite slow demand. Ammonia prices remain stable with limited activity expected.

India’s Urea Tender Delay Pushes Prices Lower

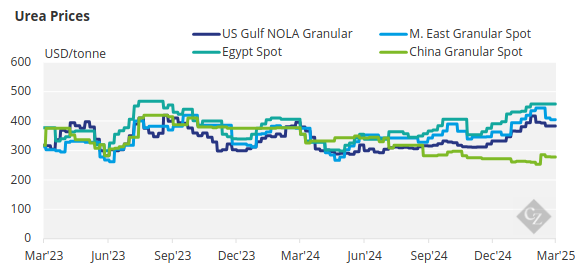

The continued delays by the Indian government agency IPL in announcing the long-anticipated urea purchase tender are putting pressure on global urea prices. Week by week, prices are decreasing across all regions.

A small prilled urea tender held by Pupuk Indonesia, however, saw the highest bid in the high USD 380s/tonne FOB, with producers expecting a price of USD 415/tonne FOB. For comparison, the highest bid on March 14 was USD 395/tonne FOB, while bids on February 18 were in the USD 430s/tonne FOB. In other words, the price erosion has been substantial. On March 21, Indonesia will tender for another 45,000 tonnes of granular urea, and we will witness another price discovery.

Thailand buyers, who will enter the main buying season after the Songkran Water Festival/Thailand New Year celebrations in mid-April, are now looking at prices below USD 400/tonne CFR, with most bids around USD 390/tonne CFR, down from highs of USD 450/tonne just a few weeks ago.

Egyptian producers are facing gas delivery issues again, with plants reportedly operating at around 75%. Export business is slow, with bids around USD 380/tonne FOB, approximately USD 70/tonne lower than the peak in February 2025. Brazilian buyers are now expecting prices to fall substantially, with bids around USD 365-375/tonne CFR.

Middle Eastern producers are looking at bids around USD 370-380/tonne FOB, though returns for Brazilian business are closer to USD 340/tonne FOB. However, they don’t appear to be in a rush, as contract shipments to Thailand and Australia, some on a formula basis, help maintain inventories under control.

South Korean urea imports for January-February fell 80,000 tonnes year over year to 152,000 tonnes, with Vietnam being the largest supplier. The Chinese urea export situation is closely watched, and it seems it will take some time before Chinese urea reaches the export market. Some sources report that producers have requested the government to allow urea producers to export 5-10% of their production during limited export windows.

The outlook for the urea business and prices remains bearish without India declaring an import tender. The big question now is whether India can carry the market even if a tender is issued. As always, urea prices will need another major market, like the US/NOLA, to come in and salvage the price.

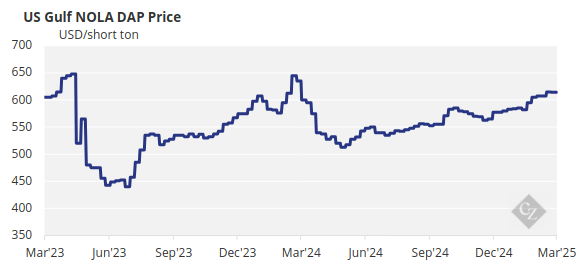

Phosphate Prices Surge Amid Declining Chinese Exports

In the ongoing absence of Chinese processed phosphates, prices are increasing in major markets. For January-February 2025, China exported only 66,000 tonnes of DAP, down 43% year over year. MAP exports for the same period were just 32,000 tonnes, down 67%. As a result, MAP prices in Brazil were offered at USD 660/tonne CFR, although reports of completed transactions are closer to USD 640-645/tonne CFR. Last year’s price for MAP was USD 570/tonne CFR.

Saudi Arabia’s Ma’aden reported a sale of 45,000 tonnes of DAP to Argentina, netting around USD 635/tonne FOB. India’s DAP situation is critical, with inventories around 1 million tonnes, considered to be nearly empty. India’s imports for the period from April 2024 to February 2025 are down 14%, to 9.1 million tonnes compared to 10.48 million tonnes year over year.

Due to the Chinese absence, India has had to focus on DAP imports from alternative origins but has been reluctant to pay higher prices. This has led to increased sales of NP/NPK. There is no set date for the resumption of Chinese exports, with some sources suggesting it may extend into May before any meaningful exports occur. On the other hand, China increased NPK imports to 1.23 million tonnes in 2024, up 1.4% year over year.

On another note, US fertilizer producer MOSAIC expects phosphate and potash demand to exceed 80 million tonnes by the end of the decade, meaning phosphates will rise by 7 million tonnes and potash by nearly 9 million tonnes. MOSAIC referenced biofuel demand, feed use and food use as the main drivers of agriculture commodity demand growth.

The outlook for processed phosphate prices is bullish due to limited supply and increased demand in major markets.

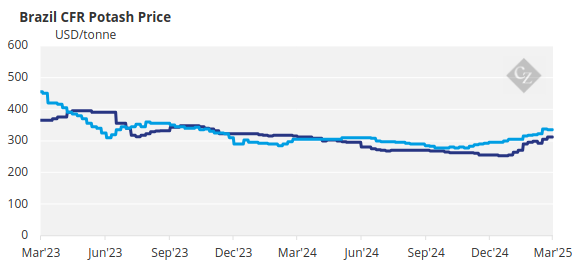

Potash Prices Edge Up Amid Slow Demand

Potash markets in Brazil, Southeast Asia and the US experienced a dip in demand this week, while China focused on its second round of potash tendering.

The Chinese MOP market has been a key focus, as the second round of trading, from March 17-21, covered all regions in China. Potash tender results have shown lower prices in each round, though this has not yet fully reflected in domestic prices. Port wholesale prices averaged RMB 3,110/tonne (USD 430/tonne) FCA this week, still significantly higher than those in the tender. This has led to a flat to bullish outlook for the short term.

Additionally, the long-discussed Russia-China cross-border contract has been settled at USD 313/tonne DAP, up USD 43-46/tonne from February. Brazilian spot potash prices rose to USD 335-340/tonne CFR, amid slow demand.

The market remains quiet, with buyers expected to hold off until May as they focus on securing phosphate before prices rise. Producers are sold out for April, with May offers ranging from USD 335-350/tonne CFR, though no deals above USD 345/tonne CFR have been reported. Standard MOP prices in Southeast Asia firmed to an average of USD 315/tonne CFR, with rumours of USD 320-330/tonne CFR dominating discussions.

Despite limited buying and sales during the Eid al-Fitr celebrations, prices are expected to rise after the public holidays due to tightening supply and limited Q2 offers. Granular MOP prices in the region are also expected to rise, with offers currently set at USD 335-345/tonne CFR for May loading.

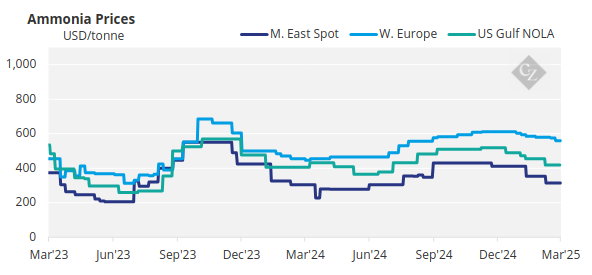

Ammonia Prices Remain Stable

With limited activity this week, ammonia prices on both sides of the Suez remained more or less stable, though supply and demand fundamentals suggest further declines in the second half of March. Market participants are awaiting news from the US Gulf, where a Yara vessel is headed to Texas City – home to the long-awaited 1.3 million tonnes/year Gulf Coast Ammonia (GCA) facility – amid indications that the plant could soon begin exports.

If this happens, the Tampa ammonia settlement for April may be agreed upon by Yara and Mosaic at an even greater discount to March’s USD 460/tonne CFR than is already expected.

Further east, there were few changes to fundamentals in Indonesia and Malaysia, where suppliers are preparing term cargoes for export to the wider region. Spot demand remains low in South Korea, Taiwan and China, with downstream run rates said to be poor.

In China, import appetite was similarly limited, though domestic prices gained considerable ground this week after several inland plants went offline for maintenance in early March. Prices should remain stable-to-soft as we move into April, with the global supply glut showing no clear signs of tightening just yet.