Insight Focus

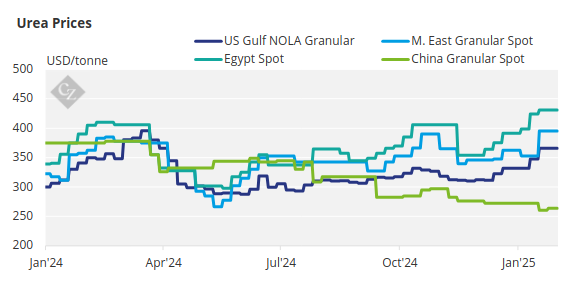

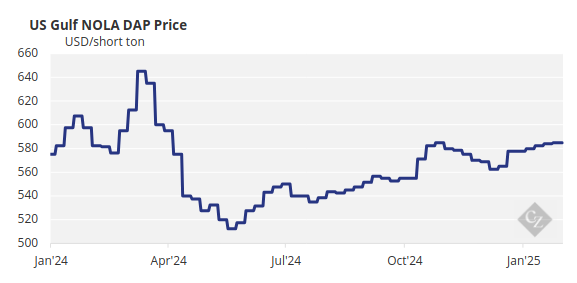

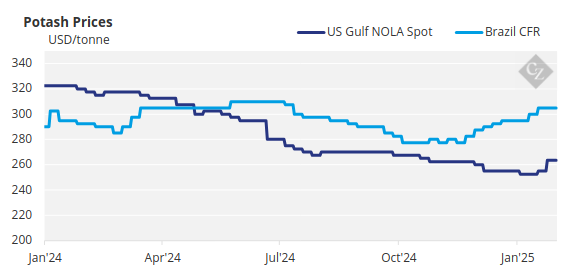

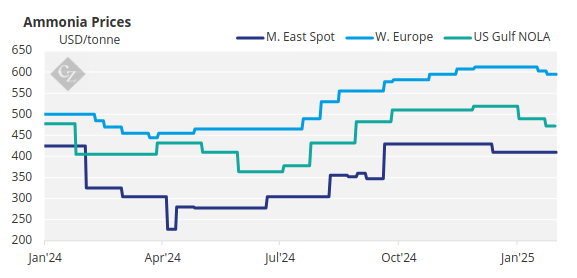

Urea prices are rising, but it’s unclear for how long or how high they will go, with Chinese exports absent. Phosphate prices remain steady as limited demand meets restricted supply. Potash prices in the US are expected to rise due to proposed 25% tariffs, while ammonia supply exceeds demand, creating a bearish outlook.

EU Tariffs Disrupt Fertiliser Market

The European Commission announced proposed import tariffs on all Russian and Belarusian fertilizers, except for ammonia. If approved by the European Council, these tariffs will be introduced on July 1, 2025, with annual increases starting at EUR 40-45/tonne, reaching between EUR 315/tonne and EUR 430/tonne by 2028, on top of the already imposed 6.5% duty.

In the January-October 2024 period, the EU 27 states imported 1.8 million tonnes of DAP, MAP, NPK and NPS from Russia, accounting for 25% of the total 7.4 million tonnes imported.

The general consensus is that trade flows will shift, with more products from OCP Morocco finding their way to Europe, while Russian fertilizers will need to find alternative markets. This could lead to increased urea imports from the Middle East and other sources.

As a result, fertilizer prices are expected to rise, putting additional financial strain on European farmers. Companies like Yara, which sells about 10% of its urea production in Europe but 80% of its nitrate production in Europe, will now have an open order book with higher prices.

India Struggles to Secure Urea Tonnage

Global urea prices continue to rise, prompting producers to hesitate in participating in the most recent urea tender in India, which requested shipments by March 5. As a result, India’s buying agent, RCF, is currently securing only 558,000 tonnes, well below the desired volume of 1.5 million tonnes.

This marks the second time that India’s urea tender has failed to secure the desired tonnage, as the December tender resulted in only 187,000 tonnes being secured. The question now is whether and when India will attempt to secure additional volumes, with some suggesting another tender for shipments in March or April.

Price discovery on the tender resulted in the lowest prices for the West Coast at USD 422/tonne CFR and for the East Coast at USD 427/tonne CFR. Most offers, however, were significantly higher than these prices, so price matching was not an option for most offers.

While these prices are around USD 50/tonne higher than the December tender prices, producers and traders are looking for even higher prices in the near future.

The current FOB Middle East price is USD 415/tonne, with expectations of further price increases. Egypt has reached USD 435/tonne, and Iran has achieved USD 365/tonne FOB for March shipments. Producers in Southeast Asia are also securing prices of USD 415/tonne or higher, with one cargo from Ca Mau, Vietnam reportedly sold at this price.

Factory inventory in China is reported The outlook for urea prices remains bullish, as there is no indication that China will enter the export market anytime soon. Strong demand from both Australia and Thailand over the next six months is expected to help maintain high prices. However, some traders are hesitant to take long positions due to concerns that China may enter the market in March or April, which could put downward pressure on prices.to be at an all-time high, with 1.6295 million tonnes compared to the same time last year. Warehouse inventory currently stands at 9,075 lots, suggesting a relatively sufficient market supply, which is putting pressure on futures contracts. In summary, Chinese exports of urea seem imminent, but the key question remains: when?

Togliattiazot in Russia achieved record urea production in 2024, reaching 1.78 million tonnes, including its new 800,000-tonne prilled urea plant. This performance has allowed it to surpass ACRON, which produced 1.5 million tonnes of urea.

In another related development, China exported a record 17.1 million tonnes of ammonium sulphate (AS) in 2024, up from 11 million tonnes the previous year. The major buyers included Brazil, which imported 6.27 million tonnes for use in bulk blends combined with TSP to support Brazil’s expanding soybean acreage. Other significant buyers included Indonesia, Vietnam and Myanmar, all of which purchased more than 1 million tonnes, mainly for use in mining.

The outlook for urea prices remains bullish, as there is no indication that China will enter the export market anytime soon. Strong demand from both Australia and Thailand over the next six months is expected to help maintain high prices. However, some traders are hesitant to take long positions due to concerns that China may enter the market in March or April, which could put downward pressure on prices.

Phosphate Prices Stable Amid Limited Activity

Processed phosphate prices are holding steady, supported by limited demand and constrained supply. China has not been exporting since December 2024, when the government implemented export restrictions to support decreased domestic prices.

A major DAP tender in Ethiopia, where China was expected to deliver 400,000 tonnes, appears to have been cancelled, with only a couple of 60,000-tonne vessels being delivered. Demand for DAP in Pakistan remains subdued due to drought conditions, unfavourable crop prices and challenges in raising DAP prices to secure margins. Offers of USD 645/tonne CFR were rejected.

Other major markets are also quiet, notably Brazil, which is facing affordability issues. MAP prices in Brazil remain unchanged at USD 630-635/tonne CFR, a level that has persisted for seven months since July 2024. Brazilian buyers are seeking alternative processed products like NPK, NP, TSP and SSP to counter the high prices of MAP.

Market rumours also suggest ongoing negotiations between OCP of Morocco and Indian buyers to secure 2-3 million tonnes of DAP. These negotiations are reportedly at a standstill, with OCP requesting around 900,000 tonnes of TSP to be included in the package. What is clear is that India is in urgent need of DAP, given its low domestic stocks.

The outlook for processed phosphate prices is neutral. Both price upside and downside appear limited, as tight supply is balanced by limited demand and affordability concerns, with phosphate prices remaining high compared to downstream agricultural commodities and other fertilizer nutrients.

Potential Potash Price Increase in Brazil

Potash prices in Brazil were a key topic at this week’s annual fertilizer conference in Rio de Janeiro, with expectations for price increases confirmed, though the potential extent of the rise remained debated.

Granular potash import prices held steady, with limited buying activity for the 2025/2026 soybean crop. Brazilian potash prices stayed at USD 310-315/tonne CFR, with producers targeting USD 350/tonne CFR by June. Favourable affordability in recent months has spurred forward buying, but the weak Brazilian real and a lack of urgency to buy or sell kept deals minimal this week.

The production halt at Asia Potash and upgrades at BPC’s Soligorsk-4 mine, leading to an estimated 900,000 to 1 million tonne production cut, have raised minor concerns about tightening supply and potential price increases amid strong demand. However, CRU does not foresee major price hikes.

The key topic at the conference was President Trump’s proposed 25% tariff on Canadian potash imports, with most market players expecting higher domestic prices if the tariff is implemented. The US imports about 80% of its potash from Canada, so a 25% tariff would increase costs and likely make Russia the lowest-cost supplier to the US. All eyes are firmly on February 1 for further clarification.

Meanwhile, the US MOP market has started to strengthen following Nutrien’s recent USD 25/short ton (USD 27.50/tonne) price increase, signalling renewed pricing strength.

Thailand imported 908,300 tonnes of potash in 2024, a 28% increase from the previous year. The rise is attributed to potash becoming more affordable, prompting importers to increase their purchases. Potash imports from Laos, represented by Chinese owners Lao Kaiyuan and Asia Potash, increased by 85% to 247,300 tonnes. With comparable quality to traditional suppliers like BASF, BPC, and Canpotex, potash quantities from Laos are expected to rise significantly in the coming years due to its proximity.

On the project side, Agrimin’s potash project at Lake MacKay in Western Australia has moved closer to a final investment decision after the WA environment ministry granted approval for development, subject to several conditions. The company has three binding off-take contracts with Sinochem Fertilizer, Nitron and MacroSouce for the supply of 150,000 tonnes, 115,000 tonnes and 50,000 tonnes, respectively. Wyndham Port, located 940 kilometres north of the project, is set to be the export point for the project.

Ammonia Market Faces Downward Pressure

Ammonia markets on both sides of the Suez remain relatively well-stocked, with little change from last week. In the face of largely absent demand, prices are generally under varying degrees of downward pressure.

Bearish sentiment is growing in many regions as the first confirmed spot FOB and CFR deals for February shipments approach. Plants at major export hubs are running very well, but the market is struggling to absorb the excess tonnes.

UBE Corp of Japan has also decided to close both its Japanese industrial operations by March 2028 and its Thailand unit by March 2027. The Thailand operation will cease producing caprolactam and ammonium sulphate. In addition to the closure of PTT Asahi Chemicals in 2024, this means that imports of ammonia to Thailand will no longer be necessary, resulting in a combined loss of approximately 500,000 tonnes from the two operations. UBE’s Japanese imports of ammonia accounted for 330,000 tonnes. Clearly, these closures will have a significant impact on future ammonia trade flows.